Winklevoss Bitcoin Trust Moves Filing to BATS Exchange

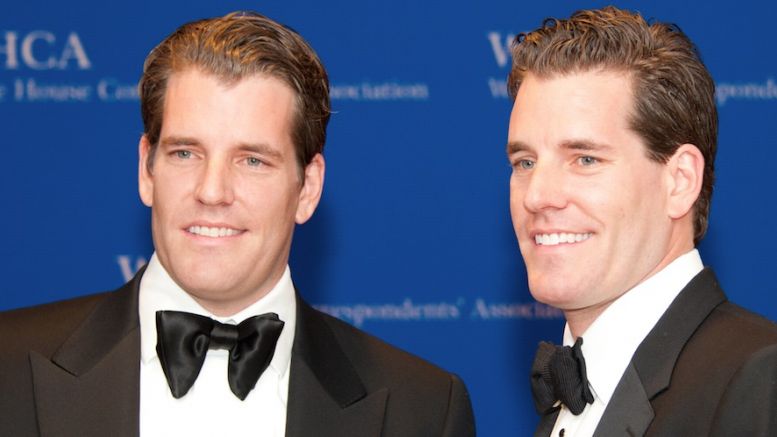

The Winklevoss Bitcoin Trust is no longer attempting to list on Nasdaq, according to an SEC document filed today. After three years of waiting for regulatory approval from the Securities and Exchanges Commission (SEC), the Trust’s founders, investors Tyler and Cameron Winklevoss, have changed tact and are now seeking to list the product on the BATS Global Exchange. Notably, the Winklevoss brothers have also increased the size of the offering, from $20m to $65m, a move that would boost the maximum price of shares offered to retail investors. If the SEC approves the request, the Trust would....

Related News

According to an SEC document filed yesterday, the Winklevoss Bitcoin Trust has filed to switch the listing from Nasdaq to BATS Global Markets and has filed for a maximum offer of $65 million. Having listed their first application to list on Nasdaq, with the Securities and Exchange Commission (SEC) three years ago, the brothers are now looking to list the Winklevoss Bitcoin Trust, their bitcoin exchange-traded fund [ETF] to BATS Global Markets. The filing reveals that the size of the offering will be a listing of 1 million shares, at $65 each. That figure is up from the list price of $20.09....

Investors Tyler and Cameron Winklevoss are another step closer to offering the first Securities and Exchange Commission (SEC) regulated bitcoin investment product following a request for comment published Friday. Last month, BATS proposed a rule change that would result in the listing and trading of the Winklevoss Bitcoin Shares issued by the Winklevoss Bitcoin Trust. Now, in response to that request, SEC assistant secretary Jill Peterson has opened the proposal for comment from the public. Peterson wrote: "In its filing with the Commission, the Exchange included statements concerning....

On January 20, Grayscale Investments, LLC, a wholly-owned subsidiary of Digital Currency Group, filed with the Securities and Exchange Commission (SEC) for its Bitcoin Investment Trust to be listed on the New York Stock Exchange with the intention of launching the first listed Bitcoin ETF in the U.S. Grayscale Investments seeks to launch its ETF with an initial $500 million public offering according to the filing. This is the third Bitcoin ETF in the U.S. that has been filed with the SEC for approval. Bitcoin pioneers Cameron and Tyler Winklevoss filed the first Bitcoin ETF back in 2013....

A new regulatory filing with the Securities and Exchange Commission (SEC) indicates that Cameron and Tyler Winklevoss are planning to have their Winklevoss Bitcoin Trust exchange traded fund (ETF) listed on the NASDAQ stock exchange. If the SEC gives its final approval, investors will be able to buy into the fund and participate by owning "shares" of bitcoins. The filing is an amendment to a series of documents that the ETF has submitted to the SEC in order to get the fund off the ground. It was initially registered with the SEC last July. Math-Based Asset Services. The Winklevoss Bitcoin....

State Street has been tapped to help launch the first bitcoin exchange-traded fund (ETF). In a new SEC filing, State Street is now listed as the administrator and transfer agent for the Winklevoss Bitcoin Trust, a proposed bitcoin ETF backed by investors Cameron and Tyler Winklevoss, the founders of the Gemini bitcoin exchange. According to the filing, State Street would be responsible for the "day-to-day administration of the Trust" when it is launched, as well as maintaining its books of account and calculating the Trust’s net-asset value (NAV), or the value per share of the....