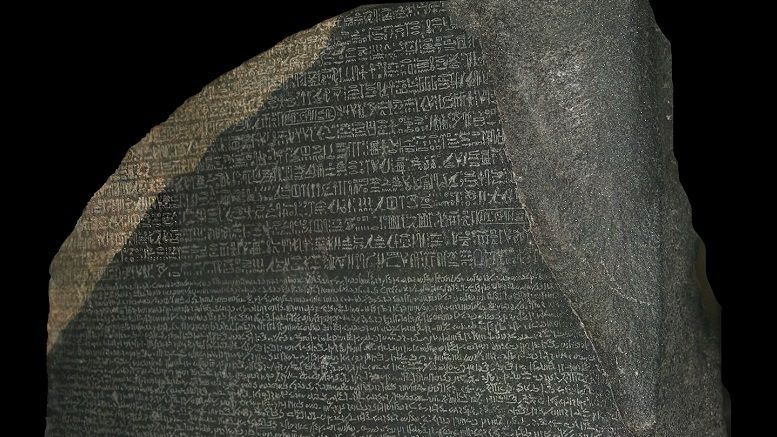

ICAP is Building a Blockchain 'Rosetta Stone' to Enhance its Post-Trade Process

ICAP has built what it refers to internally as a 'Rosetta Stone' for trades. That description refers to an ancient hieroglyphic text that brought together several languages from antiquity, and opened a pathway to understanding messages encoded in Egyptian ruins. ICAP invokes this term to describe its new system for managing securities post-trade workflow, one it has now encoded into a single business process. It's designed to let any buyer transact with any broker across a wide range of possible trades. To use the current blockchain terminology, the company has written what they describe....

Related News

ICAP, a leading markets operator and provider of post trade risk mitigation and information services with more than $1.6 billion in revenue, announced that its Post Trade Risk and Information (“PTRI”) division has successfully carried out a proof-of-technology pilot test using blockchain technology. The ICAP PTRI division plans to use its newly developed proof-of-technology protocol to handle post-trade processing, a process in which the buyer and the seller compare trade details, alter ownership records, transfer securities and cash and approve transactions. The foundation and....

Interdealer broker ICAP announced today that it has completed an internal blockchain technology trial focused on securities post-trade processes. ICAP's Post Trade Risk and Information division conducted the test last month, completing it on 26th February, the firm said, with blockchain startup Axoni providing the software infrastructure for the trial. The UK-based firm said that the test involved the use of a multi-asset messaging and matching network called Harmony, from which messages were converted, in real time, to smart contracts built on a blockchain. ICAP explained: "The....

There was an outlier among a group of financial institutions that this week announced they are in the process of building a new blockchain and digital currency settlement network. Called the 'Utility Settlement Coin', the project was created by startup Clearmatics and tested by four global banks: UBS, BNY Mellon, Deutsche Bank, and Santander. But a fifth member of the consortium, ICAP, stands apart for two reasons. First, its team of participants span multiple companies within the market infrastructure provider. Second, as a market infrastructure provider, a digital currency that runs on a....

The executive director of the European Securities and Markets Authority (ESMA), the European Union’s top securities watchdog, has said that the agency believes blockchain technology could enhance the post-trade process. ESMA has spent more than a year investigating the impact of digital currencies like bitcoin on the investment landscape in the EU, and in April issued a call for more information on the technology in a bid to assess how it could affect the securities trade lifecycle. Executive director Verena Ross spoke earlier this month at an event in the United Kingdom organized by the....

Fidelity, Standard Chartered Bank, and TP ICAP are collaborating to launch a cryptocurrency trading platform. It will feature a marketplace for spot crypto trading and provide “connectivity and post-trade infrastructure into a network of digital assets custodians.” TP ICAP, a leading provider of market infrastructure, announced Tuesday that it is launching a cryptocurrency trading platform in collaboration with Fidelity Digital Assets, Zodia Custody, and Flow Traders. The new platform is subject to registration with the U.K. Financial Conduct Authority (FCA). It “will....