Lessons in Crypto Arbitrage: NAV Coin

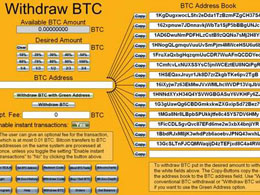

Arbitrage has never been simple. At first glance, it seems like a simple task—buy on one exchange, sell on another—but fees prevent the gap from completely closing, and delays in the deposit/withdrawal process can lead to losses in changing market conditions. Traditionally, traders needed vast amounts of liquid capital to do this effectively, but cryptocurrency has changed that to a degree. With vastly reduced transaction fees and times, they can be more easily moved across exchanges, making for a more even market. At the same time, their revolutionary nature leads to unique new problems....

Related News

Crypto exchange Valr has announced it has closed its crypto arbitrage service to new customers in order to comply with the requirements of its banking partner. This announcement makes Valr the latest South African crypto exchange platform to close its arbitrage business. Ovex was one of the first exchanges to announce its exit from the market.

Banking Partner Requirements Push Exchange out of Arbitrage Market

The South African cryptocurrency exchange, Valr, will be exiting the crypto arbitrage market on February 28 in order to comply with its banking partner’s....

The current lull in the price of bitcoin is an opportunity to reflect on lessons learned during these experiences.

CZ took to Twitter on Nov. 8 sharing "two big lessons" that crypto companies should learn amid the downfall of crypto exchange FTX. Binance CEO Changpeng “CZ” Zhao has shared his take on "two big lessons" to be learned from the FTX saga, saying cryptocurrency firms shouldn’t use their own tokens as collateral and should also keep “large reserves.”In a Nov. 8 tweet, Zhao laid out two learnings after the significant “liquidity crunch” at FTX which has ultimately resulted in a non-binding letter of intent from Binance to acquire the struggling exchange.Two big lessons: 1: Never use a token....

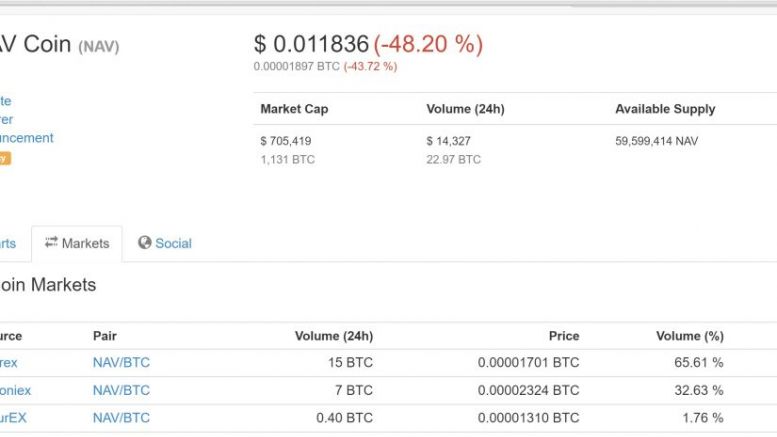

NAV Coin has seen major price action the last several months, with lots of major updates. Some of them produced creative new arbitrage opportunities, but possibly the most exciting was the development of the NAVTech network. Although NAV Coin has long been touted for financial privacy, NAVTech allows more decentralized (and thus safer) anonymity, making it an attractive option for investors in dark markets. When last we covered NAV Coin, they were in the midst of some massive upgrades. Instead of forking their blockchain, however, they decided to start a new one, which recorded the old....

Arbitrage serves an important function in the Bitcoin economy. Thanks to the individuals and automated bots that actively look for price differences between the various Bitcoin exchanges and buy from one and sell to another if the price disparity ever becomes high enough for the transaction to be worth it, people who are buying or selling BTC for their own use can rest assured that they are paying roughly the same price no matter which exchange they go to. Arbitrage also promotes competition among exchanges; if the only people trading on exchanges were those who were actually seeking to....