NRI Report: Japan's New Payment Rules Hold Back Bitcoin Remittances

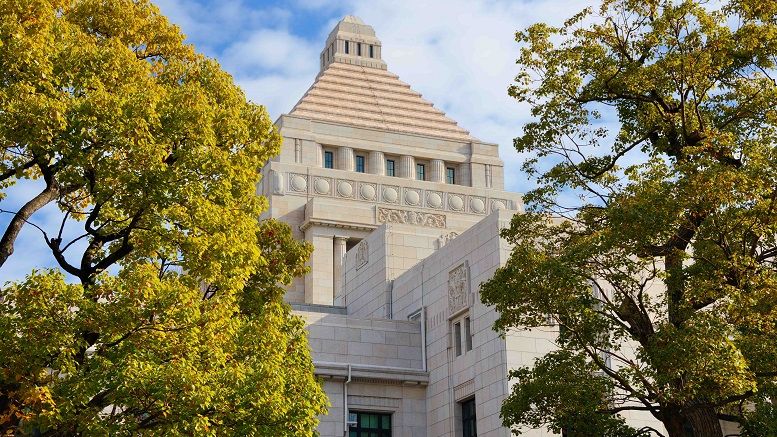

A forthcoming report from Nomura Research Institute (NRI) argues that despite new regulations aimed at bitcoin and digital currencies, more needs to be done to bring clarity to the innovators working with the technology in Japan. Penned by senior consultant Yasutake Okano, the report centers on the Payment Services Act (PSA), a bill passed by Japan’s legislature in May. Debated for months, the bill brought domestic bitcoin exchanges under existing anti-money laundering (AML) and know your customer (KYC) rules by classifying virtual currencies as a type of prepaid payment instrument. But....

Related News

The Japan Virtual and Crypto Assets Exchange Association (JVCEA) plans to allow crypto trading platforms to list coins without going through a lengthy screening process. “We hope the latest measure will help revitalize Japan’s crypto assets market,” said the vice chairman of the association. Relaxing Listing Rules for Cryptocurrencies The Japan Virtual and Crypto Assets Exchange Association (JVCEA) is planning to loosen crypto listing rules to make it easier for trading platforms to list cryptocurrencies, Bloomberg reported Wednesday, citing a document it has seen. The....

According to a new report, the depreciation of some currencies against the U.S. dollar is contributing to the declining international remittances. After touching an all-time high of $548 billion in 2019, the World Bank report now projects remittances to drop 7.2% in 2020 to $508 billion and a further decline of 7.5% to $470 billion in 2021. Volatile Currencies In its Migration and Development Brief 33, the World Bank details how the Covid-19 induced currency depreciation has affected the flow of global remittances. In the brief, the authors point to the exchange rate between the U.S.....

Crypto exchange giant Binance is the latest platform to receive a warning from regulators in Japan for operating in the country without a license. Crypto trading platform Binance may once again be heading for a standoff with financial regulators in Japan.On Friday, the Financial Services Agency (FSA) issued a warning to Binance, accusing the company of offering crypto exchange services in the country without registration. The agency also served a similar warning to crypto derivatives trading platform Bybit back in May.After China banned crypto trading back in 2017, Binance, along with many....

The International Money Transfer Conference (IMTC) is set to hold the first Blockchain and Remittance Day in Istanbul on May 25. This one-day event is part of a larger conference featuring remittances in the Middle East, Africa, and Europe. In particular, the Blockchain and Remittance Day event will feature a range of new systems and services built to enhance remittances and money transfers. Spotlight on Bitcoin and Blockchain. Blockchain refers to a public ledger of transactions for bitcoin which undergo verification through complex algorithms solved by computers or bitcoin miners. Apart....

Citing unnamed but informed sources, Japanese publications are reporting that a working group under the Financial System Council have complied a draft of Japan's first ever cryptocurrency regulations. Under the new proposed rules, bitcoin exchanges and those dealing with virtual currencies must register with the government to fall under a regulatory framework. The rules, as reported by The Japan Times, are drafted by a working group under the Financial System Council (FSA). The proposals and discussion for the new rules began yesterday, while the bills required to enact the new rules and....