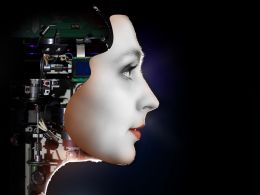

Mobile Apps are Taking Over Jobs of Financial Experts As Millennials Prefer Fintech

The technology-phobic financial experts are running out of jobs-- making ways for the tech-savvy ones. The younger generation of investors is no more happy with 9 to 5 business hours to seek out financial experts, and sit in a room with them for consultation. Not when, the same is available at the click of a button in their electronic gadgets. The investment industry has never been static, and everyone working in the industry has had to deal with changing times. But the XXI century has brought rapid changes with the advancement in technology, and many generations of financial experts....

Related News

An economic modelling study has concluded that Scotland stands to lose over 14,000 jobs in its financial services sector over the next decade if the country does not embrace the rushing wave of Fintech innovation. Like any other country in the world, Scotland’s financial services and banking sectors are, if the hype is to be believed, under the threat of an upcoming Fintech revolution with innovation such as blockchain at its fore. A report by the Centre of Financial Regulation and Innovation by Strathclyde Business School in Glasgow has revealed that Scotland could, in a worst-case....

A new survey from one of the world’s leading financial advisory firms, advising on over $10 billion in client capital, claims that two-thirds of its millennial customers far prefer Bitcoin over precious metals as the ideal safe haven asset. And in 2020 as the world goes almost entirely digital, millennials are being proven right. Gold fund flows are pouring into crypto, and the difference in ROI is substantial. Here’s why this trend is only going […]

Fintech companies have now been provided with a great opportunity by the growing preference of millennials to accomplish tasks through digital applications. CEO of FIS, Anthony Jabbour, says the digitally native ways of millennials have given more insight into their needs and wants than any previous generation. FIS, the world’s largest global provider, dedicated to banking and payments technologies, conducted a research recently. It showed that millennials already make up a third of banked consumers in America. This highly educated and entrepreneurial generation represents a banked client....

Scotland’s University of Strathclyde has announced the launching of its new FinTech masters course, making it a first in the U.K. in an announcement on the university’s website. The Master of Science (MSc) in Financial Technology will provide students the financial, programming and analytical skills needed to help companies accelerate and enhance their security. It is hoped that this new course will support the digital transformation of Scotland’s growing financial sector. Boost in Scottish Jobs. An economic modelling study found last year that Scotland could lose more than 14,000 jobs in....

A report published by the cryptocurrency exchange Kraken shows that two-fifths of Australian millennials prefer to invest in cryptocurrency assets over real estate. The survey shows that a number of Australians are losing faith in traditional assets like gold, stocks, and real estate. Kraken’s Australia Managing Director: ‘Young Aussies Look for Other Options to Grow Wealth’ A survey conducted by the San Francisco crypto exchange Kraken indicates that 40% of millennials believe investing in digital assets like bitcoin (BTC) will end up turning into long-term gains. In....