Digital Currencies Can Fill in for Falling CBRs in Weaker Economies

Banks are withdrawing their Corresponding Banking Relationships (CBRs) in weaker economies stating increased risk, leading to financial exclusion of various countries. Digital currencies like Bitcoin may be the way forward for nations with small or weak economies. Many major banks have been withdrawing their Correspondent Banking Relationships (CBRs) across geographies in the recent days as the global economy slows down. A recent action report by the International Monetary Fund titled ‘The Withdrawal of Correspondent Banking Relationships: A Case for Policy Action‘ discusses this emerging....

Related News

This week, it was revealed that India would seek to impose some of the most stringent rules globally on cryptocurrencies, banning citizens from owning, trading, transferring, or mining assets like Bitcoin and altcoins. The move comes as cryptocurrency technology captures the interest of the financial world, Bitcoin grows considerably, and India plans to introduce its own digital currency framework. But could this be the start of a domino-like effect where other weaker governments and economies […]

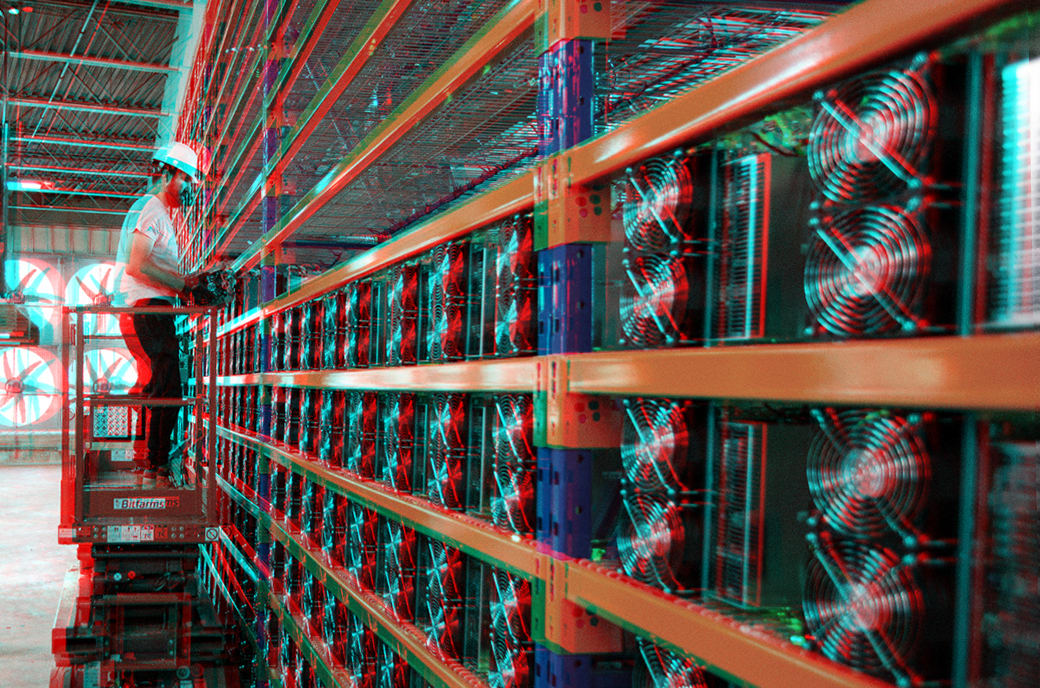

The trend of falling hash price will force weaker miners to unplug, find more efficient energy sources and/or sell off machines or bitcoin holdings.

The Central Bank of Brazil (Banco Central do Brasil) has issued a digital currency warning, joining the central banks of India, China and many other large economies across the globe in outlining risks associated with digital currencies. The Brazilian warning does not bring anything new to the table, it reads like similar statements issued by other national regulators over the past few months. The bank points out that digital currencies should not be confused with electronic money, as defined by Brazilian legislation. Unlike digital currencies, electronic money is governed by various....

Since the beginning of 2015, an increasing number of central banks and government agencies have begun to show interest in bitcoin and digital currencies. Investment Strategist Philipp Vordran believes that countries are considering turning their currencies into crypto-currencies. "Countries are thinking about turning their currencies into crypto-currencies. I don't know if that's a smart idea. Once customers are used to them they might think about using independent currencies like Bitcoin instead of currencies issued by central banks," said Vordran. Several central banks including the Bank....

Bitcoin price action is back in the low $30,000 range, after another failed attempt to reach $40,000 over the Father’s Day weekend. The effort from bulls is getting weaker and weaker, even now resulting in a “death cross” on daily timeframes. But could they be simply feigning weakness, ready to squeeze short traders and push […]