Report: Blockchain to Rewrite the Financial Infrastructure’s Future

Blockchain technology is expected to change the way financial organizations conduct business with banks implementing distributed ledger technology (DLT) projects by 2017, according to the World Economic Forum. After 12 months of research which saw the WEF engage over 200 industry leaders and subject matter experts through interviews and multi-stakeholder workshops, the organization compiled a 130-page report on the impact distributed ledger technology (DLT), also known as blockchain, will have on the financial infrastructure’s future. WEF’s ‘The Future of Financial Infrastructure’ report....

Related News

The World Economic Forum (WEF) and Deloitte have concluded that the blockchain is “the future of financial infrastructure” in a new report published today. World Economic Forum Praises So-Called ‘DLT’. Both parties announced the results of a year-long study based on the findings of their 2015 report, “Disruptive Innovation in Financial Services.” The....

The recent World Economic Forum report showcases the importance of blockchain technology in the future of financial infrastructure. Read more... A comprehensive report by the World Economic Forum released yesterday reiterates the importance of blockchain technology in global finance. The 129-page report presents the findings of an in-depth analysis of nine different use cases of the distributed ledger technology. The report titled “The Future of Financial Infrastructure – An ambitious look at how blockchain can reshape financial services” presents the findings from an earlier....

IDATE DigiWorld, a prominent technology consulting and research firm, has released the report “Blockchain - A New IT Infrastructure” on the Research and Markets platform to help large corporations and organizations implement the Blockchain technology. Since early 2015, analysts and research firms, including Greenwich Associates, estimated that nearly $1 bln is allocated in the development and implementation of the Blockchain technology. Yet, banks and financial institutions are struggling to demonstrate its single working commercial application. Non-finance applications. In its research,....

Standard & Poor’s (S&P) Global recently published a report detailing its view of blockchain technology. The credit rating agency also revealed how blockchain development could change its credit ratings of financial institutions. Blockchain Could Affect Credit Ratings. Known for its stock market indices such as the S&P 500, the company is one....

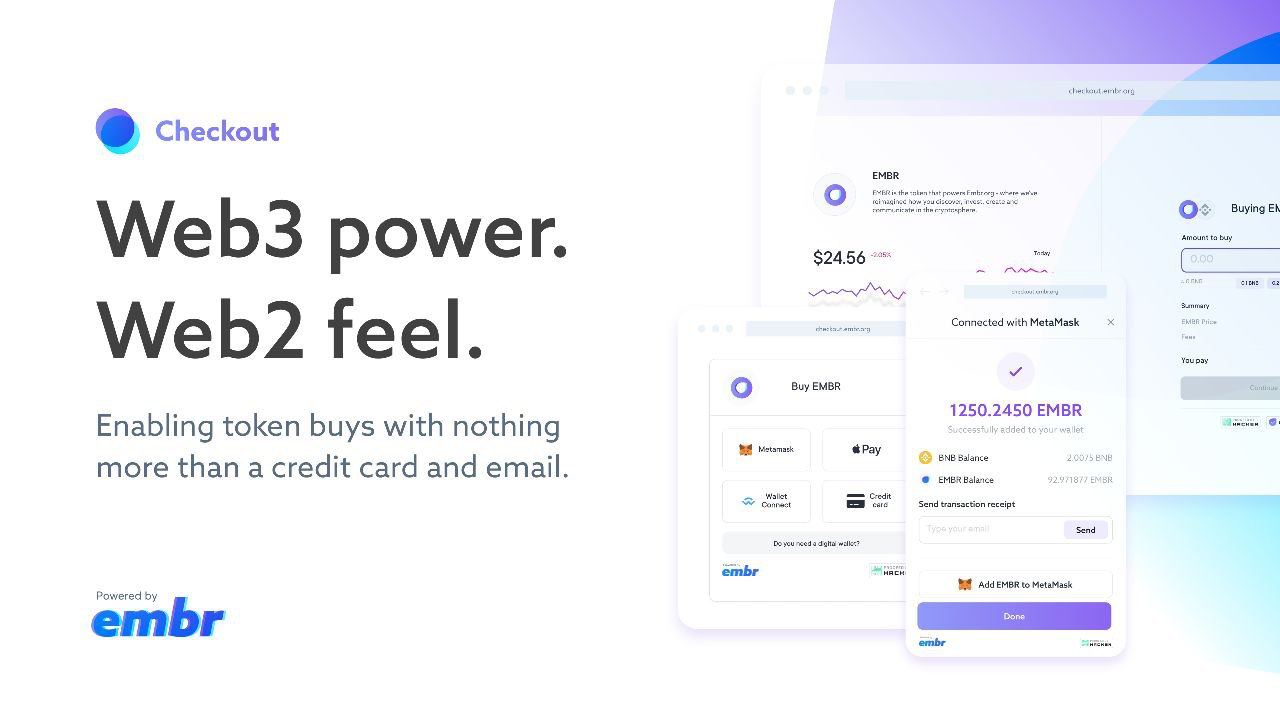

Embr is an all-remote corporation building a global Web3 fundraising infrastructure, and Checkout is the first of many product releases focused on moving startups and creators into a new era of the internet. Web3 has the potential to rewrite the future of economic opportunity for innovators and investors everywhere. Still, crypto first-timers and veterans alike often suffer through long, error-prone processes when purchasing digital assets. Embr Checkout eliminates all friction from the current state of token purchases, enabling people to buy tokens with nothing more than a credit card and....