China Needs To Sort Out Its Corporate Debt, IMF Says

With so much volatility in fiat currency and stock markets, traditional debt-relief solutions are not a valuable option either. Interesting things are happening in the world of traditional finance these days. China, while often seen as a prosperous economy, has received a stern warning from the IMF. The country needs to address their corporate debt levels before things spiral out of control. This will put a lot of pressure on entrepreneurs and corporations, which may cause citizens to flock to Bitcoin in the long run. China is one of the many countries in the world today dealing with a....

Related News

According to the International Monetary Fund (IMF), China needs to control its corporate debt before the situation becomes unmanageable. Does bitcoin hold the answer? A report from the IMF has found that at $25 trillion, China’s debt accounts for 254 percent of GDP. As a consequence, startups and businesses could soon turn their attention to the growing popularity of bitcoin. Of course, China isn’t the only country that is experiencing a high percentage of GDP. CNN reports that the U.S. also has a similar percentage, but what sets China apart is the rate at which it has been growing. A....

In these new series of posts, we will be discussing price trends and important developments in the Blockchain industry. Today we will be reviewing the price increase of both Bitcoin and Ethereum. Another week goes past in the Crypto Sphere. Since June 10 Bitcoin and Ethereum have experienced an incredible surge in price. Bitcoin has managed to pull a +28% increase in valuation against the United States Dollar and +29% against the Chinese Yuan. A quick retrace in Bitcoin price some hours ago left the price close to the 2 hour Moving Average. Cryptocurrencies are looking strong, the perfect....

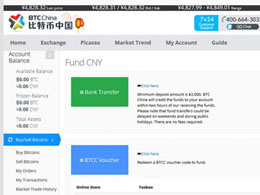

The story of BTC China has been an interesting one. This exchange went from nobody's talking point to the largest bitcoin exchange in the People's Republic of China in a matter of weeks. That is, until, they stopped accepting bank deposits. Many were convinced it was the end of BTC China's short, short history. Unlikely. The exchange has once again begun accepting bank deposits with its corporate bank account, according to a number of user reports and confirmation from the company's head honcho. "Previously, we judged doing this as not being viable, however, we have since changed our....

Presidential candidate Donald Trump claimed that the US is incapable of defaulting on its debt because of the Federal Reserve’s ability to “print money.” The Republican Party’s presumptive presidential nominee attempted to clarify previous statements that he could persuade America’s creditors to accept less than full payment for the national debt, which was construed by some publications to mean he intended to default. Trump insisted that he meant that the US could simply buy back debt at a discounted rate. “You know, I’m the king of debt. I understand debt probably better than anybody. I....

Coinbase has sold $2 billion worth of corporate bonds in an offering that saw $7 billion worth of bids placed. Leading U.S.-based cryptocurrency exchange Coinbase has seen enormous demand for its junk bond offering, with the firm increasing the size of the sale by one-third from $1.5 billion to $2 billion.According to Economic Times, at least $7 billion worth of orders were placed in competition for equal quantities of seven and 10-year bonds, offering interest rates of 3.375% and 3.625% respectively.The publication cites an anonymous source as claiming the interest rates were cheaper than....