UK Is Still a World Leader for Fintech

A recent report by the All-Parliamentary Group (APPG) has reiterated confidence in the U.K.’s entrepreneurship and innovation in the long term despite Britain’s recent vote to exit from the European Union. After the Brexit referendum, there were concerns that the exit would reduce access to markets, talent, passporting powers and funding for U.K. SMEs. The fear was compounded by moves by other European cities to present their readiness to accept Fintech startups to leave the U.K. Paris Europlace, which promotes French finance plans, chose to travel to London to entice financial firms and....

Related News

A tech leader and software company director has said that the setup of a national FinTech organization will push New Zealand’s economic growth. Mitchell Pham, tech leader and director of NZTech, said that New Zealanders should care about FinTech as electronic interactions will play an important role across the country’s economy, according to Scoop News, a New Zealand news website. After gathering support from NZTech and the New Zealand government, FinTechNZ was launched last week. Pham is reported as saying that e-commerce as a subset of FinTech is important for the future of small to....

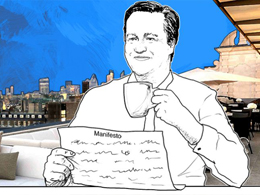

Earlier this year, Prime Minister David Cameron expressed his desire to make UK the world leader in the fintech sector by 2020. Chancellor George Osborne has also said that he wishes to makeUK the global fintech capital. However, as the year comes to a close, their plans are being dented by the Bitcoin hotbed that is China, which has surprisingly bagged 7 spots in the top 50 fintech companies list published by Fintech Innovators. Two of these companies, ZhongAn (#1) and Qufenqi (#4), feature in the top 5. ZhongAn is an online insurance company which has the backing of Jack Ma, the founder....

UK Prime Minister David Cameron has given his nod to an ambitious manifesto presented by the industry think tank Innovative Finance, focused at making UK the world leader in the fintech sector by 2020. The manifesto sets ambitious goals of attracting $8bn of investment and for UK to become the global home of 25 top financial technology companies based on IPO, global market share or valuation, and help in creation of 100,000 jobs by 2020. Currently, the UK fintech sector generates £20bn of GDP and employs 135,000 people and investment in UK FinTech more than doubled last year to $623m,....

Malaysia is one of the most recent countries to look at its current regulatory guidelines and come up with changes to take part of the FinTech revolution. Keeping in mind how Bitcoin is a part of FinTech as well, these changes will have a rippling effect on cryptocurrency adoption. FinTech Regulation is a Double-edged Sword. Various countries around the....

A new Fintech manifesto ‘UK FinTech 2020’ has been released as UK Prime Minister David Cameron voiced his support, leading a trade delegation of British FinTech leaders, including bitcoin wallet provider Blockchain, to South East Asia. The manifesto, released by the independent membership association for the global FinTech (financial technology services) sector, Innovate Finance, has some ambitious goals including securing London’s position as the world’s FinTech capital and creating 100,000 jobs. UK Prime Minister David Cameron has expressed his support for the initiative: “This....