The Bank of Ireland Will Penalize Large Cash Deposits

This is another clear example of why users should not keep their funds in a bank account. Holding cash is becoming a less favourable option for many customers around the world. Charging fees on cash deposits is becoming the new norm in Germany, and more of them will follow in the coming months. So far, two more banks have taken this route, including the Bank of Ireland and Ulster Bank It looks like the negative interest rates will be passed on to customers who make cash deposits. It was only a matter of time until the negative interest rates would be passed on to the customers. Not only....

Related News

Unfortunately, this appears to be another way of ending cash in Ireland. The war on cash waged by governments and central banks is in full effect as of right now. Ireland’s Central Bank plans to dispense more 10 and 20 euro banknotes through ATMs. Although that may sound like an innocent decision, it is a significant step towards getting rid of high-denomination banknotes. Officially, the bank sees this move as a way to make lower denomination notes “more accessible.” It is apparent the Central Bank of Ireland has a clear plan in mind. Banks are forced to issue lower denomination banknotes....

The boss of MasterCard in the UK and Ireland believes cash will be practically extinct in the next five years across Britain and Ireland and will seem as antediluvian as carrying a pouch full of gold. Speaking to Business Insider during Money2020 Europe in Copenhagen last week, Mark Barnett CEO of MasterCard UK and Ireland claimed cash in 30 years will seem as old fashioned as the horse and cart. Barnett says: "We're quite ahead of the rest of the world, because if you take the world as a whole it's still 85% cash. I think in five years time there'll be practically none. There will be....

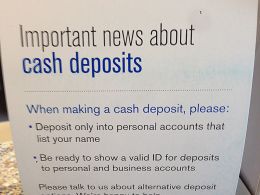

Chase have outlined a new policy on cash deposits. Picture via /u/throwwwwaway81. One of the key aspects of the Charlie Shrem and BTCKing money laundering case is that anonymous individuals were able to go to various banks around the United States and make deposits of less than $1,000 to bank accounts owned by BitInstant. BitInstant was not required to collect information on people who wanted to buy less than $1,000 worth of bitcoins per day, and the banks allowed anonymous individuals to make deposits into bank accounts controlled by BitInstant. It seems that Chase is implementing a new....

BNP Paribas and the Bank of Ireland have started trial runs for their respective blockchain applications. BNP Paribas has partnered with a crowdfunding platform, Smart Angels for the same. The banking sector is finally making some headway with their exploration of blockchain technology. Soon after UBS and Deutsche Bank made an announcement about the success of their blockchain technology experiment, two more international banks have now come up with their own solutions and testing them out. The French banking firm, BNP Paribas and the Bank of Ireland are the duo who have brought their....

The Central Bank of Ireland has provided regulatory approval to Gemini, a cryptocurrency exchange. Gemini will now be able to extend crypto services in Ireland. The exchange is situated in Ireland (Dublin), it established its headquarters there in the year 2021. After a thorough review of the security and compliance programmes, this license was granted […]