Can the Federal Reserve Really Save the US Economy?

Is the US Federal Reserve still capable of reducing negative effects from recessions and other economic shocks? Not without drastic measures, says a critic. More Extreme Measures. The answer is yes – at least, according to a paper by the Fed’s own deputy director of its research and statistics division. Closer inspection of the details, however, suggests....

Related News

By definition, a savings account is designed for businesses and people to save cash for emergencies or urgent expenditures in the future. However, banks and financial institutions, including the Fed, are doing exactly the opposite of what people require to maintain financial security. The general population does not benefit. The Federal Reserve raised interest rates this week, to cope with the rising inflation rate and maintain the stability of its economy. In simpler terms, a rise in interest rates means that the central bank is printing out more fiat money to distribute to the economy.....

As the total debt of the US federal government surpassed it’s an all time high record with $19,659,460,647,160.83. Bitcoin is proving to be one of the very few alternatives for financial protection. The US economy is found on an entirely debt-based monetary system, which is presumed to surpass $20 trillion in debt by 2017. The outstanding debt of the US federal government is covered by the Federal Reserve’s quantitative easing process, in which billions of Dollars are printed out to be distributed amongst top-tier commercial banks, corporations, and the Federal Reserve bank. Bloated US....

On Friday, May 9th, 2014, the Federal Advisory Council and Board of Governors of the Federal Reserve met for their quarterly meeting in Washington D. C. This meeting was historically held in secrecy until Bloomberg News "won" a Freedom of Information Act request under the Freedom of Information Law requiring the Fed to make the meetings minutes available to the public. The Federal Advisory Council (FAC) is "composed of twelve representatives of the banking industry, consults with and advises the Board on all matters within the Board's jurisdiction..." according to the Federal Reserve in....

The Federal Open Market Committee has surprised markets by speaking in dovish tones about the US and the global economy. While many people expect the Fed... and we examine the implications for the economy and Bitcoin. Meanwhile, the Bitcoin Price, along with Gold, continues advancing. The layout of the article has changed. Bitcoin price analysis is now posted as the final section and updates made during the European and US sessions will be added after it, at the bottom of the article. The chronology of price development should be easier to follow. Links to the various sections are provided....

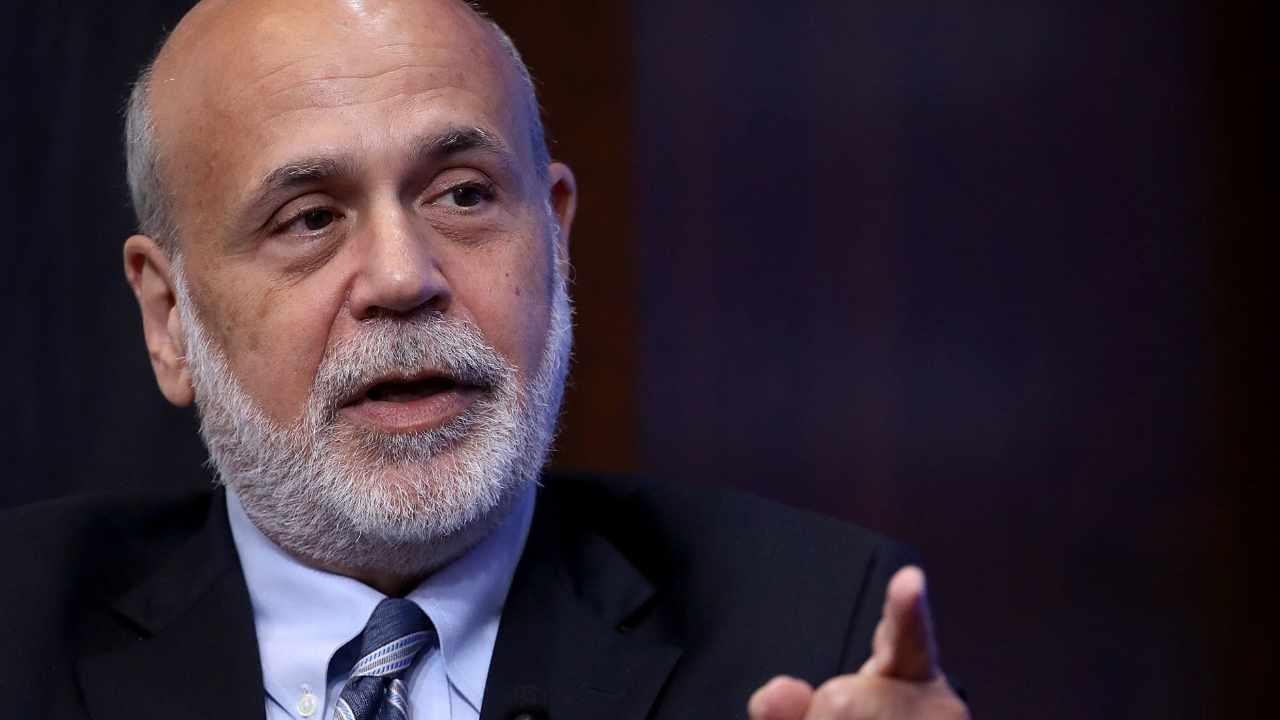

Former Federal Reserve chairman Ben Bernanke says the main use of bitcoin is “mostly for underground economy activities and often things that are illegal or illicit.” He added, “I don’t think bitcoin is going to take over as an alternative form of money.”

Ben Bernanke on Bitcoin, Cryptocurrency

Former Federal Reserve chairman Ben Bernanke shared his view on bitcoin and other cryptocurrencies in an interview with CBNC Monday.

Bernanke is an economist who served two terms as the chairman of the U.S. Federal Reserve, from 2006 to....