US Credit Unions’ CULedger to Do ‘What R3 Does For Banks’

August saw the first meeting of US credit unions looking to pioneer so-called distributed ledger technology (DLT) in CULedger, a “dedicated” version of the banks’ R3 Consortium. CULedger ‘Does What R3 Is Doing for Banks’. CULedger, which seeks to mimic R3 in order to allow organizations to benefit from blockchain technology, is currently fundraising....

Related News

Coinbase’s CPO has defended stablecoins and pushed back on the banking sector’s fears of a potential collapse of bank deposits and community banks, arguing that the concerns are unfounded and could pose a risk to the emerging sector. Related Reading: Ondo Finance Brings Tokenized Stocks, ETFs To BNB Chain With New Expansion Coinbase Refutes Banks’ […]

Most people in the Bitcoin community agree that the digital currency has the ability to render fractional reserve banking impossible, but not everyone agrees on whether or not this development would be a good thing. The skeptics worry that without fractional reserve banking, it will somehow be impossible for banks to make loans. Taking this ability from....

Traditional finance is built not on collateral but on reputation, and DeFi will grow by following suit. Over the last 12 months, the remarkable growth in decentralized finance has been driven by one thing: the ability of users to earn strong yields on their crypto assets by lending, staking and providing liquidity. Depending on your risk appetite, gains from DeFi investments can run tens or even hundreds of times higher than standard returns in the traditional markets.Even if those kinds of yields don’t last forever, DeFi offers significant promise to transform the financial markets in the....

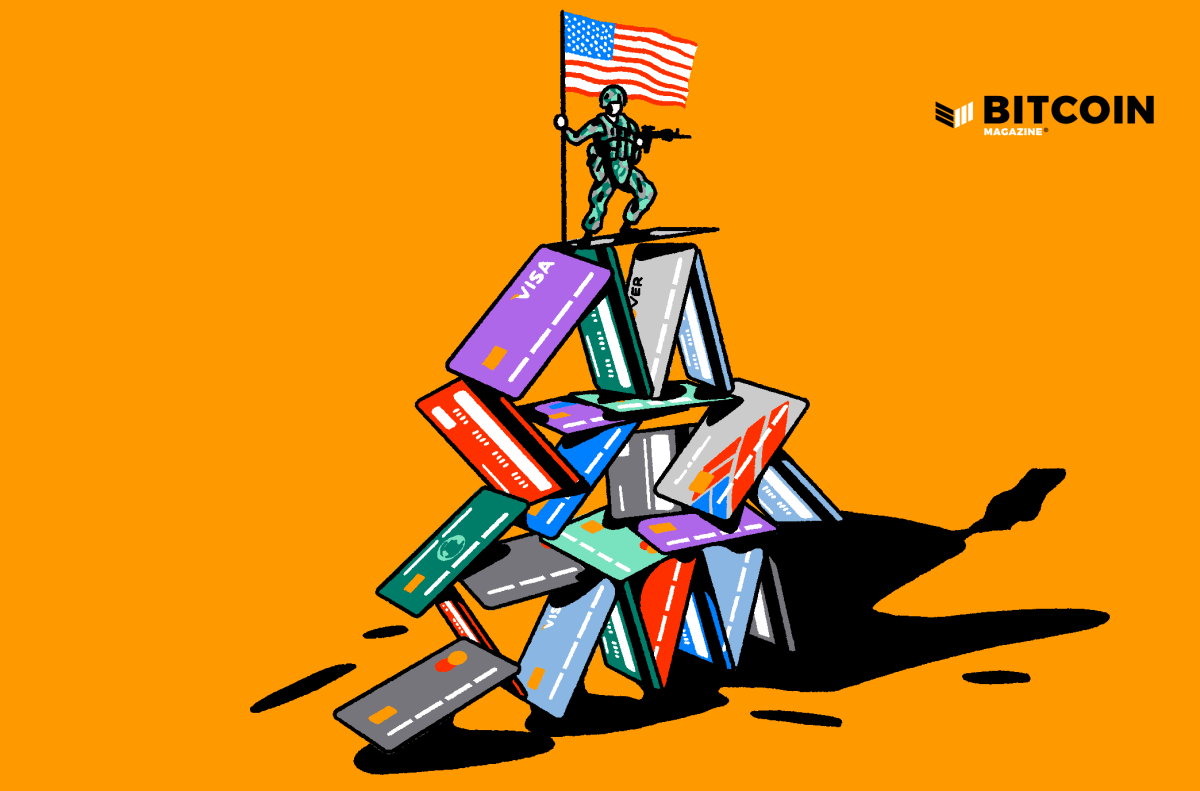

Credit is needed to leverage trust, whereas bitcoin is a tool for trustlessness. Both credit and bitcoin will coexist during hyperbitcoinization.

The plans to add crypto to credit cards impressed the community. With such additions, users can access credit facilities in crypto for payments or other activities. A credit card is one of the fastest means of accessing money for payments. Many countries operate a cashless economy whereby debit and credit cards reign. But according to […]