DLT Financial Bitcoin Tracker Fund to Follow its Crypto Index

DLT Financial has announced the upcoming launch of a cryptocurrency tracker fund, associated with its latest DLT10 Index. Bitcoin has presented itself as an excellent investment vehicle in the past few years. However, the nature of cryptocurrencies combined with the absence of clear regulations has kept traditional investors away from it for a long time. DLT Financial, a spin-off of well-known firm Tramonex has announced its plans to launch a new Bitcoin fund. The fund follows the company’s recent launch of its cryptocurrency index. The DLT10 Index lists 10 different cryptocurrencies....

Related News

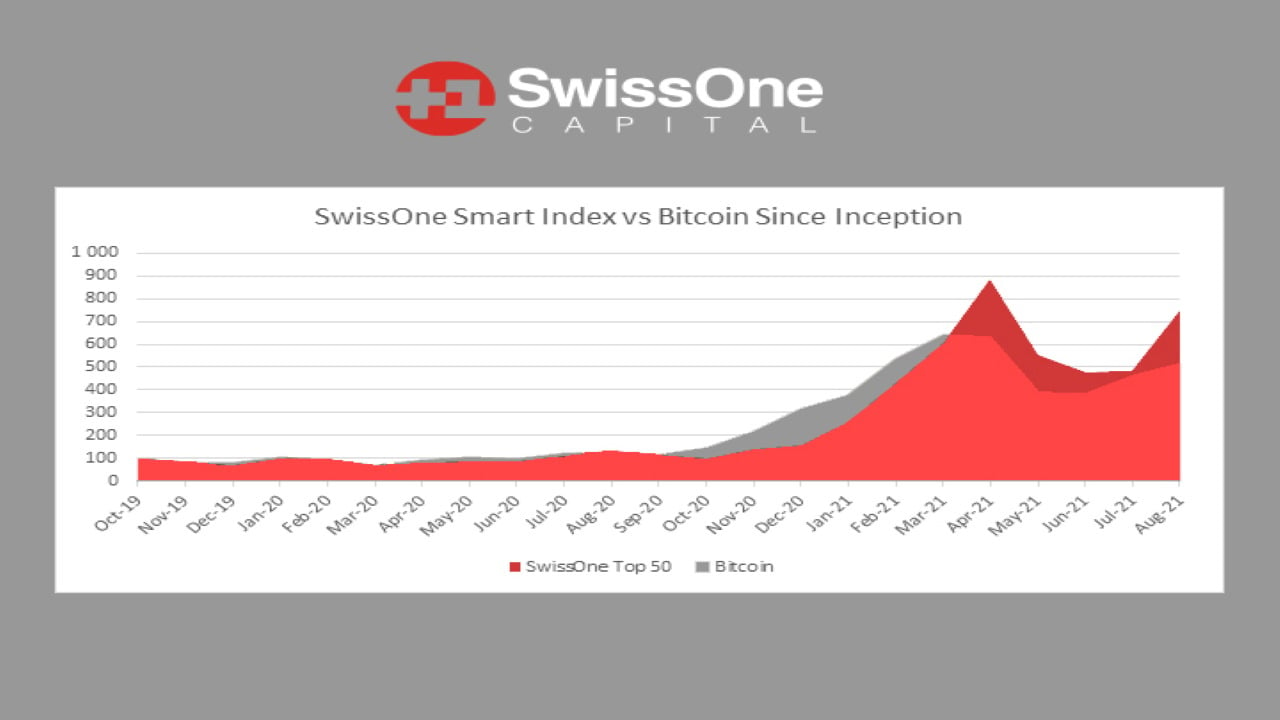

PRESS RELEASE. Zug, Switzerland: SwissOne Capital AG, a specialized digital asset manager with a focus on blockchain investment funds, has partnered with ISP Securities AG for the launch of their Smart Index Crypto Fund Tracker Certificate. This fund tracker certificate is the first of its kind to capitalize on 50 of the best-performing cryptocurrencies, offering unprecedented market exposure compared to individual currencies, exchanges, DeFi, and other platforms. SwissOne Capital’s deep experience in the crypto space combined with their premiere concierge service can give....

HashKey Capital, a digital asset management firm based in Hong Kong, has announced the launch of a new investment product focused on XRP, marking a strategic step toward increasing institutional exposure to the third largest crypto asset by market cap in Asia. The product, called the HashKey XRP Tracker Fund, is positioned as the region’s […]

According to Yahoo Finance, a London-based startup named DLT Financial said it will launch a fund to track an index of the top ten cryptocurrencies on the market — one of them of course being Bitcoin. DLT Financial: New London-Based Cryptocurrency Index Fund. Recently rebranded from Tramonex, DLT Financial is a fintech company that aims to make virtual....

Ripple is again breaking into the Asia market with a new XRP product, which would help drive institutional adoption. This move has been made in partnership with HashKey Capital, which launched this fund in order to expand institutional access to the altcoin. Ripple Invests In HashKey’s XRP Product In an X post, Hashkey Capital announced that it is launching Asia’s first XRP Tracker Fund with Ripple as an early investor. The asset manager noted that this move represents a significant step in expanding institutional access to XRP. Related Reading: Cardano Price Surge To $1.7: Here Are The....

The fund tracks the performance of the 10 largest cryptocurrencies from SIX Swiss Exchange’s Crypto Market Index 10. Cryptocurrency adoption continues gaining momentum in Switzerland as local financial authorities grant more regulatory approvals for crypto investment instruments.The Swiss Financial Market Supervisory Authority (FINMA) has approved the Crypto Market Index Fund as the “first crypto fund according to Swiss law,” the authority officially announced Sept. 29.The fund is launched by Swiss asset manager Crypto Finance and is administered by investment management firm PvB Pernet....