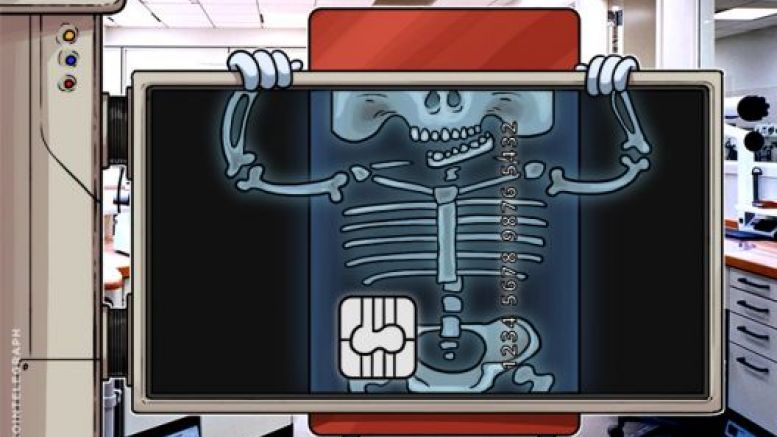

Debit Card Users Are at Massive Risk in India, Millions of Cards Compromised

Banks are perceived to be safe by most people. The common public is wary of risky investments and tend to gravitate more towards the familiar and what could be more familiar than the neighbourhood bank with a cash machine sticking out of the wall? The month of October has brought shocking news for Indian debit card users as more than 3.2 mln debit cards are now known to have been compromised. This compromise is the largest ever breach of security in the Indian banking system. The largest Indian bank, the State Bank of India has been the worst hit with more than 600,000 debit cards....

Related News

XAPO Cat is watching you... You may have heard about how XAPO is charging excessive previously undisclosed fees on their Xapo Debit Card, but what you may not know is that they will reimburse you for the third-party monthly fees, in Bitcoin! Though, aside from the $15 shipping fees, XAPO included a few other hidden fees they consider to be "customary fees just as with any other debit card." XAPO Debit Card Fees. XAPO has been under a lot of PR stress lately as they released the fee schedule from their debit card supplier. On August 4th, XAPO posted an update on their news feed which stated....

Xapo: Making Bitcoin Easy & Accessible For All. We have all been waiting and waiting for Xapo's Bitcoin Debit Card and according to Ted Rodgers, the Chief Strategy Officer at Xapo, our wait will soon be coming to an end. In fact, the first shipment of debit cards went out on July 29, 2014, so many of those who pre-ordered, should check their mailboxes this afternoon. The Xapo debit card is the world's first Bitcoin debit card that is tied to your wallet balance. The card acts as a seamless extension of your Xapo wallet and allows Bitcoin holders to spend their bitcoins at any merchant that....

Upon the interests of those that have awaited for the highly anticipated bitcoin debit cards of Xapo, the multi-million dollar startup has finally begun shipping its cards internationally. However, in correlation to its launch, Xapo has announced that the cards cannot be shipped to the United States, and cannot be used by its residents. "Unfortunately, Xapo cannot issue nor ship the Xapo Debit Card to users who reside in the following countries: United States Minor Outlying Islands Uzbekistan Vanuatu Venezuela Vietnam Virgin Islands, U.s. Wallis And Futuna Western Sahara Yemen Zambia....

Coinbase, the largest Bitcoin exchange in the world, has launched debit card payments in the US. The debit and credit card payments were already available to Coinbase’s European customers. Coinbase released the following statement on its website, saying that from the March 1, Coinbase users in the US will be able to buy Bitcoin via their debit cards: The Bitcoin subreddit, /r/Bitcoin, has always had mixed feelings with regards to Coinbase, but the general consensus among the community is that this is a positive development. “Today we’re launching a new Coinbase product (in beta) to users....

Anyone who has visited or lived in India will tell you that cash is the most favoured method of payments for Indians. In 2016, the Reserve Bank of India (RBI), India’s Central Bank released a concept paper titled ‘Card Acceptance Infrastructure’. Merchants discourage cards use. The paper noted that whilst there has been a significant increase in electronic transactions in India, the growth has not occurred uniformly in all segments. In fact card usage in India is invisible in many areas. Many merchants actively discourage customers from paying with a card, particularly for smaller....