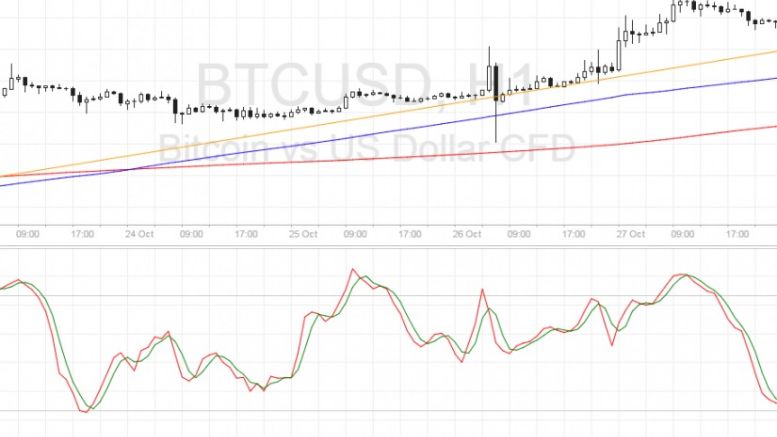

Bitcoin Price Technical Analysis for 10/28/2016 – Steeper Climb in Play

Bitcoin price is enjoying stronger bullish pressure that’s pushing it up on a much steeper climb lately. Bitcoin Price Key Highlights. Bitcoin price has been making one upside breakout after another, indicating the presence of strong bullish momentum. A steeper rising trend line can be drawn to connect the latest lows of price action on the 1-hour time frame. Price could be in for a shallow pullback to this rising trend line or a larger correction to the nearby area of interest. Technical Indicators Signals. The 100 SMA is safely above the longer-term 200 SMA so the path of least....

Related News

Bitcoin price followed through with its consolidation breakout and sustained its climb. Bitcoin Price Key Highlights. Following the recent upside breakout from the symmetrical triangle pattern, bitcoin price continued to climb as predicted in the earlier post. Price has now made its way to the triangle highs around $780 and is showing increased buying pressure to form new highs. Technical indicators are giving mixed signals at the moment, but it looks like the odds are in favor of more bullish action. Technical Indicators Signals. The 100 SMA is above the 200 SMA so the path of least....

Bitcoin price is testing a long-term support area, with technical indicators hinting at a continuation of the climb. Bitcoin Price Key Highlights. Bitcoin price is in the middle of a sharp selloff but it seems to have found support at the rising trend line as predicted in the previous post. Price spiked off the $500 level, as plenty of buy orders were likely waiting in that area of interest, which held as resistance in the past. Technical indicators seem to be suggesting that the longer-term climb could resume from here. Technical Indicators Signals. The 100 SMA is above the longer-term....

Bitcoin Price Key Highlights. Bitcoin price recently made a strong upside break from a consolidation pattern, indicating that buying pressure is building up and that an uptrend might take place. A bit of hesitation can be seen right now, though, so a correction to the short-term Fib levels might be needed before more bulls come out to play. Bitcoin price could retreat to any of the Fibonacci retracement levels marked on the 1-hour time frame before resuming is climb to the previous highs or beyond. Technical Signals Favor Rallies. Even though a bit of selling pressure could come into play....

Bitcoin price has given way to dollar strength after the FOMC statement but could be ready to resume its climb. Bitcoin Price Key Highlights. Bitcoin price seems to be forming a new short-term rising channel visible on the 1-hour chart. Price was weighed down by dollar strength after the FOMC sounded more hawkish than expected in its latest statement. Bitcoin price still looks intent to carry on with its climb as technical indicators hint that a bounce is due. Technical Indicators Signals. The 100 SMA is above the longer-term 200 SMA so the path of least resistance is to the upside. In....

Bitcoin price could pull back as low as the broken triangle resistance before resuming its climb, as technical indicators are hinting at a quick selloff. Bitcoin Price Key Highlights. Bitcoin price appears to be taking a break from its sharp climb, offering buyers an opportunity to catch the uptrend on a pullback. Bitcoin recently broke out of a symmetrical triangle formation and has surged past the previous year highs at $500. Price peaked at $600 before showing signs of a correction. Technical Indicators Signals. The 100 SMA is above the 200 SMA for now, confirming that the longer-term....