ICICI Bank and Others Partner with Stellar to Offer Blockchain Based Fund Transfer

ICICI Bank and three other financial services platforms have partnered with Stellar cryptocurrency platform to enable blockchain based fund transfer. The Indian fintech sector has lately been in the news a lot. In yet another milestone achievement, one of the leading banking institution — ICICI has partnered with Stellar blockchain platform. In the latest release, Stellar has announced partnerships with not one but four different entities across the world. In addition to ICICI Bank, other platforms include Coins.ph — a Philippines-based mobile financial services provider; Flutterwave — a....

Related News

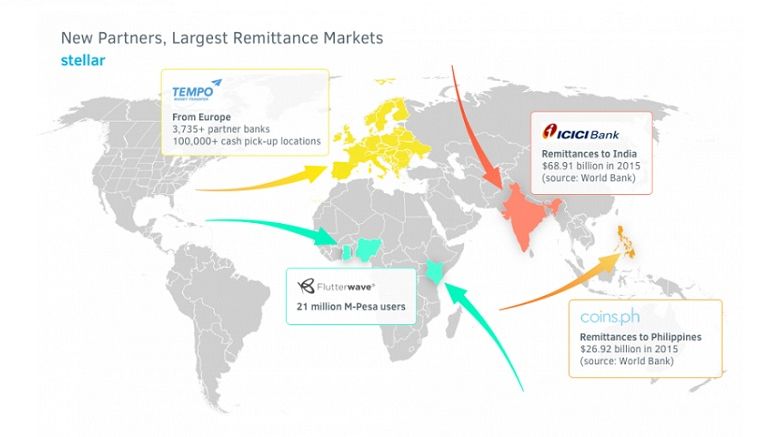

Stellar, the open blockchain platform and non-profit payment protocol has unveiled a slew of new partners including, notably, India’s largest private bank by consolidated assets ICICI, to bring low-cost, near instantaneous remittance solutions in India, the Philippines, Africa and Europe. Announced yesterday, Stellar revealed four new partners in some of the largest remittance markets in the world. Indian bank ICICI; Philippines-based financial inclusion-focused Fintech startup Coins.ph; pan-African Fintech firm Flutterwave which is notably plugged into the popular M-Pesa network; and....

Two more major banks successfully completed a cross-border transaction executed on a blockchain today. Announced by ICICI Bank and Emirates NDB, the trial represents the latest efforts among banks worldwide to use the technology to facilitate faster, lower-cost transactions. Notably, ICICI and Emirates NDB are among the largest banking groups in their respective countries. In one of the tests, an ICICI bank branch based in Mumbai transmitted a transaction, via a blockchain, to an Emirates NDB location in Dubai. The banks also tested a distributed ledger for tracking documentation for trade....

ICICI Bank, India’s largest private bank, will focus on Blockchain technology to make its services more secure and create a more robust experience for its customers.. ICICI Bank, India’s largest private bank, will use Blockchain technology to make its services more secure. According to the Indian newspaper Mint, ICICI Bank, headquartered in Mumbai, India, will create a new position with the title Chief Technology and Digital Officer (CTDO) for this purpose. The CTDO will report directly to Chanda Kochhar, Managing Director and CEO of ICICI Bank. The CTDO will be in charge of the bank’s....

India’s largest private sector lender, ICICI Bank, has tied up with Dubai’s largest bank, Emirates NBD, to develop a blockchain platform to facilitate international trade finance and remittance. Indian bank ICICI has announced the successful pilot of transactions executed over a blockchain, developed in partnership with Middle Eastern banking giant Emirates NBD. A custom-made blockchain platform was used for the transactions, developed by a subsidiary of Indian technology powerhouse Infosys. The pilot transactions saw an ICICI Bank branch in India’s industrial capital Mumbai, remit funds....

Since blockchain technology makes it cheap and easy to send immutable data and information all over the world in seconds, this field trial was only a matter of time. Blockchain technology is being explored by many financial service providers all over the world right now. Over in India, the first-ever blockchain transaction has been successfully completed. ICICI Bank, one of the country’s largest private banks, conducted several transactions using this technology. In doing so, they became the first Indian bank to publicly acknowledge success in the world of distributed ledgers. As one would....