Indian Chief Minister of Assam Launches Cashless Digital Banking Campaign

Sarbananda Sonowal, chief minister at Assam, a northeastern state in India, has launched a digital banking campaign to instill in the local population that digital banking is the way forward, according to a report by The Times of India. Launched on Monday and in partnership with the State Bank of India, it is hoped that the campaign will help to spread awareness across the country to reduce the number of cash transactions. This news comes in light of the recent demonetization in India. Speaking to The Times of India, Sonowal, said: The Assam government is taking all possible measures to....

Related News

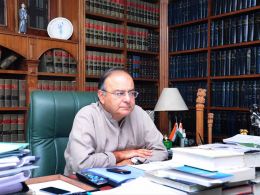

Arun Jaitley, Finance Minister of Corporate Affairs in the Cabinet of India, has said that banks should start to promote digital banking in ‘mission mode’ to limit the use of physical currency. It is hoped that by doing so cashless transactions will increase in the country, reports The Times of India. Only recently the Indian Prime Minister Narendra Modi announced the banning of two of the country’s biggest fiat banknotes in the country. The move, according to Modi, was to tackle corruption, black money, and terrorism. It is also believed that the withdrawal of the Rs 500 and Rs 1,000....

Since the announcement of the banning of India’s two biggest banknotes last November by Indian Prime Minister Narendra Modi, the country has pushed efforts toward digital banking. Yet despite the drive to make this happen, hurdles still face the country to make it a reality. At the news of India’s demonetization, the digital currency bitcoin reached new highs in the country with demand pushing the price of one bitcoin to $881 in November. With a surge of bitcoin adopters in India it appeared that a push toward digital banking was the way forward as more than a billion people faced....

Could blockchain tech take India cashless? As India's government pushes ahead with a controversial plan to move the country away from physical cash, a group of researchers backed by its central bank has called for an investigation into how blockchain could achieve that goal. The Institute for Development and Research in Banking Technology (IDRBT) was founded in the 1990s by the Reserve Bank of India (RBI), and last week, it released its first major white paper focused on blockchain (which includes details of a test related to trade finance applications). In addition to providing a broad....

The Indian finance minister has finally revealed clues about what is in the cryptocurrency bill that is due to be introduced in parliament. Mentioning no crypto ban, she said that the government will take “a very calibrated” approach to cryptocurrencies. Indian Finance Minister Provides Clues on Upcoming Crypto Regulation Indian Finance Minister Nirmala Sitharaman shed some light on the upcoming crypto regulation in her country during CNBC-TV18’s IBLA townhall Friday. This is the first time she talked about the content of the bill and the Indian government’s plans....

Indian crypto exchanges have pooled their resources together and launched a campaign to gain support from as many parliament members as possible about cryptocurrency regulation. The crypto bill is listed to soon be introduced in parliament. It seeks to prohibit cryptocurrencies while creating a framework for the digital rupee to be issued by the Reserve Bank of India (RBI). Indian Crypto Industry’s Campaign to Bring About Positive Crypto Regulation The Indian government plans to introduce the cryptocurrency bill entitled “The Cryptocurrency and Regulation of Official Digital....