Chinese Exchanges Trade Bitcoin At US$800 And More

One also has to keep in mind how the US$800 mark is quite important, even more so for the Chinese. China has always been the driving force behind the Bitcoin price. Interestingly enough, it is the Chinese exchanges pushing the price well above the all-important US$800 threshold. It is up to the rest of the markets around the world to follow this lead. Them again, it is not certain the US market will get to US$800 anytime soon, as it is a major point of resistance. Many people woke up to can exciting surprise, as Chinese Bitcoin exchanges are trading at US$800 and above. Compared to the....

Related News

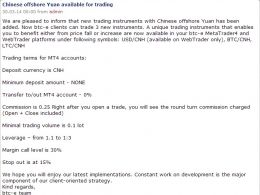

BTC-e has opened up USD/CNH, BTC/CNH, and LTC/CNH markets today. Withlooming PBOC action that would end Chinese Bitcoin exchange's access to domestic bank accounts, Chinese traders are undoubtedly looking for new exchanges to trade on. Along with Chinese RMB (CNH to BTC-e) trading comes RMB deposits, which are handled through an international bank. An international bank means that Chinese traders wishing to convert fiat to crypto through this route will be subject to the Chinese $50,000 annual limit. In fact, people are starting to realize that the PBOC's still shrouded notice to regional....

Read the original Chinese article on btc38 and btckan, a prominent Chinese Bitcoin exchange and website, respectively. BTC China's CEO Bobby Lee has introduced a new method for Bitcoiners in China to "recharge" their RMB balances on Chinese Bitcoin Exchanges: BTC China vouchers. Within a week, Chinese Bitcoin Exchanges led by BTC China, have found a solution for getting RMB deposits into Chinese Bitcoin Exchanges in compliance with ever-changing interpretations of Chinese law. Alternatively, Huobi's CEO has been using his personal bank account to provide RMB liquidity for all of his....

Most of the Bitcoin trading volume is changing hands across Chinese bitcoin exchanges. Therefore, Chinese exchanges are feeling pressure to come up with new and innovative features to preserve their dominance and expand bitcoin adoption. OKCoin, one of China’s leading bitcoin exchanges, is attempting to do exactly that. There are a few things all Chinese bitcoin exchanges have in common. For starters, all of these platforms are exchanging bitcoin against the Chinese Yuan (CNY). Furthermore, major Chinese bitcoin exchanges such as OKCoin, BTC China, and Huobi all offer 0% spot fees on the....

Last week’s warning from the PBOC to its citizens about the risk of investing in bitcoin and the following on-site investigations at China’s three largest bitcoin exchanges, OKCoin, Huobi and BTCC, spooked bitcoin investors and pushed the price down to its current trading price in the low $800s from recent highs above the $1,000 mark. Margin Trading Halted at Chinese Exchanges. The first result of the PBOC’s on-site checks at the exchanges, which were conducted to look into possible market manipulation, unauthorized financing and money laundering, was that all three exchanges initially....

In the long run, suppressing volatility and speculation will be positive for the bitcoin market. Bitcoin trading volume has been plummeting across all major Chinese exchanges. That is not entirely unexpected, considering these platforms have removed most of their margin trading options. Moreover, trading fees have been reinstated across Chinese exchanges, which will heavily impact trading activities. For the time being, this has not impacted the Bitcoin price all that much, though. The one-hour trading volumes across most major Chinese bitcoin exchanges took a big hit. Earlier tonight,....