Two Major Banks To Pay Billions In Fines Over Subprime Mortgage Bonds

During all of these ongoing investigations, the Bitcoin price has been soaring. Two of the world’s largest banks have been fined over their malpractices. Deutsche Bank agreed to a US$7.2bn settlement over its mortgage-back securities investigation. Credit Suisse Group AG will pay US$5.28bn for a similar incident. More and more of these stories have been popping up in recent months. It is evident the banking sector is prone to more fines shortly. Settlement cases in the financial sector are not out of the ordinary. Unfortunately, it appears banks have so much malpractice to answer for as of....

Related News

Since the 2008 financial crisis, twenty of the world's largest banks including JPMorgan, Citibank and HSBC have paid over US$235 billion in fines. Interestingly, the majority of the fines derived from the banking system's inefficiency and failure to keep track of sold mortgages and insurance products. According to the financial data provided by news agency Reuters, fines for U. S. mortgages have accounted for nearly US$150 billion, with America's biggest banks including Bank of America, JPMorgan and Citigroup being fined for billions of dollars due to their non-fulfilment in maintaining a....

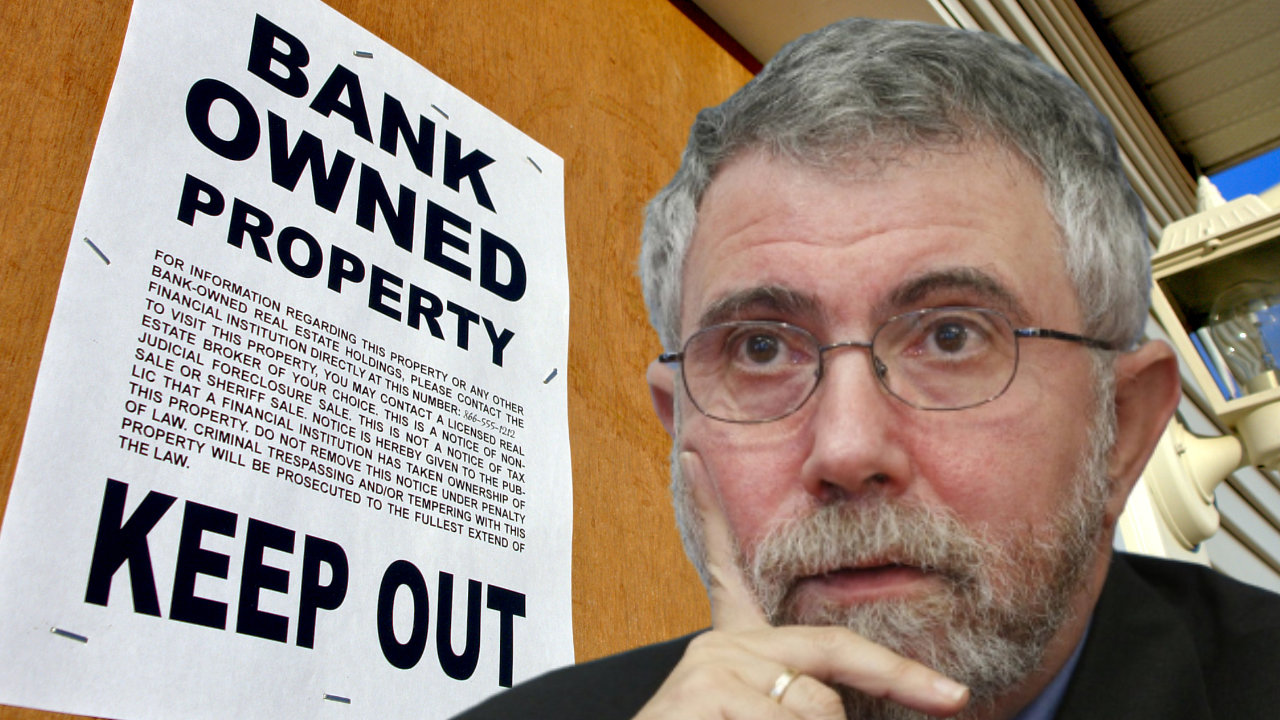

Nobel Prize-winning economist Paul Krugman has compared the current state of cryptocurrency to the housing bubble and the subprime mortgage crisis. Noting that crypto lacks any real value, he said: “it is a house built not on sand, but on nothing at all.”

Paul Krugman on Crypto, Housing Bubble, and Subprime Mortgage Crash

Nobel laureate Paul Krugman discussed the current state of cryptocurrency in an opinion piece published in the New York Times Monday.

Krugman won the Sveriges Riksbank Prize in Economic Sciences in Memory of Alfred Nobel in 2008....

Nobel Prize-winning economist Paul Krugman sees parallels between the crypto market and the subprime mortgage crash. “There’s growing evidence that the risks of crypto are falling disproportionately on people who don’t know what they are getting into and are poorly positioned to handle the downside,” he stressed. Nobel Laureate Paul Krugman Warns About Crypto Crashing Like Subprime Mortgage Nobel laureate Paul Krugman warned about cryptocurrency investing in an opinion piece he authored in the New York Times, published Thursday. Krugman won the Sveriges....

Top U.S. banks have racked up almost $200 billion in fines and penalties over the past 20 years from illegal activities in 395 major legal cases. Bank of America tops the list, followed by JPMorgan, Citigroup, and Wells Fargo, according to a new report, which also covers Morgan Stanley and Goldman Sachs. Big Banks’ $200 Billion in Fines Bank of America, Citigroup, Goldman Sachs, JPMorgan Chase, Morgan Stanley, and Wells Fargo have collectively racked up $195 billion in fees and penalties, according to Washington-based advocacy group Better Markets. The fees and penalties from 395....

Greg Foss and Dylan LeClair discuss how bitcoin solves the global credit unwind and the way this cycle differs from the 2008 subprime mortgage crisis.