Needham: Winklevoss Bitcoin ETF Would Have Profound Impact on Price, but Approval Unlikely

Needham & Company has put together a report on the prospects of the Winklevoss twins’ proposed bitcoin ETF, and it comes with both positive and negative news for the digital bearer asset. Spencer Bogart, a research analyst at Needham & Company, put together the report in response to the questions the company had been receiving from their clients....

Related News

Needham & Company, an independent investment bank and asset management firm, released today a mini investors’ report on the prospect of a Bitcoin ETF in 2017. The company currently hands Barry Silbert’s Bitcoin Investment Trust (GBTC) with a ‘Hold’ rating. Report author, Spencer Bogart, detailed the upside potential of a bitcoin ETF being approved....

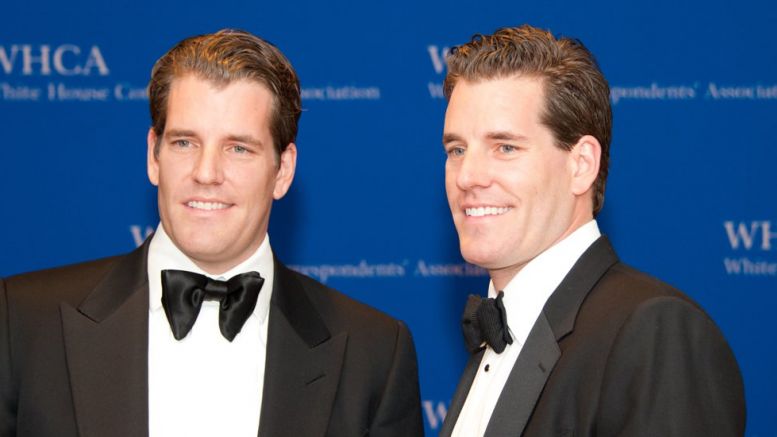

As one of the more high-profile bitcoin ETF efforts edges closer to possible approval, analyst Needham & Co has released a deeper look at the factors that could influence the US Securities and Exchange Commission's decision on the matter. Published Friday, the report doesn't go so far as to alter its outlook for the Winklevoss Bitcoin ETF, positioning its odds of approval at below 25% while continuing to state strongly that any positive outcome would be a substantial boon for the technology. Perhaps most notably, however, the report offers a wider lens-look at three investment vehicles....

Speculation about the Winklevoss twins’ Bitcoin ETF possible regulatory approval continues. On March 11, the US Securities and Exchange Commission should come to its “yes” or “no” verdict after almost four years of waiting. It may happen by the time two of the world’s top Bitcoin exchanges that are based in China - Huobi and OKCoin - would have resumed their full withdrawal services. Most commentators are certain that the first Bitcoin exchange traded fund or ETF is not likely to be approved. However, commentaries are still divided over the issue and none of the stakeholders rule out the....

A new investor note published today by analyst Needham & Company projects that a bitcoin exchange-traded fund (ETF) could attract as much as $300m in new assets in its first week alone. Writing about the potential impact of an ETF on the nascent market, analyst Spencer Bogart speculates that such an approval is likely to have a "profoundly positive" effect on the price of bitcoin, and that the $300m estimate is "conservative". "The resulting effort to source the underlying bitcoin for the trust would likely drive the price of bitcoin up significantly,"....

Traders seem to be already pricing in the US Securities and Exchange Commission's (SEC) upcoming ruling on the Winklevoss bitcoin exchange-traded fund (ETF), according to most analysts polled by CoinDesk. Should the fund – sought by Tyler and Cameron Winklevoss – receive approval, the creation of an easily accessible investment vehicle could trigger a massive influx of capital and robust price increases, market observers have stated. As a result, the SEC decision, which has a deadline of 11th March, has drawn significant attention from traders. Potential impact. Several analysts spoke with....