Automated, High-Speed Chinese Traders Dominate Bitcoin Trading

Professional traders using high-speed, automated trading are now responsible for 80% of bitcoin trading, according to Bloomberg. Bitcoin offers arbitrage opportunities across different exchanges, zero transaction costs on the Chinese venues hosting most of the activity, round-the-clock trading, and co-location services allowing participants to align their servers with exchange servers. As trade volumes reached record levels this month, according to Bitcoinity.org, opportunities exist for automatic traders to reap record profits. Profiting From an ‘Imperfect’ Market. Zhou Shuoji, a former....

Related News

Automated Bitcoin trading software is being increasingly used by traders to conduct high-speed trades, to maximize returns. The cryptocurrency trade volumes have been unusually high in the past few months. The increased demand for the popular digital currency has been attributed to the growing community, where users are utilising Bitcoin to safeguard their earnings amid the economic slowdown. But, a leading financial publication has a different take on the entire situation. According to Bloomberg’s recent report, a majority of increased demand is coming from extensive automation of trading....

Chinese bitcoin exchange BTC China hit its all-time high at the weekend, trading bitcoin at ¥1,978 each. The record surpasses the previous Chinese high of ¥1,944 back in April this year, which, although Western media generally quotes the Mt. Gox high of $265, was actually equivalent to approximately $308. It seems the Chinese are willing to pay premium prices for their bitcoins, as exemplified by this recent breakout, with reports that much of the recent surge in the value of bitcoin can be attributed to the enthusiasm of Chinese traders. The thirst of Chinese traders. BTC China CEO Bobby....

Lately, Bitcoin has been gaining momentum while the trading volumes have been growing like never before. Currently, China is leading the digital currency exchange Industry by having one of the largest concentrations of cryptocurrency exchanges and where the highest bitcoin trading volumes can be found. Most of the Chinese Bitcoin exchanges have large trading volumes. Besides the high trading volumes, some of the possible motivations leading newcomers to use Chinese exchanges are the low fees and other benefits (such as referral programs that offer up to 50%) which many Chinese exchanges....

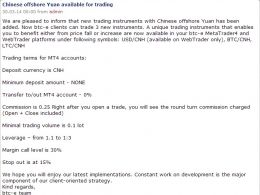

BTC-e has opened up USD/CNH, BTC/CNH, and LTC/CNH markets today. Withlooming PBOC action that would end Chinese Bitcoin exchange's access to domestic bank accounts, Chinese traders are undoubtedly looking for new exchanges to trade on. Along with Chinese RMB (CNH to BTC-e) trading comes RMB deposits, which are handled through an international bank. An international bank means that Chinese traders wishing to convert fiat to crypto through this route will be subject to the Chinese $50,000 annual limit. In fact, people are starting to realize that the PBOC's still shrouded notice to regional....

PRESS RELEASE. Chicago, Illinois, USA – Hummingbot.io, a premier open-source algorithmic trading project, has chosen to incorporate Beaxy Exchange into its most recent software release, allowing Beaxy users to take advantage of 24/7 automated high-frequency trading on a U.S. based cryptocurrency exchange. Previously, traders could use the open source codebase to run their own versions of Hummingbot. Now, a version exists which was custom tailored by the Hummingbot Development Team to ensure a streamlined integration with beaxy’s trading interface. Hummingbot differs from other....