CoinDesk Research Poll: Will Blockchain Disrupt Venture Capital?

Will blockchain technology disrupt venture capital? While not long ago that may have sound far-fetched, now more and more blockchain industry leaders are betting it could be a possibility. Blockchain token sales – sometimes known as initial coin offerings or 'ICOs' – raised over $100m in funding in 2016, and as participation in these events increases, so does interest in what was once a niche blockchain use case. Entrepreneurs are now seeking to leverage ICOs to quickly launch apps and gain users for software projects. At present, though, it still isn't clear if the funding method's full....

Related News

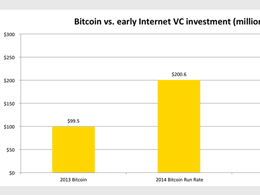

CoinDesk State of Bitcoin Q1 2014 from CoinDesk. Download the full report in PDF form. View more of CoinDesk's Research Reports here. Much has happened since CoinDesk released its first State of Bitcoin report earlier this year and today we are publishing an update featuring brand new data and analysis. We were blown away by the success of the first report, which, at the time of writing, had over 110,000 views on SlideShare. So thank you for taking the time to read and share it across your networks. The new report focuses on data and events in the first quarter of 2014 through to the....

Venture capital firm Blockchain Capital has announced the closure of its second fund used for investments in bitcoin- and blockchain-companies after fundraising $13 million in total. Blockchain Capital, a venture capital firm that set the precedent as the first investment fund for the digital currency industry has sealed its second startup fund for $13 million. A press release revealed that the second fund has already been used for investments in 2015, with a total of 23 bitcoin and blockchain technology companies invested into. In a statement, managing partner and co-founder Brad Stephens....

In addition to the companies listed below, sales portal BitSimple has raised $600,000 in a bitcoin-only seed round. This article summarizes some of the new State of Bitcoin 2014 data and analysis on venture capital investment presented at last week's Coinsummit conference in San Francisco. Several significant venture capital investments in bitcoin startups have been announced in recent weeks, including Circle's $17m second round, Xapo's $20m first round, and OKCoin's $10m first round (Table 1). Table 1: Bitcoin Venture Capital Investments - 2014 YTD. Sources: CoinDesk, Dow Jones....

Even though venture capital inflows into the blockchain industry dropped by 66% in Q3 2022, it doesn’t necessarily suggest an overwhelmingly bearish sentiment. In 2022, it’s no surprise that most assets are in a bear market. People have a variety of signals they look for when determining a good time to enter the market, and Cointelegraph Research’s Venture Capital Report for Q2 revealed that VC inflows stagnated at just above $14 billion last quarter, the same as Q1.However, the third quarter did not fare as well, dropping over 66% to just $4.98 billion, as Cointelegraph Research explores....

There are positive signals for crypto as Bitcoin closed September with only a 3% drop, while venture capital was up 20.6% and security token volume was up 19.76%. The blockchain industry does not exist in a bubble. The impact of the rest of the world’s economic turmoil seems to be stomping all over the progress of the “blockchain revolution.” Traditional markets like the S&P 500 index crashed by more than 11.5% in September, while the tech-heavy Nasdaq 100 index plummeted by 12.5%. However, Bitcoin (BTC) may have seen a decoupling, having only dropped 3% during this same period. For some,....