Bitcoin Trading Fees See Volumes Dive in China

The world’s largest bitcoin market saw a steep fall in trading volumes on the day in which exchanges began charging trading fees at a flat 0.2 percent from midday (Beijing time). In a 1-hour trading period after bitcoin exchanges introduced trading fees, trading volume at BTC China fell over 80%. Huobi and OkCoin, the two other exchanges that were investigated and saw discussions held with the People’s Bank of China saw declines of over 90 percent and 80 percent respectively. The drop in trading volume can be attributed to the lack of automated bitcoin trading, previously making up for a....

Related News

Today, China's exchanges report 98% of global volume, a figure that would suggest a huge dominance by its markets. Unfortunately, we know that most of this volume is fake. Unlike the rest of the world, China-based exchanges are unique in that they do not charge fees on bitcoin trades. Instead they make money via withdrawal charges out of the exchange. Further, these fees reduce as your trading volume increases, so this incentivizes traders to bolster this figure by buying and selling from themselves at zero cost. Still, there's a ocean of data coming from the markets, and they hold hidden....

Chinese bitcoin exchange BTC China has announced it will lower trading commission fees from 0.3% to 0.1% for all trades executed after midday China time (4:00 am GMT) today, 24th February. It will also retain its 'maker-taker' fee model, meaning those placing limit orders at prices set by them (market 'makers') will still be exempt from all fees, and actually receive a 0.1% rebate. The model is useful because it adds to market liquidity. BTC China had previously reduced fees for withdrawal into Chinese yuan from 1% to 0.5% on 3rd January. The company had been China's largest and busiest....

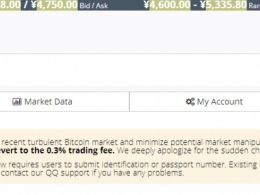

BTC China has reinstated trading fees in an attempt to combat market manipulation. BTC China has, after 3 successful months, has decided to resume trading fees. For a few weeks now, because of 0% trading fees, BTC China has consistently been the highest volume BTC exchange. Trading fees will be 0.3%, the announcement reads: Dear BTC China valued customer: To stabilize the recent turbulent Bitcoin market and minimize potential market manipulation, BTC China will end the 0% trading fee promotion, effective immediately, and revert to the 0.3% trading fee. We deeply apologize for the sudden....

The era of no-fee trading in China appears to be over. Following in the footsteps of China's 'Big Three' exchanges, smaller competitors BTC Trade, BTC100, CHBTC, Dahonghuo, Yuanbao and BitBays all moved to impose or increase trading fees yesterday in the wake of a meeting with the People's Bank of China, China's central bank. Both BTC Trade and CHBTC said that the fees would come into force on 13th February, whereas the other exchanges did not identify a starting date. Further, with the exception of BTC 100 and BitBays, the exchanges all moved to add 0.2% maker and taker fees. BitBays is....

BTC China has become the world's first major bitcoin exchange to scrap its trading commission fees, albeit temporarily. The company, which launched in June 2011, was charging 0.3% for all trades made on the site before taking the decision to run a promotion eliminating this fee. "We already deliver an outstanding consumer experience, and with this promotion, we will now also offer superb value. The future is bright, for bitcoin in China," said Bobby Lee, CEO of BTC China. He explained the promotion will continue to run over the Chinese National Day holiday, but could not confirm its end....