Meet the Ex-Banker Using Ethereum to Take On Traditional Hedge Funds

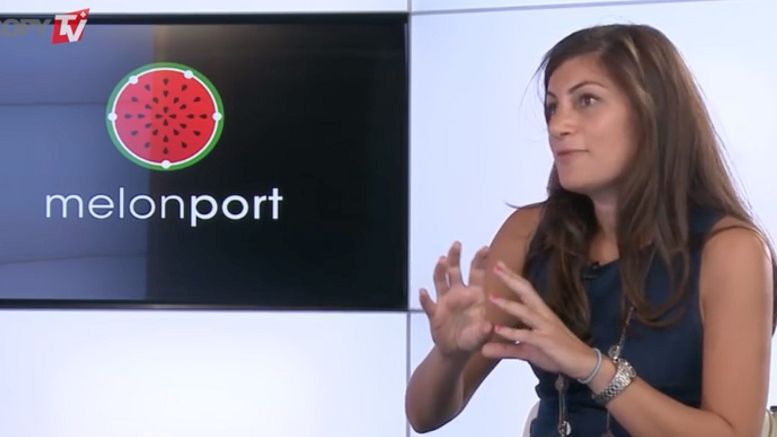

In the world of hedge funds, the old adage really is true: you have to have money to make money. The barrier to entry for an individual investor is frequently $500,000, with portfolio managers themselves needing as much as $200m just to get started. But the potential rewards are equally large. It was a tough lesson to learn for Mona El Isa, a former Goldman Sachs vice president, who after being selected as a member of Forbes 30 Under 30 and raising $30m for her own fund, found herself surprisingly under-prepared to compete against other much more heavily capitalized firms. Dismayed by a....

Related News

Although traditional fund managers remain hesitant about investing in Bitcoin and Ether, their exposure to digital assets appears to be growing. Traditional hedge funds are slowly embracing cryptocurrency investments but are keeping their exposure limited as the market continues to mature, according to new research from PricewaterhouseCoopers, or PwC.In its 4th Annual Global Crypto Hedge Fund Report 2022, PwC said roughly one-third of traditional hedge funds surveyed are already investing in digital assets such as Bitcoin (BTC). So-called “multi-strategy” hedge funds were most likely to....

According to AIMA and PwC’s Seventh Annual Global Crypto Hedge Fund Report, more than half of traditional hedge funds now hold crypto. Related Reading: No Mercy For Samourai Wallet Developer: Keonne Rodriguez Sentenced To The Maximum The survey shows 55% have some crypto exposure, up from 47% in 2024. That number alone signals a shift […]

When it comes to bitcoin and AI, it is impossible to tell what the future will hold. A new breed of hedge funds is coming to Wall Street and other financial areas all over the world. Two new technologies are becoming the next area of focus: artificial intelligence and bitcoin. One interesting example is called Numerai, a hedge fund trading through machine learning models built by scientists paid in bitcoin. It is evident there is a growing demand to access the bitcoin ecosystem without having to buy cryptocurrency directly. On paper, it is not easy to grasp the concept of a bitcoin or AI....

In a dramatic shift, hedge funds appear to be ramping up short positions in Ethereum at a rate not seen before, sparking questions on whether the second‐largest cryptocurrency by market capitalization could be facing troubled waters—or if something else is at play. According to renowned analysts from the Kobeissi Letter (@KobeissiLetter), short positioning in Ethereum “is now up +40% in ONE WEEK and +500% since November 2024.” Their findings, shared on X, argue that “never in history have Wall Street hedge funds been so short of Ethereum, and it’s not even close,” prompting the question:....

Highlighting the considerable limits of traditional banking systems, a former banker has placed XRP at the top of payment services in the financial sector, predicting that cryptocurrency will disrupt the payments industry. Bold XRP Prediction By Financial Expert In a rather lengthy X (formerly Twitter) post, ex-banker and financial expert, Kyren made a controversial prediction […]