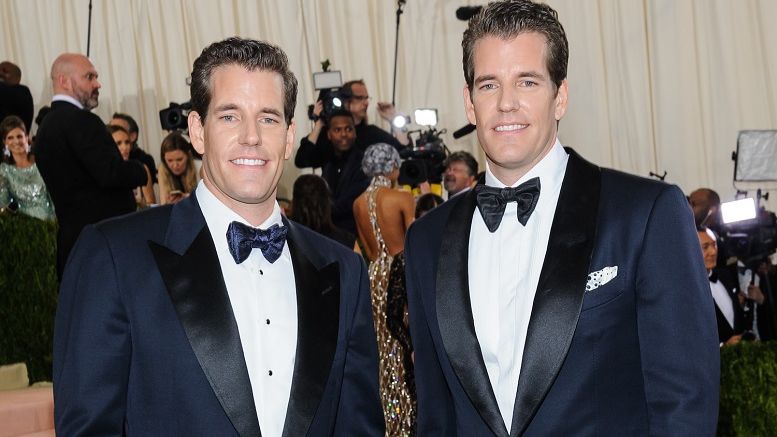

Winklevoss Bitcoin ETF Offering Expands to $100 Million

New documents filed for the bitcoin exchange traded fund (ETF) sought by investors Cameron and Tyler Winklevoss reveal that the size of the offering has grown to $100m. The years-long effort – delayed more than once by the US Securities and Exchange Commission (SEC) – is aimed at providing a means for investors to gain exposure to bitcoin without actually having to buy the digital currency. The SEC is expected to make a decision on the Winklevoss Bitcoin ETF later this year, with its self-imposed deadline of 11th March inching closer. Speculation around the approval is such that at least....

Related News

According to an SEC document filed yesterday, the Winklevoss Bitcoin Trust has filed to switch the listing from Nasdaq to BATS Global Markets and has filed for a maximum offer of $65 million. Having listed their first application to list on Nasdaq, with the Securities and Exchange Commission (SEC) three years ago, the brothers are now looking to list the Winklevoss Bitcoin Trust, their bitcoin exchange-traded fund [ETF] to BATS Global Markets. The filing reveals that the size of the offering will be a listing of 1 million shares, at $65 each. That figure is up from the list price of $20.09....

New York-based bitcoin exchange Gemini, founded by Tyler and Cameron Winklevoss will now begin operations in Canada, as a part of an international expansion program. Canadians will now have access to a new digital currency exchange in the Winklevoss twins’-led Gemini, a US-based exchange. In an announcement late yesterday, Cameron Winklevoss revealed that registered users in Canada will be able to trade bitcoin and ether on the ETH/BTC order book. Cameron Winklevoss wrote: We are thrilled to announce the expansion of Gemini services to the Great White North! This is just the beginning of....

Cameron and Tyler Winklevoss, leaders of Bitinstant’s seed funding, have proposed an idea that should shake a few heads in the bitcoin community. Many people use bitcoin for its decentralized and unregulated nature, but the Winklevoss Twins have proposed creating a regulated Bitcoin exchange in the United States. The Winklevoss twins became well known for their lawsuit against Facebook creator Mark Zuckerberg, in which they received a $65 million dollar settlement. As of right now, they are trying to open their exchange, Gemini, which should debut in the coming months. The Winklevoss....

Injecting an additional US$65m into the ecosystem would push the market cap up a bit. That said, it is possible the Winklevoss twins will use a part of their own Bitcoin stash for this project. The SEC has published a document on the Winklevoss Bitcoin Trust, which is set to issue its own shares to investors. The primary objective of this Trust is to hold Bitcoin, and the initiative is sponsored by Digital Asset Services, LLC. The name Winklevoss has been synonymous with Bitcoin for quite some time now. Tyler and Cameron Winklevoss launched their own Bitcoin exchange, called Gemini,....

Investors Tyler and Cameron Winklevoss are another step closer to offering the first Securities and Exchange Commission (SEC) regulated bitcoin investment product following a request for comment published Friday. Last month, BATS proposed a rule change that would result in the listing and trading of the Winklevoss Bitcoin Shares issued by the Winklevoss Bitcoin Trust. Now, in response to that request, SEC assistant secretary Jill Peterson has opened the proposal for comment from the public. Peterson wrote: "In its filing with the Commission, the Exchange included statements concerning....