Circle Submits Positive Comments To The SEC Regarding Winklevoss Bitcoin ETF

Last but not least, the Winklevoss bitcoin ETF can bring more market stability to the ecosystem. Companies active in the bitcoin world need to band together when it comes to regulation. The Winklevoss twins have been trying to get their bitcoin ETF approved for some time now, without much success. Interestingly enough, they received some help from Circle in the form of an official response sent to the SEC. It is doubtful this will hasten the approval of this ETF, even though it is a positive sign for sure. Institutional investors across the US can benefit greatly from having access to a....

Related News

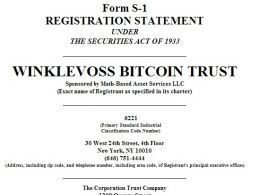

The Winklevoss Bitcoin Trust has filed a Registration Statement with the Securities and Exchange Commission. The Winklevoss Bitcoin Trust has been seeking to have an exchange traded fund linked to Bitcoin. The Winklevoss twins originally filed with the SEC in July of 2013 but have had to make edits to their proposal including information relating to the risks consumers face. The Winklevoss brothers created a Bitcoin Index, Winkdex, to better price Bitcoin. The SEC document has not yet named a ticker symbol for ETF. Each share of the ETF will represent 1/5th of a Bitcoin. The ETF will....

The newly-formed Chamber of Digital Commerce, established in mid-July by Perianne Boring, has submitted comments to the New York Department of Financial Services (NYDFS) relating to recently-released BitLicense regulations. The ten-page comments from Ms. Boring state the following: The proposed regulations shouldn't apply to business that only store or transmit digital currency. Businesses in the digital currency realm should have the freedom to make investments. Businesses in the digital currency realm should have the freedom to innovate. The proposal's "Existing Exchange Services"....

Investors Tyler and Cameron Winklevoss are another step closer to offering the first Securities and Exchange Commission (SEC) regulated bitcoin investment product following a request for comment published Friday. Last month, BATS proposed a rule change that would result in the listing and trading of the Winklevoss Bitcoin Shares issued by the Winklevoss Bitcoin Trust. Now, in response to that request, SEC assistant secretary Jill Peterson has opened the proposal for comment from the public. Peterson wrote: "In its filing with the Commission, the Exchange included statements concerning....

According to Michael J. Casey, an editor and senior columnist at The Wall Street Journal, the Winklevoss twins are receiving positive feedback from the SEC regarding their new bitcoin business venture, Winklevoss Bitcoin Trust. The following quote is from Mr. Evan Greebel, whom is the lawyer for the Winklevoss Bitcoin Trust. “The SEC has generally been receptive,” said Mr. Greebel, a partner at Katten Muchin Rosenman’s New York office. “We are working through common procedures and working through the registration process and we have not gotten any show stoppers. We think the SEC....

Bitcoin brokerage Circle Internet Financial is said to be raising as much as $40m in new funding. As reported by Fortune, Circle is raising the funds at a valuation of $200m, citing persons with knowledge of the negotiations. A representative for Circle declined to comment. The move, if confirmed, would represent Circle's largest funding effort to date. Circle raised $17m in a Series B round last year, following an earlier $9m in Series A funding from 2013. The funding would raise Circle's total investment to $66m. Circle