Bitcoin or Blockchain Eliminating Cash a ‘Pipe Dream”: Senior Indian Central Bank Official

Blockchain technology, the innovation behind digital currencies like bitcoin won’t be eliminating fiat cash despite gaining prominence in recent times, opined the deputy governor of India’s central bank. Speaking at the inaugural FinTech summit organized by prominent industry associations representing Indian commerce, industry and software, Reserve Bank of India (RBI) deputy governor R. Gandhi has dismissed suggestions that blockchain-based digital currencies would put an end to paper money. Pouring scorn over such a scenario, the central bank official was quoted by Indian business daily....

Related News

A senior central bank official has stated that the priority of the Bank of England is to create a regulatory approach to Fintech as it understands its impact, according to Reuters. Victoria Cleland, the BoE’s Chief Cashier, explained that the risks and advantages of digital currencies and blockchain were being assessed. This announcement by the BoE comes when policymakers in Britain want to know if London will remain the global centre for Fintech or if companies will move to other European countries instead. Cleland said that the BoE was working with firms in the Fintech sector to....

The Indian government is consulting with the Reserve Bank of India (RBI) on crypto policies. According to the finance minister, the government and the central bank are in “complete harmony” on crypto and other issues. Indian Government and Central Bank Discussing Crypto Policies Internally Indian Finance Minister Nirmala Sitharaman revealed Monday that the government is discussing crypto policies with the central bank, the Reserve Bank of India (RBI). At the conclusion of the RBI’s board meeting, the finance minister told reporters that the government and the central....

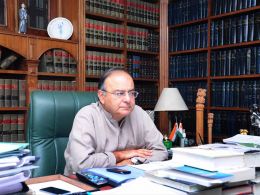

As India and its citizens continue to feel the aftermath of the unexpected and unprecedented demonetization event – the ban of Rs 500 and Rs 1,000 notes, two of India’s biggest bank notes – Finance Minister Arun Jaitley has pointed a silver lining – “less cash transactions and an increase in digital currency.” Speaking today, Indian finance Minister Arun Jaitley has opined that India will no longer see traditional cash numbers after the sweeping ban to render 86% of all cash in circulation obsolete, overnight, in early November. Instead, he sees the country moving toward a digital economy.....

Russia’s digital ruble will not have the same level of anonymity as cash, says official. Elvira Nabiullina, the head of the Bank of Russia, argued that there is a line between anonymity and privacy regarding the circulation of an upcoming digital ruble.Speaking at a press conference on Oct. 23, Nabiullina said that Russia’s digital ruble will not have the same level of anonymity as cash. However, the bank expects to strengthen user privacy, Nabiullina promised, stating:“Still, we shouldn’t confuse the anonymity with confidentiality of digital ruble transactions. Indeed, there will not be....

In a speech on Monday, Yves Mersch, Member of the Executive Board of the European Central Bank (ECB), discussed how the bank could design, issue, and manage a central bank digital currency for everyone, to be used alongside cash. One of the two types considered was a cash-like digital currency with anonymity. The proposed central bank digital currency or....