Bitcoin-Friendly Japan Plans a ‘Deregulated Sandbox’ for FinTech Sprint

The Japanese government is reportedly plotting a pro-innovation sandbox that will encourage FinTech startups to enter the banking industry through regulator-free trials. According to a report by prominent Japanese publication Nikkei, the government looking to update its often-criticized FinTech regulations to make it easier for new innovative services to take shape in the country. According to the report, a pro-innovation government panel discussed a suggested proposal for a regulatory sandbox on Friday. The new framework will encourage corporations and startups alike to trial new services....

Related News

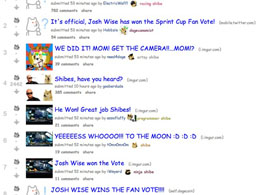

Josh Wise has won the Sprint Fan Vote and will drive in Sprint All-Star Race this Saturday. The Reddit community, which is the main reason why Wise won, proves why dogecar backwards is race god. Reddit's r/Dogecoin thread had aggressively been pushing the campaign to vote Josh Wise in the Sprint Fan Vote. Some users even tried using voting booths until CAPTCHAs were employed and voting restricted to 100 votes per day. The dogecoin community on Reddit has been waiting eagerly to hear the news and it has been spreading fast. Clint Bower was the Sprint Showdown winner and AJ Allmendinger was....

FinTech is growing in Japan, but, unlike the rest of Asia, it’s doing so at a much slower pace. With the Asian market tapping into the industry, Japan is establishing itself as a late adopter, falling significantly behind. According to a report from Brink News, in 2014 Japanese FinTech investments amounted to only 0.4 percent; however, while that figure doubled in 2015, the total amount was just $142 million. And yet, while FinTech is certainly growing in the country, it appears the reason it hasn’t taken off so quickly is due to a strong bank-branch culture. The Data Market has found that....

The Monetary Authority of Singapore (MAS), the country’s central bank and financial regulator, has now entered a FinTech partnership with its Japanese counterpart, the Financial Services Agency (FSA). The move sees the two countries to establish a FinTech cooperation framework. Announced yesterday, the financial regulators from the two major Asian economic hubs have fundamentally reduced the barriers for entry of FinTech companies in their countries enter each other’s markets. “Technology and innovation remain key enablers of financial sector growth in Singapore and Japan,” stated MAS....

The influential financial regulators from Japan and the United Kingdom have ‘exchanged letters’ toward jointly promoting innovation of Fintech or financial technology. The collaboration will also provide guidance and support for FinTech businesses and startups to enter each other’s markets. Announced today, the UK’s Financial Conduct Authority (FCA) and the Financial Services Agency of Japan (FSA) agreed toward the Exchange of Letters (EoL) that will establish a framework for cooperation and referrals between the two countries. Fundamentally, the EoL agreement is designed toward respective....

XRP is giving signs of a significant price rebound as its backer, Ripple Labs, said that it plans to move out of the US. The San Francisco-based blockchain company iterated via its co-founder Chris Larsen that it may shift to a crypto-friendly country – the UK, Switzerland, Japan, or Singapore – because of America’s enforcement-focused […]