Should Bitcoin traders be worried about lower highs ever since $12K?

Bitcoin price technical analysis shows some key levels that traders should watch this week as BTC remains range-bound below $11,000. The previous months have given incredible volatility across the boards, including Bitcoin (BTC). However, in recent weeks, the volatility drastically decreased to a state of boredom.The overall momentum and bullishness have left the crypto markets only to be replaced by range-bound sideways movements. In other words, very boring. However, what is the crucial Bitcoin price level to watch for in the coming week? Let’s take a look at the technicals. Bitcoin....

Related News

Investors watch trading volume and other momentum indicators alongside descending channel patterns to better gauge when to open and close trades. Buying an asset in a downtrend can be a risky maneuver because most investors struggle to spot reversals and as the trend deepens traders take on deep losses. In instances like these, being able to spot descending channel patterns can help traders avoid buying in a bearish trend.A “descending channel,” also known as a “bearish price channel” is formed by drawing two downward trendlines, parallel to each other, which confine the price action of....

It’s starting to appear that Bitcoin traders are a bit too bullish for their own liking. The leading cryptocurrency has exploded higher in the past two days, rallying from the weekly lows of $13,300 to highs near $16,000. This rally comes as the U.S. dollar has plunged lower on expectations that Joe Biden will be […]

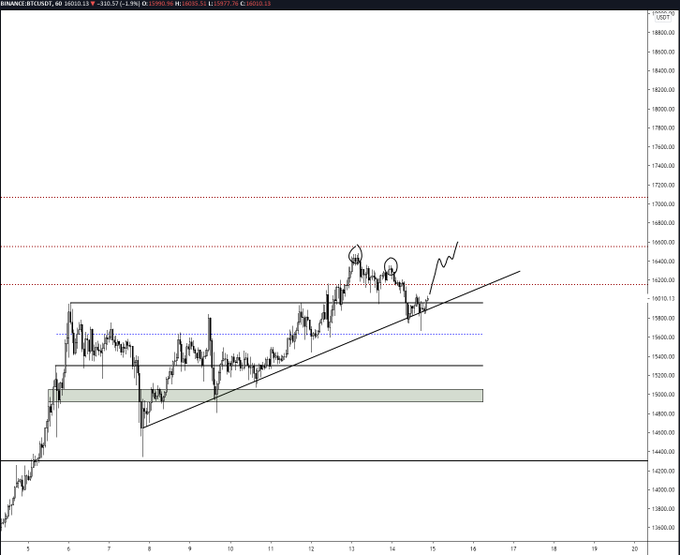

Bitcoin Price Key Highlights. Bitcoin price has been trending higher on the short-term time frames but a reversal may be brewing since the rally has weakened. Price formed lower highs, suggesting that buyers are starting to lose steam and might not be able to sustain the climb any further. Bitcoin price is on its way to test the ascending trend line on the 1-hour chart once more, with a downside break likely to indicate that a selloff will take place. Bearish Divergence Seen? Stochastic has formed higher highs while bitcoin price made lower highs, creating a slight bearish divergence....

Bitcoin has begun to slide lower over the past few days as selling pressure has tapered off at the $16,500 highs. The leading cryptocurrency currently trades for $15,900, a few percent below those highs but still situated above key support levels. Analysts remain optimistic despite the downward-sloping price action. One trader says that if the […]

The XRP price has spent the past week struggling with bearish momentum, and the latest dip below the $2 price level has further added to the bearish sentiment. The cryptocurrency briefly slid under this psychological level in the past 24 hours, continuing a multi-week sequence of lower highs and lower lows. Despite this pullback, one crypto analyst on X proposes that the current movement is not as alarming as it appears. His price chart, which maps XRP’s weekly candles, shows the XRP price falling to a familiar support area inside a larger descending channel. XRP Price Still Trading....