Melanion Capital Bitcoin ETF to launch on Euronext Paris on Oct. 22

French financial regulator AMF officially approved Melanion Capital’s Bitcoin-linked ETF product in August. Amid the United States finally launching its first Bitcoin (BTC) futures-based exchange-traded fund (ETF) today, France is inching closer to a major Bitcoin-related ETF launch as well.Paris-based alternative investment firm Melanion Capital is preparing to launch its Bitcoin-linked ETF product already this Friday, the firm’s CEO Jad Comair announced to Cointelegraph on Oct. 18.Called “Melanion BTC Equities Universe UCITS ETF,” the Bitcoin ETF will start trading on France’s primary....

Related News

A Bitcoin-thematic ETF lists on the Borsa Italiana providing savers, institutions and pensions planners with exposure to Bitcoin. The Italian Stock Exchange, Borsa Italiana, this morning listed a “Bitcoin (BTC)-thematic” exchange-traded fund (ETF) by Melanion Capital, bringing Bitcoin exposure to Italian institutions and retirement plans. Cyril Sabbagh, managing director at Melanion Capital told Cointelegraph, "the Melanion BTC Equities Universe UCITS ETF is an equity ETF around stocks in the crypto ecosystem.” Sabbagh explained that the ETF would be “accessible to as many people as....

France’s securities regulator approves: The Bitcoin-tracking fund fully complies with the European Union’s UCITS standards. Paris-based derivatives fund manager Melanion Capital has launched a new, European Union-regulated fund that aims to track the price of Bitcoin (BTC) at a correlation of up to 90%.The fund is the first of its kind to be issued under the EU’s investment fund umbrella UCITS — an acronym for “undertakings for the collective investment in transferable securities.” According to the European Commission’s data, UCITS-compliant funds account for roughly 75% of all collective....

Melanion Bitcoin Exposure Index tracks an equities basket with the highest correlation and revenue exposure to Bitcoin. Institutional investors are looking for ways to participate in the crypto market without going out of the regulated space or mastering the advanced technology behind Bitcoin (BTC), and asset managers are finding alternative solutions to meet the need.Paris-based investment management company Melanion Capital partnered with index platform Bita to launch the Melanion Bitcoin Exposure Index, according to information shared with Cointelegraph. The index tracks a beta-weighted....

The Jacobi Bitcoin ETF will start trading on the Euronext Amsterdam Exchange under the ticker BCOIN in July. Major Dutch stock exchange Euronext Amsterdam, a part of the pan-European marketplace Euronext, is debuting its first Bitcoin (BTC) exchange-traded fund (ETF).Jacobi Asset Management, a London-based digital asset management platform, is preparing to launch its Jacobi Bitcoin ETF on Euronext Amsterdam next month, the firm announced on Thursday. The spot Bitcoin ETF will start trading on the Euronext Amsterdam Exchange under the ticker BCOIN.The Jacobi Bitcoin ETF is positioned as the....

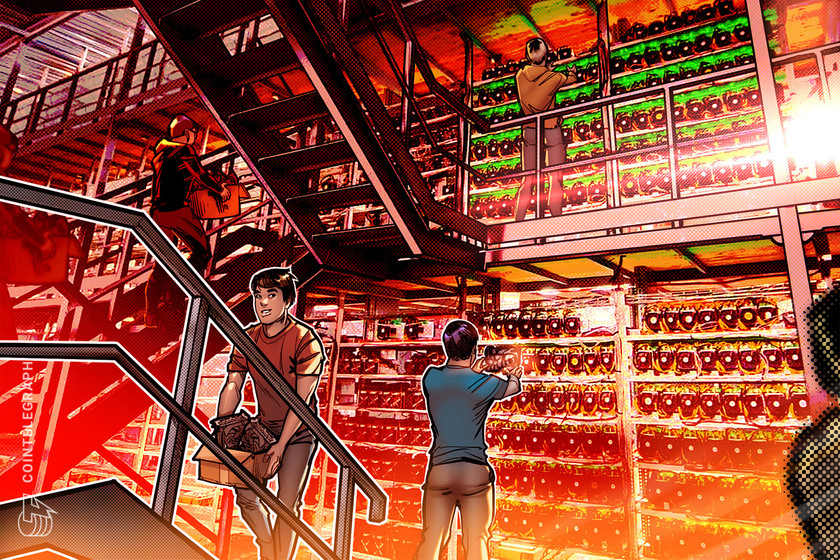

“The claim that Bitcoin miners jeopardize the electricity network is completely misinformed,” says EU-based fund manager Melanion Capital. A Swedish financial watchdog’s call for a European Union-wide ban on proof-of-work (PoW) crypto mining, mainly known as the method of minting new Bitcoin (BTC), has received backlash from crypto-related fund managers. Melanion Capital, a Paris-based alternative investment firm known for its Bitcoin ETF, addressed the Swedish Financial Supervisory Authority and Swedish Environmental Protection Agency’s call to ban PoW mining across Europe. “The claim....