DeFi wars heat up as Curve Finance TVL hits $3.99B, surpassing Uniswap

Curve Finance has surpassed Uniswap’s total value locked, a sign that competition between DeFi protocols is heating up. As decentralized finance grows in prominence, a battle of the DEXs is brewing between several of the top protocols like Uniswap (UNI), SushiSwap (SUSHI) and Curve DAO (CRV) as the growing list of platforms vie for investor liquidity and transactions on the network. In terms of total value locked, DeFi lending platforms currently dominate the space with the top 3 positions currently occupied by Maker (MKR), AAVE, and Compound (COMP). Decentralized exchanges hold the next....

Related News

The total value locked on Vector Finance hit a new high after the protocol integrated multiple stablecoins in the Avalanche ecosystem in order to become the network's largest liquidity hub. The battle to attract stablecoin liquidity has been a trending theme across the cryptocurrency landscape for the past year, especially as decentralized finance users have come to realize the hefty APY that can be earned on dollar-peg assets.While Curve Finance remains the undisputed leader in interest bearing stablecoin liquidity pools, several new entrants have begun to climb the ranks, including....

Reports indicate that the decentralized finance (defi) protocol Curve was hacked for $570,000 in ethereum after people noticed that Curve’s front end was exploited. The attackers then tried to launder the funds via the crypto exchange Fixedfloat, and the trading platform’s team managed to freeze $200K worth of the stolen funds. Curve Finance Exploited for $570K — Fixedfloat Exchange Freezes More Than $200K, Domain Service Blamed Another defi hack was discovered on August 9, when the Paradigm researcher Samczsun tweeted that Curve Finance’s frontend was....

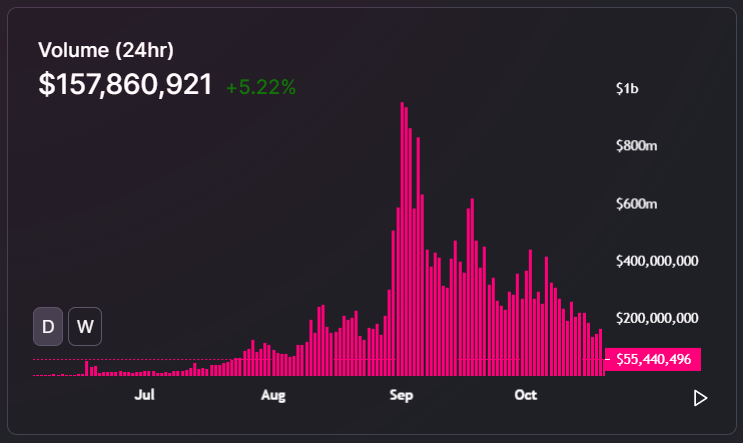

Daily trading volume on Uniswap surged by over 1,200% to a record $2.04 billion, surpassing the previous record high of $953.59 million registered on Sept. 1 by a big margin.

The booming DeFi sector is driving up MetaMask’s user base, with the popular Ethereum wallet report now reporting more than one million active monthly users MetaMask, the Ethereum (ETH) browser wallet developed by ConsenSys, has surpassed one million monthly active users for the first time.The milestone comes roughly seven months after the wallet first surpassed one million users in total, suggesting the parabolic rise of decentralized finance (DeFi) in 2020 has driven the surge in MetaMask’s user base.In an announcement, MetaMask notes top DeFi protocols Uniswap, Yearn Finance, Curve,....

The decentralized finance (DeFi) market is slumping as large-cap tokens like Uniswap (UNI), Yearn.finance (YFI), and Maker (MKR) decline. Atop the lackluster performance of major tokens, the volume of the Uniswap decentralized exchange has substantially dropped. On September 1, when Uniswap surpassed Coinbase Pro in daily volume, it processed $953.59 million of volume in 24 […]