Hashstack launches Open protocol testnet, offering under-collateralized loans

Harmony's Ecosystem Fund financed Hashstack's solution to improving DeFi lending. The DeFi lending and borrowing market has grown significantly in volume as new lending protocols continue to attract capital and NFT-backed loans become more popular. According to Dune Analytics, the top three platforms in terms of market capitalization are Aave (AAVE), Maker (MKR) and Compound (COMP). These platforms, however, still are facing issues when it comes to collateral requirements and volatile digital assets.Hashstack Finance is a DeFi platform whose crypto-native lending protocol, called Open, is....

Related News

Decentralized finance is a thriving industry, but there is much room for improvement. The lending segment can benefit greatly from under-collateralized loans. Hashstack brings that option to market as its Open Protocol is now on the public testnet. Open Protocol Is A Big Deal As lending is the largest segment in decentralized finance, any improvement […]

Hashstack aims to disrupt and improve the appeal of decentralized borrowing and lending. Users can access under-collateralized loans through its Open Protocol at a 1:3 collateral-to-loan ratio. It is a welcome change for the broader DeFi industry, as current collateralization rates remain too high. Adjusting Loan Collateralization In DeFi In traditional finance, one can obtain a loan if they have a fraction of the borrowed amount to put up as collateral. One would expect the same to apply to decentralized finance, yet that is not the case. Instead, users often put up 150% – or more....

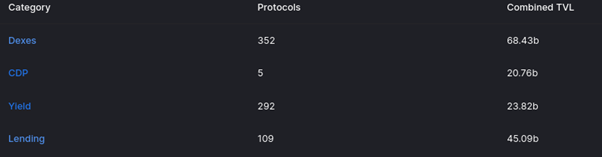

Lending is the second-most-popular segment of decentralized finance today. The industry represents over $45 billion in total value locked yet still suffers from significant inefficiencies. Hashstack finance and the testnet version of Open Protocol offer a much-needed breath of relief on that front. DeFi Lending Is Popular No one will deny that decentralized lending and […]

The decentralized finance industry needs a severe shakeup where its current borrowing requirements are concerned. Forcing users to put up more collateral than they seek to borrow is not feasible in the long term. Hashstack solves this issue by bringing undercollateralized loans to decentralized finance. Unlocking The Full Potential of DeFi Lending The concept of decentralized lending and borrowing provides a necessary alternative financial approach. Millions of people have little or no access to traditional financial products and services. The underbanked and unbanked population will be....

Arcx has launched a new version of its “DeFi Passport,” Sapphire, promising the pseudonymous on-chain credit check will enable new decentralized finance products. Decentralized finance (DeFi) protocol Arcx has announced the launch of Sapphire v3, a DeFi passport allowing crypto users to pseudonymously build and verify their reputation on-chain.Announced June 2, the DeFi passport will score users on a scale between 0 and 1,000, with Arcx advancing that the passport “incentivizes reputation-building and curates on-chain identity into DeFi.”In the absence of a DeFi passport, Arcx asserts that....