XRP Price Set For Massive Rally As BlackRock And JPMorgan Make Their Move

Amid the struggles in the cryptocurrency market, recent reports have suggested that the world’s largest asset manager Blackrock, and financial giant JPMorgan might spark a massive bull run for the XRP price as they work simultaneously. Blackrock, JPMorgan Move Might Affect XRP Price According to the report, Forbes Senior Contributor, Billy Bambrough, highlighted that Blackrock and JPMorgan are purportedly laying the foundation for an impending surge in the cryptocurrency sector. The report further identified several collaborative cryptocurrency moves taken by the two financial....

Related News

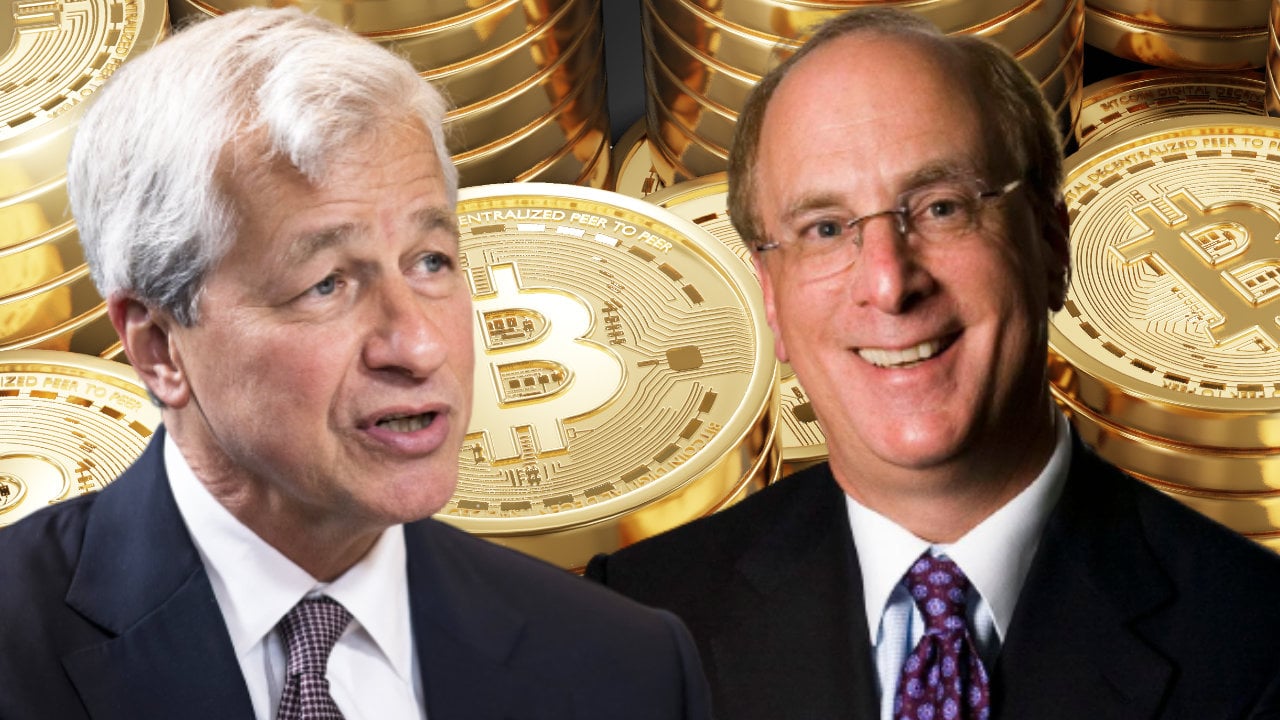

The chief executive officer of the world’s largest asset manager, Blackrock, says he is “more on the Jamie Dimon camp” when asked whether he thinks bitcoin is worthless. However, the executive says he is fascinated by people’s interest in crypto and sees “a huge role for a digitized currency.”

Blackrock’s CEO Sides With JPMorgan’s Jamie Dimon on the Value of Bitcoin

Larry Fink, the CEO of the world’s largest asset manager with $9.5 trillion in assets under management, Blackrock, answered some questions about....

JPMorgan analysts, led by Nikolaos Panigirtzoglou, have predicted that the Bitcoin price could still rally to $165,000. They also provided a timeline for when this could happen and their reasons for this bullish outlook on the flagship crypto. JPMorgan Analysts Predict Bitcoin Price Rally To $165,000 JPMorgan stated that Bitcoin is undervalued against gold and […]

Global banking behemoth JPMorgan Chase has disclosed its increased exposure to the world’s largest cryptocurrency through BlackRock’s spot Bitcoin exchange-traded fund (ETF), iShares Bitcoin Trust (IBIT). JPMorgan Held 5.2 Million IBIT At End Q3 In the latest 13-F filing with the United States Securities and Exchange Commission (SEC), JPMorgan disclosed its holding of 5,284,190 IBIT […]

JPMorgan struggles to “see any tangible economic benefits associated with adopting bitcoin as a second form of legal tender.” Commenting on El Salvador’s bitcoinization, JPMorgan did not rule out that the country’s move to make the cryptocurrency legal tender may be “the beginning of a broader trend among similarly situated, smaller nations.” JPMorgan’s Opinion on Bitcoinization in El Salvador Investment bank JPMorgan released a report Friday titled “The Bitcoinization of El Salvador.” The country’s congress passed the bill making....

BlackRock and Bitcoin ETFs, according to Bloomberg analyst Eric Balchunas, have consistently stopped disastrous declines in the value of the crypto. Related Reading: Crypto Beef Up 2024 US Elections With $190 Million In Donations This coincides with speculations that BlackRock uses Coinbase’s Bitcoin IOUs to control the market, therefore shorting BTC and perhaps triggering price […]