Why Bitcoin Dominance Is No Longer Relevant To Crypto

Bitcoin dominance is a metric weighing the top cryptocurrency’s market share against the rest of the crypto space, including Ethereum, Polkadot, Cardano, and other altcoins. For years, analysts used it as a tool to predict divergences between altcoins and Bitcoin. However, recently, the metric has lost just about all meaning, and could explain why it […]

Related News

Bitcoin price is struggling to break through resistance at $50,000, and it could partially be altcoins to blame for the weakness. The most recent technical structure on the highest time frames suggests that not only could alts continue to gain against BTC dominance, altcoin season itself could last a while longer. Bitcoin Dominance And Technical Analysis Using The Metric Technical analysis is a subjective art. The practice has enough naysayers as is, but even those that subscribe to the study don’t always believe that all charts are created equally. For example, there are several....

Altcoin season is a phrase that is quite popular throughout the crypto market. The phrase refers to the run-up in the prices of altcoins after the price of bitcoin slows down. The altcoins usually see an uptick in their individual and collective market dominance, taking even more market share from the top cryptocurrency, bitcoin. As the coins become more valuable, their prices soar following the increased market share. An altcoin season usually sees most of the altcoins in the market rallying at the same time. With Ethereum’s price mostly leading the charge once the prices start surging.....

BTC dominance has always had an inverse effect on the price movements for altcoins. Historically, BTC dominance determines the direction the value of altcoins swings in. Bitcoin has so far maintained majority dominance on the market. But as more time passes, that dominance goes down as altcoins see more demand. BTC dominance simply shows how much demand there is for bitcoin compared to altcoins. The more BTC dominance rises, the lower the demand for altcoins. This means that for altcoins to rally up further, bitcoin demand has to go down. Related Reading | Ethereum Breaks 200,000....

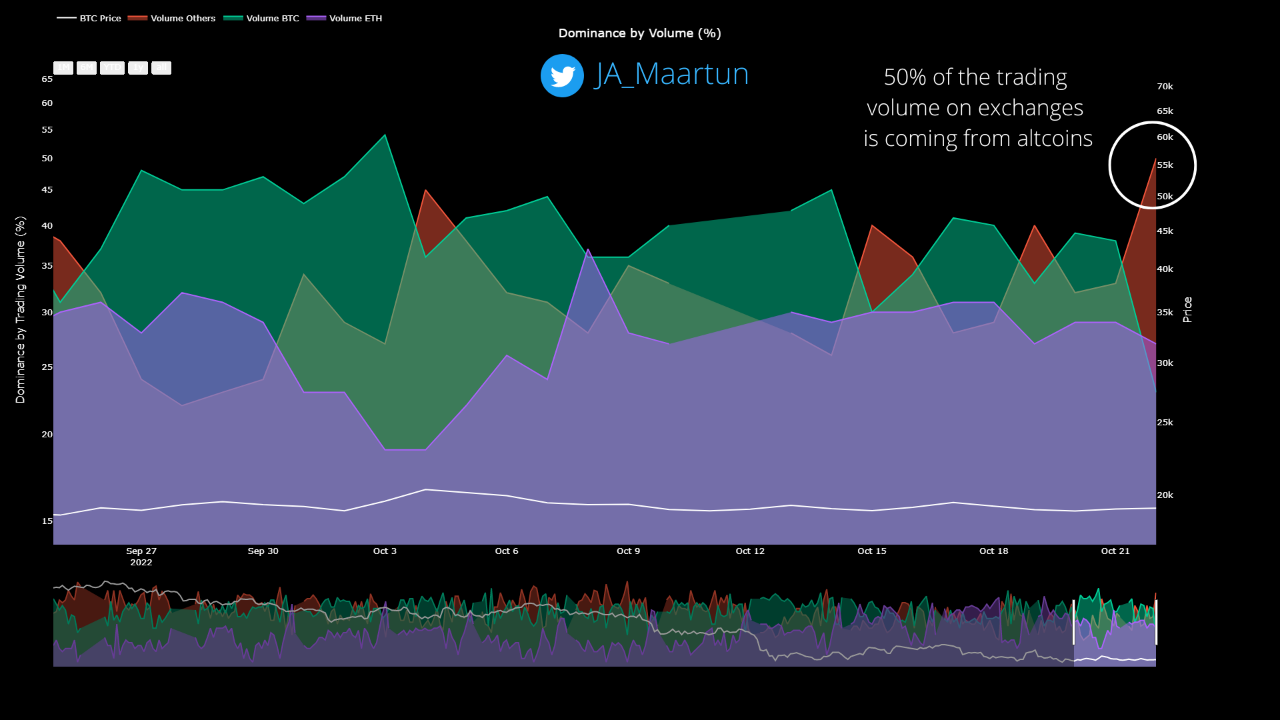

Data shows the altcoin dominance by volume on exchanges has now risen to 50%, here’s what happened to Bitcoin the last two times the crypto market saw such a shift. Altcoins Are Now Contributing To 50% Of The Volumes On Exchanges As pointed out by an analyst in a CryptoQuant post, altcoins have started to dominate after Bitcoin was number one for an entire month. The relevant indicator here is the “trading volume,” which is a measure of the total amount of coins being traded on centralized exchanges. The percentage to this total trading volume being contributed by an....

The crypto economy has dropped significantly in value during the last few days tapping a low of $2.06 trillion on Monday. Additionally, the leading crypto asset bitcoin has seen its market dominance drop to 40% of the crypto economy’s overall valuation. Bitcoin’s dominance index hasn’t been this low since June 2018. Bitcoin Dominance Drops to the Lowest Point Since 2018 At the time of writing, the cryptocurrency economy is worth roughly $2.06 trillion, as far as the value of all 9,869 digital currencies in existence is concerned. Furthermore, bitcoin’s (BTC) market....