Bitcoin Coinbase Premium Still Negative: US Institutions Keep Selling Despite...

Bitcoin has pushed back above the $90,000 level after several days of intense selling pressure, bringing a brief moment of relief to a market overwhelmed by fear and uncertainty. Despite the rebound, bulls remain under pressure as speculation of an incoming bear market continues to grow. Many investors are still digesting the sharp correction from October’s all-time high, and confidence has yet to fully return. Related Reading: Major Bitcoin LTH Sell-Off Signals Cycle Exhaustion as Supply Drops to 13.6M BTC According to top analyst Darkfost, one of the key indicators reinforcing this....

Related News

On-chain data shows the Bitcoin coinbase premium gap has improved recently and is now approaching a neutral value, suggesting the selling pressure may be drying up. Bitcoin Coinbase Premium Gap Close To Zero, But Still Negative As pointed out by an analyst in a CryptoQuant post, the selling pressure from US investors seems to have reduced in recent days. The “Coinbase Premium Gap” is an indicator that measures the difference in the Bitcoin prices listed on crypto exchanges Coinbase (USD pair) and Binance (USDT pair). The quant notes that US investors are known to use the....

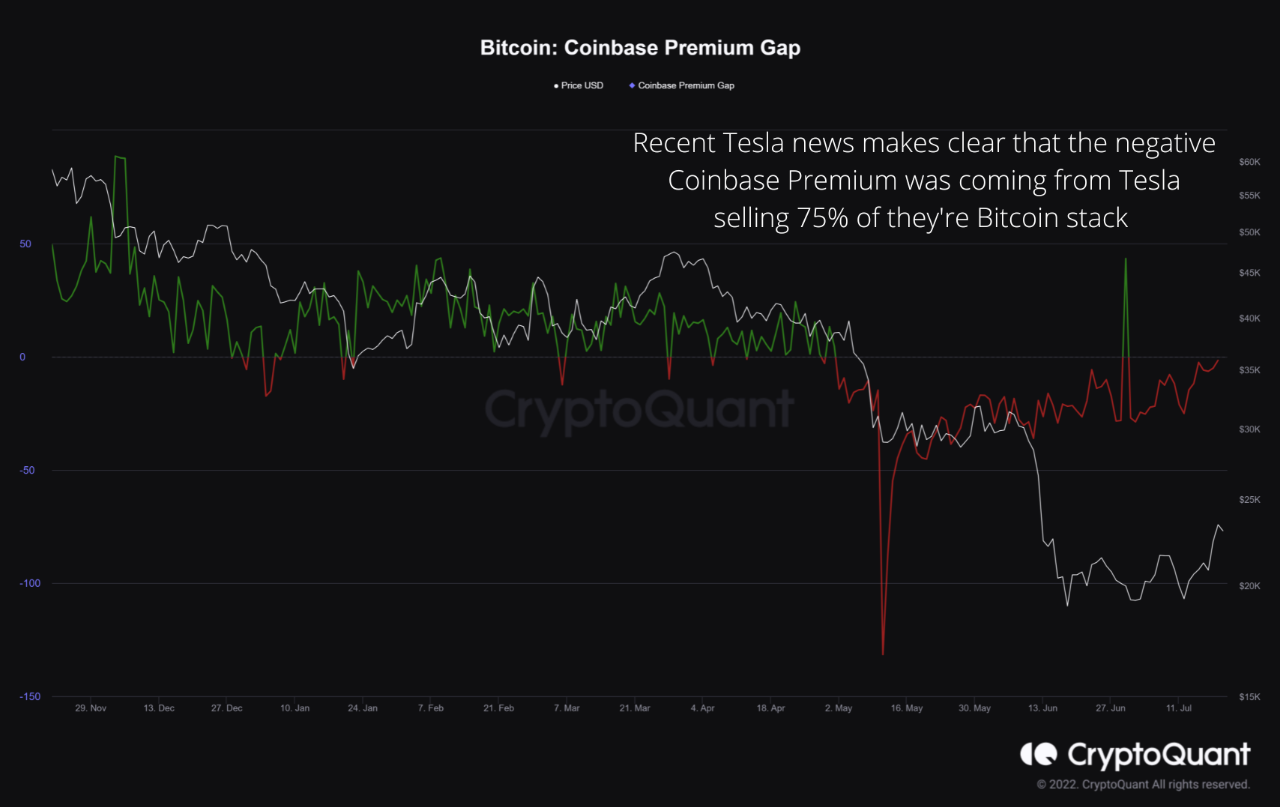

A quant has suggested that the reason behind the recent negative Coinbase Premium could have been due to Tesla’s Bitcoin selling. Tesla Dumping 75% Of Its Bitcoin Holdings Might Be Behind Negative Coinbase Premium Gap As explained by an analyst in a CryptoQuant post, the news about Tesla selling off 75% of its BTC stash […]

Data shows the Bitcoin Coinbase Premium Gap has plunged into the negative territory following BTC’s latest high above $98,000. Bitcoin Coinbase Premium Gap Has Just Observed A Plummet As explained by CryptoQuant community analyst Maartunn in a new Quicktake post, the recent positive Coinbase Premium Gap has just disappeared. The “Coinbase Premium Gap” here refers […]

Coinbase Pro is a major bellwether for institutional demand. Now, data from CryptoQuant indicates that short-term selling pressure on Coinbase is mounting. Bitcoin’s (BTC) definitive breakout above $50,000 may have to wait longer to materialize as spot buying pressure on Coinbase Pro shows signs of weakening — at least, in the short term. The Coinbase Premium Index, which measures the gap between the BTC price on Coinbase Pro and Binance, has flipped negative, according to CryptoQuant. In other words, selling pressure on Coinbase appears to be strengthening compared with other exchanges....

Bitcoin has retraced its recent recovery above $104,000 as data shows the Coinbase Premium Gap has continued to be negative. Bitcoin’s Coinbase Premium Gap Has Been Red Recently As pointed out by CryptoQuant community analyst Maartunn in a new post on X, investors on Coinbase keep selling Bitcoin. The indicator of relevance here is the “Coinbase Premium Gap,” which measures the difference between the BTC price listed on Coinbase (USD pair) and that on Binance (USDT pair). Related Reading: Bitcoin At Increased Risk Of Falling To $88,500 Support, Glassnode Warns When the....