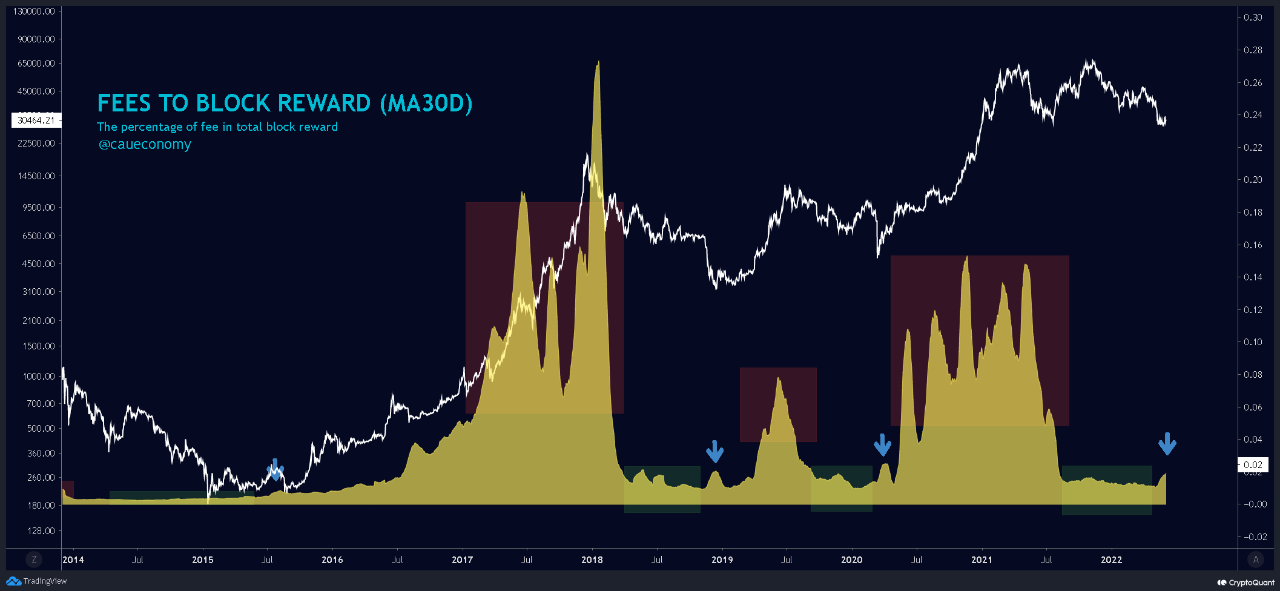

Bitcoin Fees Indicator Shoots Late Bear Market Signal

On-chain data shows recent trend in the Bitcoin transaction fees indicator may suggest that the crypto is now entering the late bear market stages. Bitcoin “Fees To Block Reward” Metric Has Gone Up Recently As pointed out by an analyst in a CryptoQuant post, the BTC fees metric may show that the bear market could […]

Related News

Per a Bloomberg report, the U.S. Securities and Exchange Commission launched a probe against crypto exchange Binance’s native token Binance Coin (BNB). The Commission is investigating Binance Holdings Ltd., the report claims, for potentially breaking U.S. securities law. Related Reading | Bitcoin Fees Indicator Shoots Late Bear Market Signal Binance was launched in 2017, and in […]

Bitcoin is likely to enter a bearish market as a never-before wrong signal just got triggered. Bitcoin Headed Towards Bear Market? As pointed out by a pseudonymous trader on Twitter, there is a certain signal that has consistently been right in the previous BTC cycles. The signal in question is the Super Guppy indicator, a […]

On-chain data shows the Bitcoin NUPL metric currently has values that would suggest the bear market is yet to hit in full swing, if the coin is in one. Bitcoin NUPL Value Still Not As Low As Previous Bear Markets As pointed out by an analyst in a CryptoQuant post, the BTC NUPL metric suggests market hasn’t neared a bear market bottom yet. The “net unrealized profile/loss” (or NUPL in short) is an indicator that tells us about the ratio of profit and loss in the Bitcoin market. The metric’s value is calculated by taking the difference between the market cap and the....

Bitcoin price is currently trading at around $23,500 at the time of this writing, up over 30% from lows and 10% for the week. The recovery has brought the weekly RSI out of oversold territory after reaching historical levels. Here is why the setup could be the buy signal bulls have been waiting for, and how the Relative Strength Index currently resembles the last bear market bottom. Weekly Bitcoin RSI Recovers From Historical Oversold Conditions In technical analysis, sometimes less is more. Traders commonly fill a chart with lines or indicators, desperately seeking an edge in the market.....

The Hash Ribbon indicator—an on-chain metric designed to identify periods of miner capitulation and subsequent recovery—has just issued a bullish signal for Bitcoin. Several well-known figures within the BTC community highlighted the event through posts on X , suggesting that the signal could mark a turning point in the market. The Ultimate Bitcoin Buy Signal? First introduced by on-chain analyst Charles Edwards, the Hash Ribbon relies on two moving averages (commonly the 30-day and 60-day averages of Bitcoin’s hash rate) to determine when mining difficulty and hash power may have....