New hashprice-based derivatives instrument gives Bitcoin miners another way t...

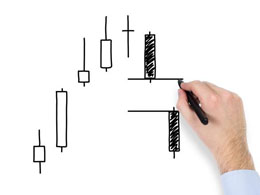

Better luck next time? Luxor’s OTC Bitcoin mining derivatives could offer miners “a much needed tool to hedge their mining operations.” Hedging against downside has always been a challenge for Bitcoin BTC miners, and the current bear market is a perfect example of how energy prices and crypto market volatility can negatively impact miners’ profit margins and their ability to stay solvent. Oftentimes, institutional and retail traders use BTC-, stablecoin- and U.S. dollar-settled derivatives (options and futures contracts) to create hedging strategies that mitigate downside in Bitcoin price,....

Related News

Data shows the Bitcoin miner “hashprice” has fallen towards all-time lows, a sign that these chain validators could be coming under pressure. Bitcoin Miners Are On The Brink Of Becoming Unprofitable In its latest weekly report, the on-chain analytics firm Glassnode has looked into some miner-related metrics to see how they are doing in terms […]

According to CoinWarz, the next difficulty adjustment is expected at block 927,360, moving the target from 149 trillion to close to 150 trillion. That is a modest rise, but it matters because Bitcoin miners are already working with very thin margins. Hashpower is strong enough to push difficulty up even while returns stay near record lows. Related Reading: Bitcoin’s November Slump Could Trigger A 2026 Revival, Analysts Say Hashprice Sits Near Break-Even Hashrate Index data shows hashprice is hovering around $38.3 PH/s per day, a touch up from a recent trough below $35 PH/s on November 21.....

Data shows the Bitcoin mining hashrate has remained at high levels recently, despite the hashprice observing a deep plunge. Bitcoin Hashrate Has Continued To Be Near All-Time Highs Recently The “mining hashrate” refers to the total computing power currently connected to the Bitcoin blockchain. The metric is measured in terms of hashes per second, where […]

Bitcoin derivatives startup Hedgy has raised $1.2m in new seed funding from a group of 10 investors that includes Draper Fisher Jurvetson partner Tim Draper, Salesforce CEO Marc Benioff and Sand Hill Ventures. In conjunction with the announcement, Hedgy has also launched a new derivatives product aimed at commercial bitcoin miners. Miners that use the derivative can effectively lock in a future price at which they can sell bitcoins, using a smart contract to settle the transaction on the bitcoin blockchain. Drawing price metrics from TradeBlock, the new product is the result of a....

Data shows the Bitcoin miner revenues have plunged down by around 81% since the October peak, here’s why. Bitcoin Miner Revenues Have Lost Big During Bear Market According to the latest weekly report from Arcane Research, the BTC miners’ hashprice is now just down to $0.077 per TH/s. The relevant indicator here is the “hashrate,” […]