Genesis Trading reveals $175M of funds are locked in FTX

Genesis Trading is the latest firm to declare exposure to FTX and may look to its parent company for help as it did after the 3AC bankruptcy. In what it hails as an effort to be transparent, Digital Currency Group’s market maker and lending subsidiary, Genesis Trading, revealed that its derivatives business has around $175 million worth of funds locked away in an FTX trading account.Genesis shared the news in a Nov. 10 tweet thread, in which the firm clarified that the locked funds would “not impact our market-making activities.”As part of our goal in providing transparency around this....

Related News

According to the company, this will bolster its position as a global leader in crypto capital markets. Genesis trading announced on Nov. 10 that it will receive an additional equity infusion of $140 million from its parent company, Digital Currency Group. According to the company, this decision was made to “strengthen its balance sheet” and boost its “position as a global leader in crypto capital markets.”Genesis said it also hopes that the equity infusion will put its company in a position to support its clients and “the growing demand” for its services. This is according to a snapshot of....

According to recent reports, cryptocurrency company Genesis has suspended customer withdrawals in its lending unit, adding to the already tumultuous landscape of the digital currency industry. This halt follows the company’s bankruptcy filing earlier this year, triggered by the Gemini exchange’s refusal to facilitate customer withdrawals. The situation has escalated, involving legal intervention and a […]

The funds, which are equivalent to roughly $1.3 billion, will be used to bootstrap the Fei decentralized stablecoin. Fei Labs concluded a successful genesis launch of its Fei stablecoin on Saturday, raising nearly $1.3 billion in Ethereum (ETH) from over 17,000 contributors, highlighting once again the market’s growing appetite for digital assets and decentralized finance. A total of 639,000 ETH was committed to the so-called minting of the FEI stablecoin, the company announced Saturday. At the time Genesis concluded, the ETH commitments were worth nearly $1.3 billion. The funds will be....

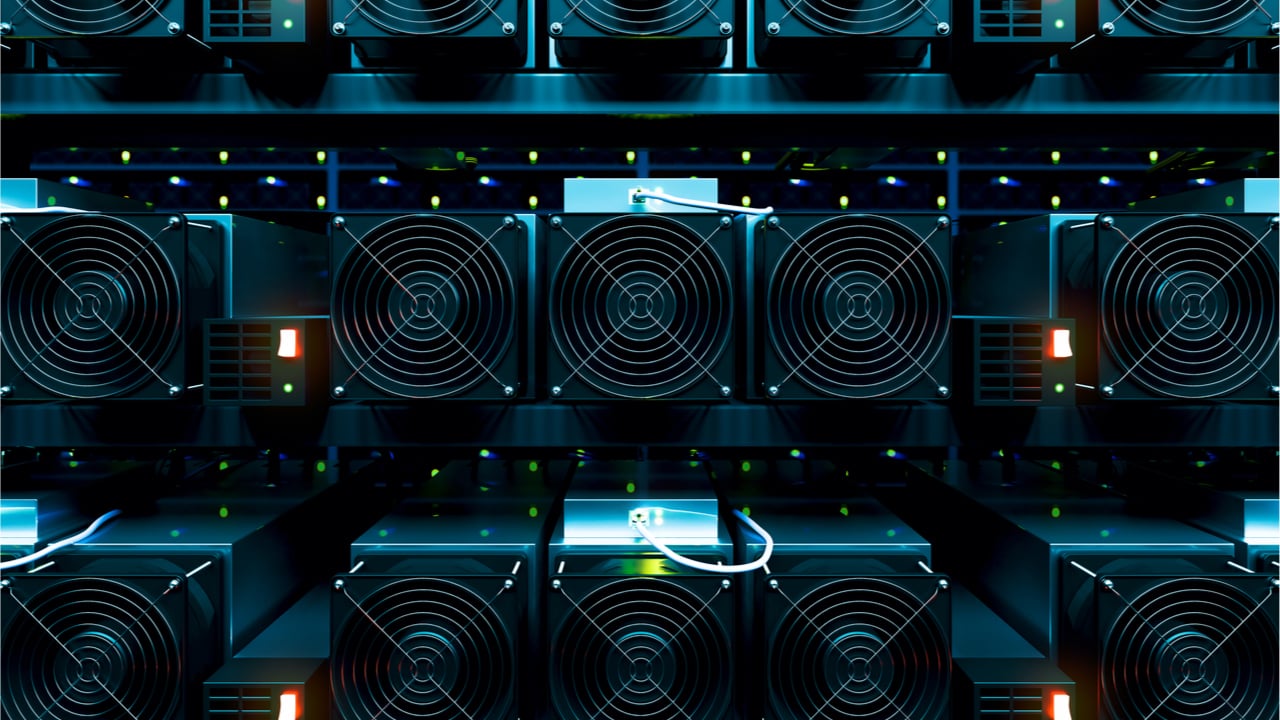

On Tuesday, the bitcoin mining firm Genesis Digital Assets announced the firm raised $431 million from strategic investors. The mining company Genesis detailed that Paradigm led the multi-million-dollar funding round and one of the firm’s co-founders has joined Genesis’s board of directors.

Genesis Digital Assets to Bolster Bitcoin Mining Operations in the US and Nordics

The industrial-scale bitcoin mining company, Genesis Digital Assets, revealed the firm has raised $431 million in a recent financing round. The funding was led by the company Paradigm but also....

The CEO of institutional cryptocurrency broker Genesis Global Trading, Michael Moro, has announced his resignation and that the company will lay off 20% of its staff. The decision represents additional fallout from the failure of Three Arrows Capital, a company to which Genesis had a sizable exposure. Genesis CEO To Resign As 20% Of Workforce […]