Philippines' central bank isn’t ready to pull the trigger on a CBDC

The central bank wants to learn from private-sector digital currencies — but still believes they are inferior to central bank money. Philippine central bank governor Benjamin Diokno has announced that the institution's "exploratory" study of central bank digital currency study suggests that much more work is needed to make a digital peso a reality.During the summer, Bangko Sentral ng Pilipinas had confirmed it was investigating the feasibility and potential policy implications of issuing its own CBDC, or digital counterpart to the physical peso.In a press briefing, Diokno reportedly....

Related News

After failing to roll out its CBDC on October 1, the Central Bank of Nigeria (CBN) has released a document in which it reiterates its commitment to launching the e-naira. In fact, in this document titled The Design Paper for the E-naira, the CBN says it is now ready to launch Nigeria’s CBDC.

CBN Prioritizes Robust Ecosystems

However, in the same document, the central bank appears to downplay the implications of failing to launch as planned. Instead, the CBN attempts to highlight the importance of getting things right the first time and how this guarantees the digital....

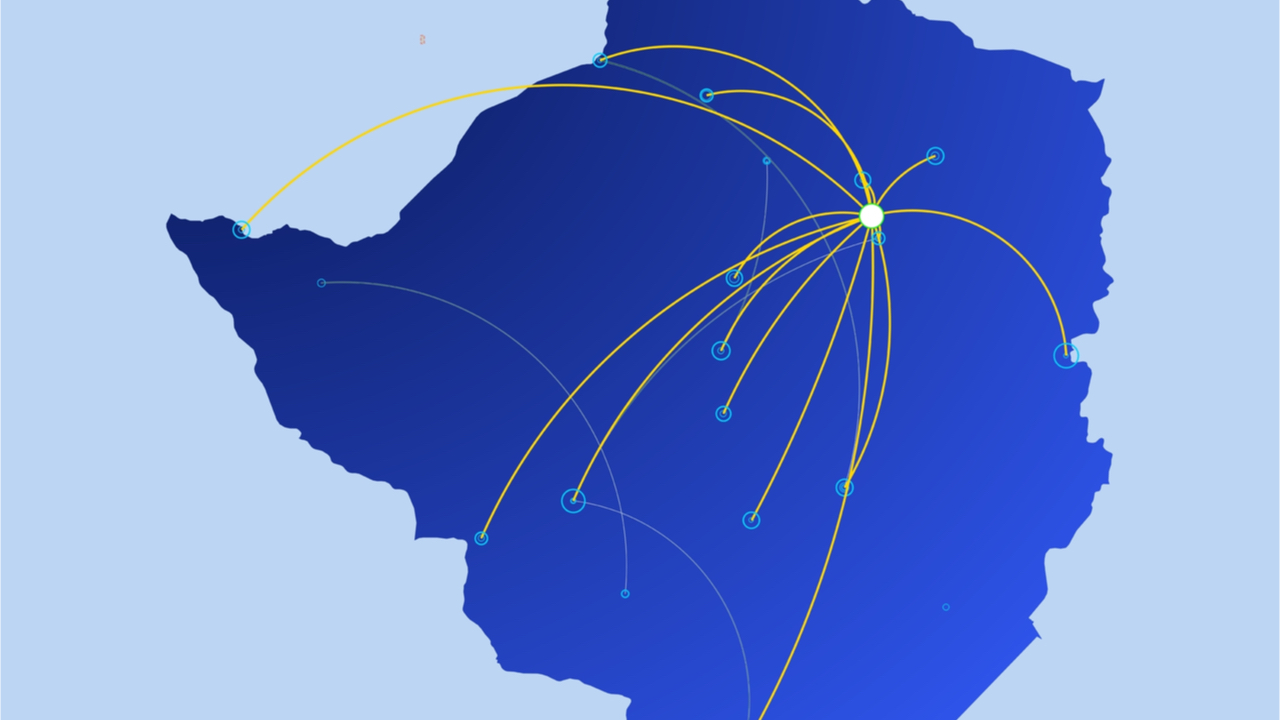

Zimbabwe’s central bank, which has expressed its opposition to cryptocurrencies in the past, announced yesterday it is presently exploring the feasibility of rolling out its own central bank digital currency (CBDC). The bank also said its regulatory sandbox continues to garner interest.

CBDC Roadmap

The Zimbabwean central bank, the Reserve Bank of Zimbabwe (RBZ), has reiterated that it prefers a central bank digital currency (CBDC) to cryptocurrencies, in its latest monetary policy statement. It adds it is now “actively exploring the feasibility of adopting a....

Bank Indonesia, the country’s central bank, is reportedly considering issuing a central bank digital currency (CBDC) to fight the use of cryptocurrency. “A CBDC would be one of the tools to fight crypto. We assume that people would find CBDC more credible than crypto,” said an assistant governor of the central bank. Central Bank Sees CBDC as Tool to ‘Fight Crypto’ Juda Agung, an assistant governor of Bank Indonesia, the country’s central bank, talked about cryptocurrency and central bank digital currency (CBDC) during his parliamentary “fit....

Brazil’s central bank, the Banco Central do Brasil (BCB), is pushing for more time to roll out its central bank digital currency (CBDC). Earlier in May, BCB released a document covering the general guidelines and characteristics of Brazil’s future CBDC. Roberto Campos Neto, BCB’s chief central banker, also stated earlier last year that the country […]

The Central Bank of Nigeria has said it is slashing transaction fees for the e-naira platform by 50% — a move which the bank claims will increase the volume of transactions on the central bank digital currency (CBDC) platform. The central bank also believes that wider adoption of the CBDC will bolster Nigeria’s cross-border trade volumes. Boosting E-Commerce Transaction Volumes In yet another move aimed at boosting the embrace and adoption of the e-naira central bank digital currency (CBDC), the Central bank of Nigeria (CBN) reportedly said it will slash the service fees....