‘World War III Has Begun,’ Says Gerald Celente; Plus, Long-Term BTC Predictio...

Trend forecaster Gerald Celente told Bitcoin.com News that “World War III has begun,” weighing in on Covid-19, crypto, the Great Reset, and gold in an exclusive interview. Jordan Belfort, aka the Wolf of Wall Street, talked long-term BTC investing, as scorching inflation in the U.S. continues to plague Americans, though Biden’s White House says the latest numbers are “out-of-date.” All this and more in your bite-sized digest of this week’s hottest stories from Bitcoin.com News. Trend Forecaster Gerald Celente Says World War 3 Has....

Related News

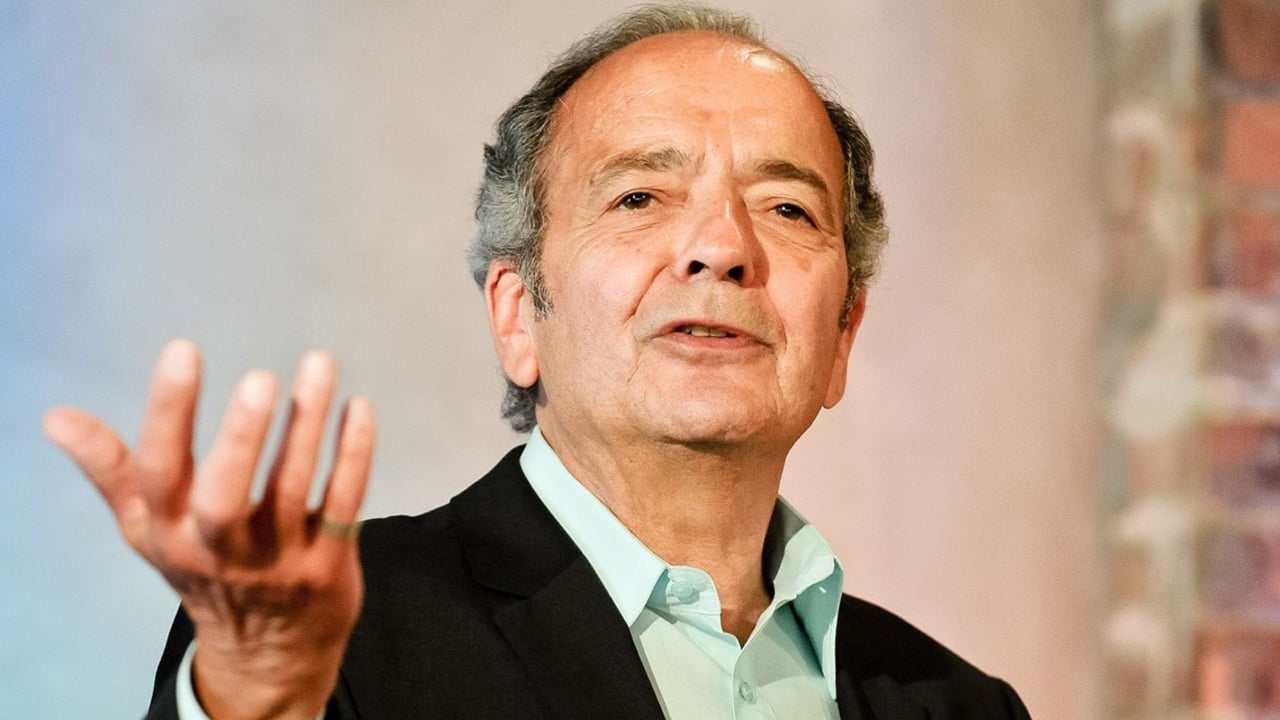

This week Bitcoin.com News spoke with Gerald Celente, the popular trends forecaster, and publisher of the Trends Journal. During a telephone conversation, Celente discussed the uncertainty surrounding the global economy after governments worldwide locked down the world’s citizens over the Covid-19 pandemic, shut down businesses and injected trillions into the economy. The discussion touches upon gold, bitcoin, the pandemic, the Ukraine-Russia war, and the Federal Reserve. The trends forecaster believes that World War III has already begun, and if people do not assemble to bolster....

In the ever-evolving world of decentralized finance (DeFi) and cryptocurrency, investors are constantly on the lookout for altcoins that offer both short-term gains and long-term stability. Among the myriad of options, Aave (AAVE) and Mpeppe (MPEPE) have emerged as two standout choices for those seeking reliable, long-term profits. While both projects operate in different niches, […]

The Bitcoin price is down over 5% this Sunday, as it appears that we are returning to a long term down-trend which has been in place, and holding fairly steady in its path, since the summer of 2014. For a couple of weeks at the end of January, the Bitcoin world was full of optimism. With a strong upturn in price it seemed to many that we may have finally broken the digital currency's long term decline in value. But looking at longer term charts - 90 or 180 days - it becomes clear that January's spike was simply an overcorrection for the dip in early January which had taken the bitcoin....

Bitcoin Price has risen to long-term support from Sunday's lows in what appears to be an impulsive wave structure. There is no conclusive evidence that advance has begun and the trading survivalist's best tactic at this time is to be patiently safe rather than sorry and out-of-pocket. Bitcoin Price Analysis. Time of analysis: 13h00 UTC. Bitstamp 15-Minute Chart. The 15-minute Bitstamp chart shows the past week's price action in detail. Yesterday (Sunday) price had dropped through long-term support (solid red trendline) and crisscrossed the level of the April 2013 high at $261. Today's....

Even though the Bitcoin price has fallen sharply from its all-time high of $126,000, the decline still does not have that much impact on seasoned BTC investors or long-term holders. On-chain data is showing that these long-term BTC holders are still experiencing notable gains from their positions. Long-Term BTC Holders’ Profit Margins Stay Impressive With […]