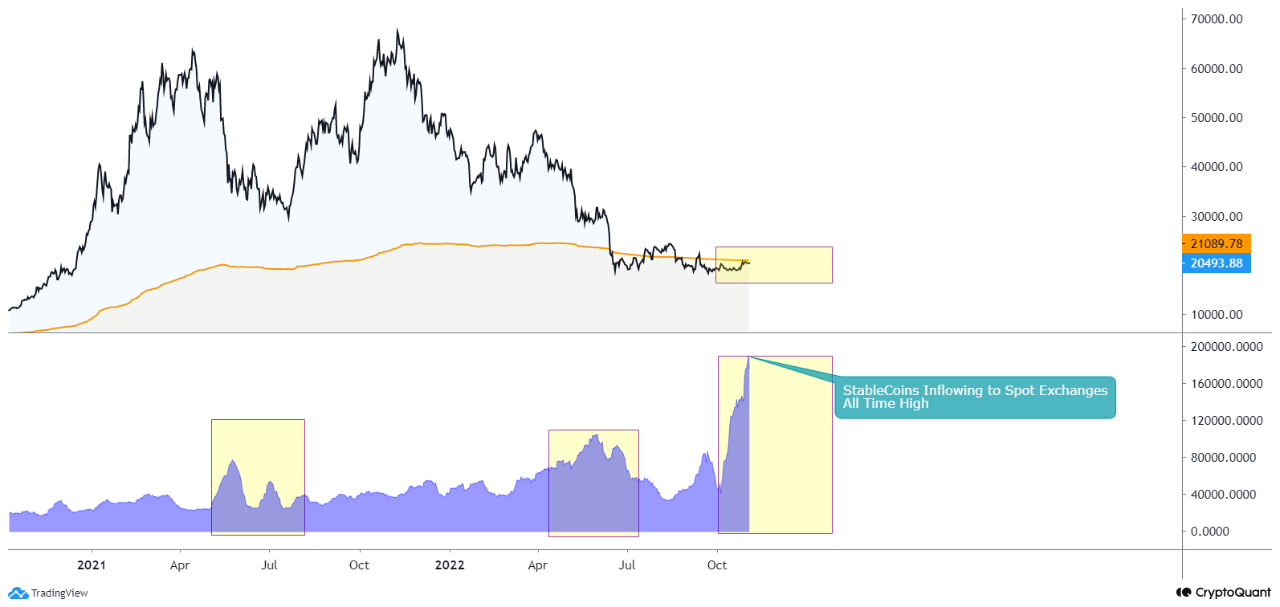

Stablecoin Exchange Inflow Mean Hits ATH, Why This Could Be Bullish For Bitcoin

On-chain data shows the stablecoin exchange inflow mean has reached a new all-time high, here’s why this might prove to be bullish for Bitcoin. Stablecoin Exchange Inflow Mean Has Surged Up To A New ATH Recently As pointed out by an analyst in a CryptoQuant post, these inflows can be positive for Bitcoin in the long term, but might be bearish in the short term. The “stablecoin exchange inflow mean” is an indicator that measures the average amount of stablecoins per transaction going into the wallets of centralized exchanges. As stablecoins are relatively stable in value....

Related News

On-chain data shows the exchange inflows related to the stablecoins USDT and USDC have seen a sharp plunge. Here’s what this could mean for Bitcoin and other cryptocurrencies. Stablecoin Exchange Inflows Have Dropped Below Yearly Average In a new post on X, CryptoQuant author Axel Adler Jr has discussed about the latest trend in the Exchange Inflow of the top two stablecoins in the sector, USDT and USDC. The “Exchange Inflow” refers to an on-chain indicator that keeps track of the total amount of a given asset that’s moving into the wallets associated with....

On-chain data shows a large amount of USDC inflows have just hit exchanges, a potential sign that investors are looking to buy the Bitcoin dip. USDC Exchange Inflow Has Registered Multiple Spikes Recently As explained by CryptoQuant community analyst Maartunn in a new post on X, the USDC Exchange Inflow has shot up recently. The “Exchange Inflow” here refers to an indicator that keeps track of the total amount of a given asset that’s being transferred to wallets connected with centralized exchanges. Related Reading: Bitcoin Mayer Multiple Retraces To Lower Bound—What....

On-chain data shows that shortly after crypto exchange Binance observed Bitcoin inflow of around 12k BTC, price fell by almost 5%. Huge Bitcoin Inflow To Binance As pointed out by a CryptoQuant post, inflow of around 12k BTC was seen on Binance, the largest crypto exchange by market volume. The Bitcoin inflow is an indicator that shows the total amount of BTC transferred to a crypto exchange from a personal wallet. As investors usually send their crypto to exchange wallets for cashing out, altcoin purchasing, etc., the indicator’s value going up would imply there is some selling....

On-chain data shows the USDC exchange inflow has spiked up. Historically, stablecoins have provided dry powder for kicking off new Bitcoin rallies. USDC Exchange Inflow Sharply Rose To High Values Recently As explained by an analyst in a CryptoQuant post, almost one billion USDC has flowed into exchanges recently. Past pattern suggests this may lead to uptrend for Bitcoin. The “USD Coin exchange inflow” is an indicator that measures the total amount of the stablecoin entering wallets of all exchanges within a given period. When the value of this indicator moves up, it means....

On-chain data shows a recent rise in the number of stablecoin addresses sending to exchanges, suggesting an increase in dry powder supply pumping into Bitcoin. Stablecoins Exchange Inflow Addresses Count Recently Surges As pointed out by a CryptoQuant post, the number of stablecoin addresses making inflow transactions to exchanges saw a sharp rise yesterday. Stablecoins are tokens that have their values tied to a fiat currency. Since they are relatively stable (as their name suggests), investors like to use them for temporarily pulling out of volatile markets like Bitcoin. The “all....