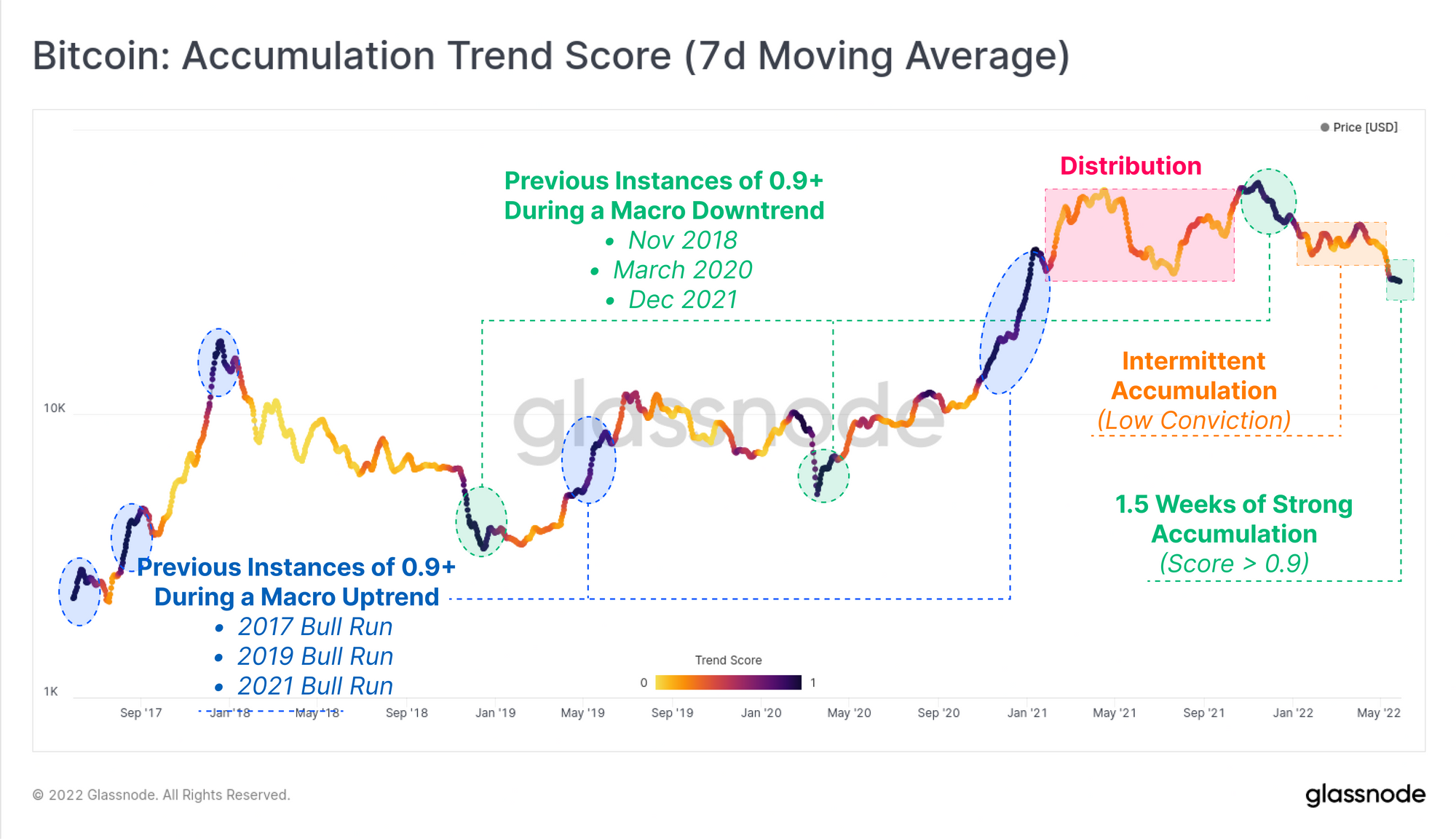

Glassnode: Bitcoin Market Behavior Has Now Returned To Strong Accumulation

Latest data from Glassnode shows investors in the Bitcoin market have shown strong accumulation behavior recently. Bitcoin Holders Show Strong Accumulation For First Time In Months As per the latest weekly report from Glassnode, the BTC accumulation trend score has shown a value of more than 0.9 in the past couple of weeks. The “accumulation […]

Related News

On-chain data shows the largest of the Bitcoin whales have returned to distribution, a sign that could be bearish for the asset’s price. Bitcoin Investors With More Than 10,000 BTC Are Selling Again As explained by analyst James V. Straten in a new post on X, the BTC whales, who had earlier been in a phase of accumulation, have switched their behavior to that of distribution now. The relevant indicator here is the “Trend Accumulation Score” from Glassnode, which keeps track of whether Bitcoin investors have been buying or selling during the past month. This metric finds....

On-chain analytics firm Glassnode has highlighted how accumulation from the large Bitcoin entities has remained relatively weak recently. Bitcoin Accumulation Trend Score Has Been Struggling To Break 0.5 In a new post on X, Glassnode has talked about the latest trend in the Accumulation Trend Score for Bitcoin. This on-chain indicator tracks whether BTCinvestors are accumulating or distributing right now. The metric calculates its value by looking at the balance changes happening in the wallets of the investors. Additionally, it also accounts for the size of the wallets themselves. This....

The on-chain analytics firm Glassnode has revealed in a report how the Bitcoin investors have seen a shift toward strong distirbution recently. Bitcoin Accumulation Trend Score Has Been At A Low Level Recently In its latest weekly report, Glassnode has talked about the latest trend in the Bitcoin Accumulation Trend Score. The “Accumulation Trend Score” is an indicator that tells us about the degree of accumulation that the BTC investors as a whole are participating in. Related Reading: XRP Faces Bearish MVRV Crossover—Price Plunge To Continue? The indicator calculates its value....

Glassnode has talked about the four phases of Bitcoin accumulation and distribution during the past year in their latest report. Bitcoin Accumulation Trend Score Shows Market Has Been Selling Recently As per this week’s edition of the weekly Glassnode report, the market has observed four distinct phases in the last twelve months. The relevant indicator […]

On-chain data shows the Bitcoin network has seen a shift recently as mid-sized entities have shifted to a strong accumulation behavior. Bitcoin Accumulation Trend Score Shows Whales Are Still Selling In a new post on X, on-chain analytics firm Glassnode has talked about the latest trend in the Bitcoin Accumulation Trend Score for the various […]