Has The Bitcoin Price Hit Its Bottom? Key On-Chain Data Signals Potential Reb...

Following a significant downturn that saw Bitcoin (BTC) plunge to the $80,000 mark on November 21, the leading cryptocurrency has managed to stabilize above this critical threshold for several days. This development has sparked speculation about whether this level represents a short-term bottom and if a new upward trend might follow. Potential Local Bottom For Bitcoin According to analysis from CryptoQuant analyst Carmelo Aleman, on-chain data indicates a market landscape characterized by institutional redistribution, structural weakness, and signs of a rebound that may hint at a local....

Related News

Bitcoin price remains stuck below its former all-time high set five years ago. The shocking decline has been one of the worst crypto winters on record, and the market is bracing for continued meltdown. However, a series of on-chain indicators in BTC could provide clues to how close we are to a bottom. Let’s take a look. A Series Of Six On-Chain Indicators Shout: Bitcoin Bottom Is In Bear markets are brutal in Bitcoin or otherwise, because the bottom is only known in hindsight. The feeling that markets will fall forever, creates a fear that freezes investors from buying at long-term....

In this episode of NewsBTC’s daily technical analysis videos, we take a look at Bitcoin price action following today’s selloff in reaction to August CPI numbers. Take a look at the video below: VIDEO: Bitcoin Price Analysis (BTCUSD): September 13, 2022 Today just so happened to be August CPI numbers release day, so volatility was expected all around. The Consumer Price Index went up by 0.1% month over month from July, leading to an immediate selloff in anything that wasn’t the dollar. Related Reading: WATCH: Bitcoin Weekly Chart Fires Bottom Signals At Open | BTCUSD....

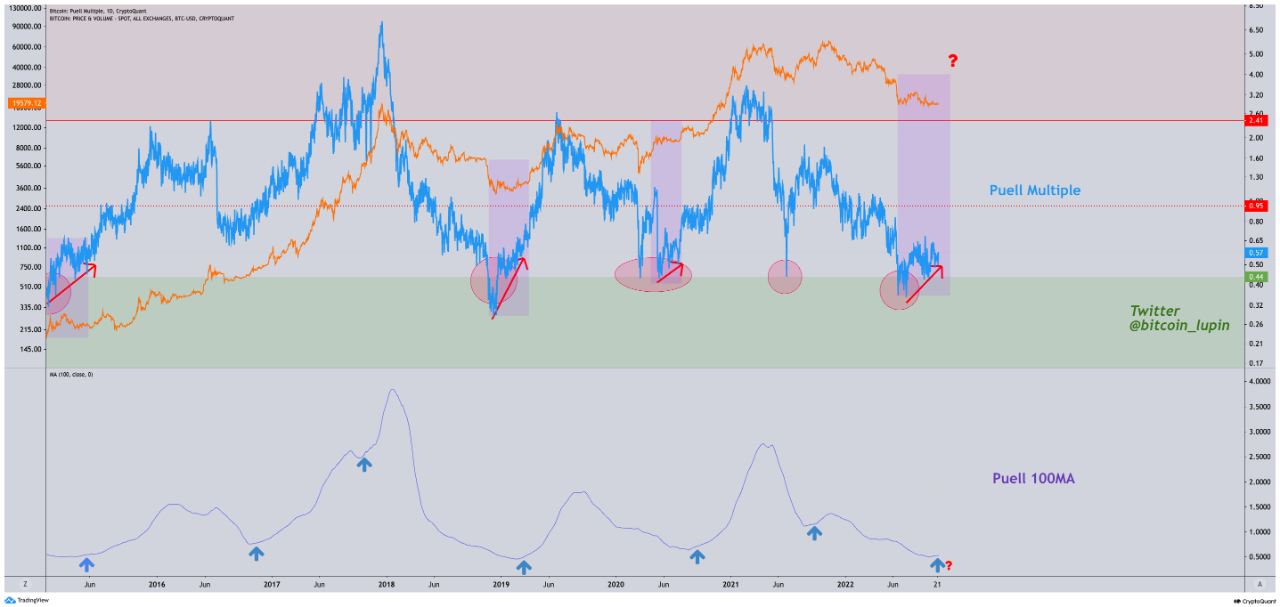

On-chain data shows the Bitcoin Puell Multiple has been going up recently after having formed a possible bottom. Here’s what history says could happen next for the crypto’s price. Bitcoin Puell Multiple 100MA Has Bounced Off A Potential Cycle Bottom As pointed out by an analyst in a CryptoQuant post, BTC miners seem to be […]

The Bitcoin market remains in a prolonged correction phase, registering a 10.4% price drop in the last seven days. As multiple analysts attempt to chart the asset’s price trajectory amid this volatile period, recent on-chain data have revealed potential local bottom targets. Related Reading: Kiyosaki Dumps Bitcoin At $90K After Predicting A $250K Moonshot – Here’s Why $55,900 Or $44,700 – How Low Can Bitcoin Go? In an X post on November 23, prominent market analyst Ali Martinez shares some insight on Bitcoin’s potential downside targets, amid the heavy price correction....

Over the past week, Bitcoin prices rose slightly by 1.04% to enter the $110,600 price zone following previous weeks of an extensive correction. Notably, on-chain data shared by crypto analyst Burak Kesmeci suggests the premier cryptocurrency may have found a potential bottom, indicating strong potential for a price rally in the coming weeks. Related Reading: […]