New ‘market fear’ index lets traders bet on crypto volatility

COTI’s new Crypto Volatility Index allows traders to profit from highly-volatile cryptocurrency markets. COTI, a blockchain-powered fintech startup, has launched a new cryptocurrency index enabling traders to profit from the market volatility.The new Crypto Volatility Index, or CVI, brings the traditional “market fear index” to the crypto market, allowing users to deposit and open positions with Tether (UDST).Gibraltar-based COTI explained that the new index allows traders to open CVI positions for high and low volatility. “Users who expect volatility to increase can open a CVI position.....

Related News

The decentralized finance (defi) platform cvx.finance has launched the beta version of its “Crypto Volatility Index”, otherwise known as the “CVX.” The CVX is an index similar to the “Market Fear Index” (VIX) commonly used in traditional finance, but cvx.finance measures the suggestive volatility from bitcoin and ethereum options markets. It’s still early but a new product has been launched that may be able to give cryptocurrency traders a rough idea of how the crypto market is feeling and if traders expect future price fluctuations. The new....

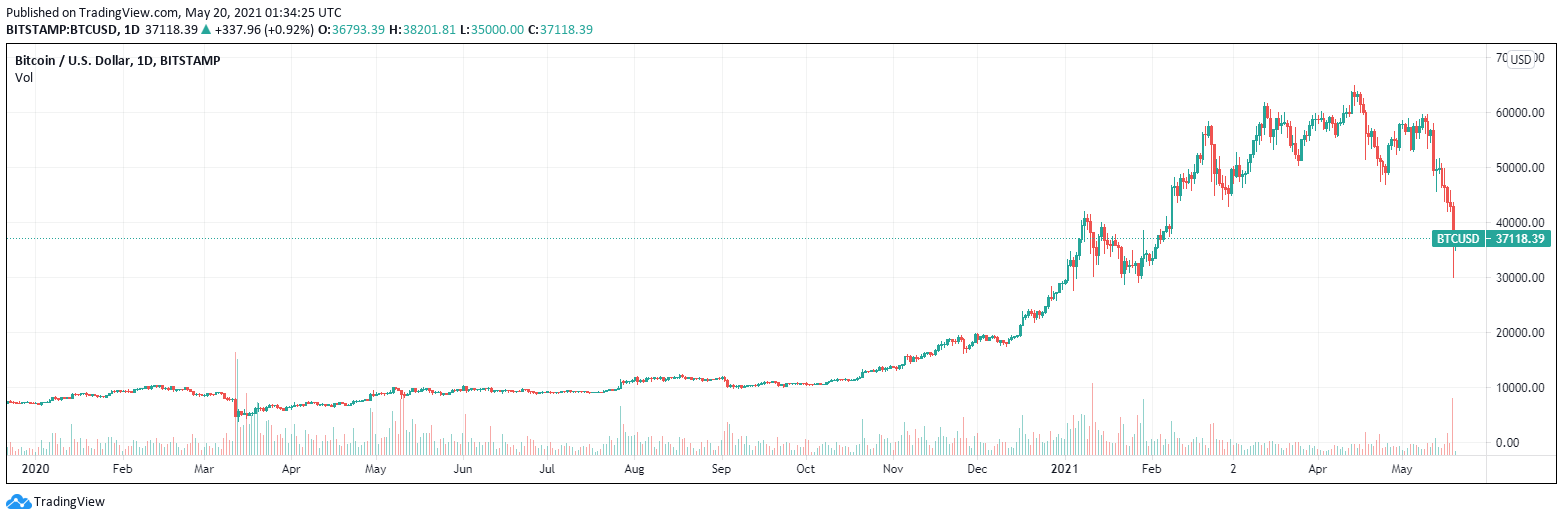

The Crypto Fear and Greed Index, a metric that’s known to measure current market sentiment, fell to its lowest point of 2021. The index, which has continued to fall alongside Bitcoin prices, hit “extreme fear” levels, which have not been observed since April 2020 during the global financial market crash. The metric has continued to […]

Bitcoin derivatives exchange BitMEX has announced that from 5th January they will publish a 30 day bitcoin volatility index, measuring the cryptocurrency's volatility against the United States dollar, and that they will create a tradable financial instrument based on the index. Often known colloquially as a 'fear index', a volatility index provides a measure of how much the value of a currency or asset is fluctuating up and down during a given period of time. A similar index called the VIX is often used by stock market traders to gauge and hedge against risk, as well as for other trading....

After 73 days of "extreme fear" on the Crypto Fear and Greed Index, investors can breathe a very small sigh of relief. Bitcoin (BTC) on Tuesday finally escaped the “extreme fear” zone after a whopping 73 days, coinciding with a 19% weekly increase in Bitcoin (BTC) as bulls make their way back to the market. The Crypto Fear and Greed Index increased from “extreme fear” to merely "fearful" on July 19, reaching a score of 30 out of 100. It has gained slightly since then to the current index score of 31.The Index analyzes the current sentiment of the overall crypto market, scoring between 0 to....

Binance founder Changpeng Zhao’s blunt reminder about buying low and selling high landed at a tense time for crypto traders. His line — “Sell when there is maximum greed, and buy when there is maximum fear” — was posted as markets showed fresh signs of strain and debate over whether now is a buying moment or another stall. Related Reading: Bitcoin Miners Face A Harsh December: Rising BTC Difficulty, Falling Hashprice CZ’s Message Meets Extreme Fear According to the Crypto Fear & Greed Index, sentiment recently climbed to 20, moving out of “Extreme Fear” after a streak of low readings. The....