Is $1 billion a day in volume the 'new normal' for Uniswap?

Uniswap could be averaging $1 billion in daily trade volume soon with the majority of trades occurring between Ethereum and stablecoins. Leading decentralized exchange, or DEX, platform Uniswap continues to lead the sector as it nears an average of $1 billion a day trading volume for the month of January.Only two-thirds of the way into the month and the platform has already surpassed the previous monthly trade volume record of $15.3 billion set in September during the DeFi boom. The DEX passed $17 billion as of this morning and is on track to surpass $25 billion by the end of January with....

Related News

Several users have aired complaints about the new version, especially its higher gas fees. The founder of Uniswap, Hayden Adams, has reported that the launch day of Uniswap’s v3 iteration was more successful than its predecessor in terms of volume.In a tweet on May 6th, Adams declared the launch of Uniswap v3 the day before a resounding success. He noted that over its first 24 hours of going live v3 had already processed more than twice the volume that v2 saw in its first month.Dividing Uniswap’s volume by total value locked, or TVL, Adams asserted the platform is operating with greater....

The decentralized exchange (dex) built on Ethereum, Uniswap has accumulated a whopping $2 billion in total value locked (TVL) this week. Tuesday’s data shows out of all the decentralized finance (defi) application’s Uniswap dominates the $11 billion landscape by over 18%. Just recently, the defi space has touched a few new milestones as the ecosystem’s TVL this week has topped $11 billion. The dex Uniswap is dominating the defi landscape by 18.65% with over $2 billion TVL to-date. Uniswap is followed by Makerdao ($1.9B), Aave ($1.56B), Curve.fi ($1.22B), and the Wrapped....

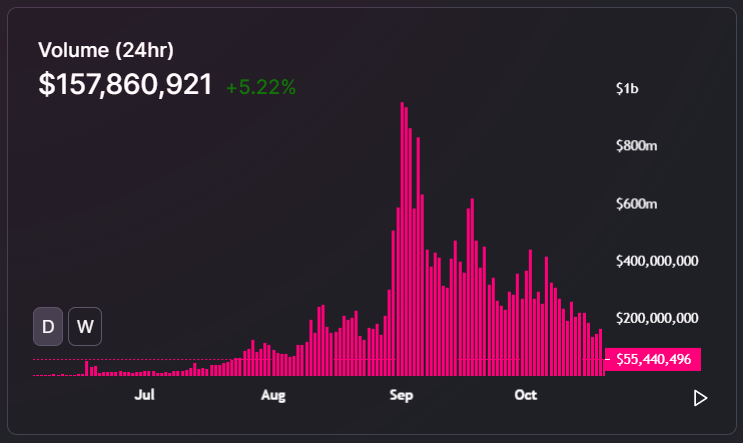

The decentralized finance (DeFi) market is slumping as large-cap tokens like Uniswap (UNI), Yearn.finance (YFI), and Maker (MKR) decline. Atop the lackluster performance of major tokens, the volume of the Uniswap decentralized exchange has substantially dropped. On September 1, when Uniswap surpassed Coinbase Pro in daily volume, it processed $953.59 million of volume in 24 […]

Popular decentralized exchange (DEX) platform on Ethereum, Uniswap, celebrates a major milestone. Via its official Twitter account, the team behind the protocol announced that it has processed $1 trillion in all-time trading volume. Related Reading | Coinbase Is on a Downwards Spiral and Could Be Taking your Crypto with It As seen below, this metric has been on an uptrend since September 2020. At that time, the protocol processed less than $10 billion in cumulative trading volume. The $1 trillion milestone was reached in less than a year as Uniswap went processing around $250 billion....

The largest decentralized exchange (dex) platform by global trade volume, Uniswap, is looking to raise between $100 and $200 million, according to a report citing people familiar with the company. The funding round is currently in a nascent stage as the report claims Uniswap has been “engaging with a number of investors.”

Sources Say Uniswap Is Eyeing a Fresh Capital Raise From Investors Like Polychain

According to four unnamed sources familiar with the matter, Uniswap is eyeing fresh capital from investors. The news stems from a report published by Tech Crunch....