Senator Warren ‘Very Worried’ About Federal Reserve Raising Interest Rates, T...

U.S. Senator Elizabeth Warren says she is “very worried” that the Federal Reserve will tip the economy into recession. “There is nothing in raising the interest rates, nothing in Jerome Powell’s tool bag that deals directly with” the causes of inflation, she explained. Senator Elizabeth Warren on Inflation and the Fed Raising Interest Rates U.S. Senator Elizabeth Warren (D-Mass.) discussed inflation and the Federal Reserve raising interest rates during an appearance on CNN’s State of the Union Sunday. She began by commenting on the speech by....

Related News

Crypto prices immediately came crashing down after Federal Reserve Chairman Jerome Powell announced they are increasing interest rates during an economic summit on September 21. Now, in a not-so-delayed reaction, the United Nations is calling on the U.S. central bank and other large western regulators not to continue raising their interest rates, a UN agency […]

The US Federal Reserve confirmed market expectations by raising interest rates with 25 basis points. Today's Global Economic Outlook considers an investment strategy for the new higher-rates world economy. This post is powered by the Bitcoin Trading Network xbt.social - CCN29 and get 29USD off! Economic Indicators. World Indexes and Forex Rates. Commodities. In the Calendar This Week. Wed 16 December. USD FOMC Economic Projections. USD FOMC Statement. USD Federal Funds Rate (actual: 0.35% expected:<0.50% previous:<0.25%). USD FOMC Press Conference. Making The News. The Federal Reserve....

Following the United Nations Conference on Trade and Development (UNCTAD) report that the U.S. Federal Reserve should stop raising rates, Ark Invest CEO Catherine Wood has published an open letter to the U.S. central bank asking the institution to stop raising interest rates. Wood says that the “unprecedented 13-fold increase in interest rates” has not only shocked the world but it’s also pushing the economy toward risking a “deflationary bust.”

Ark Invest’s Catherine Wood Says Fed’s Last 75bps Rate Hike Was ‘Surprising,’....

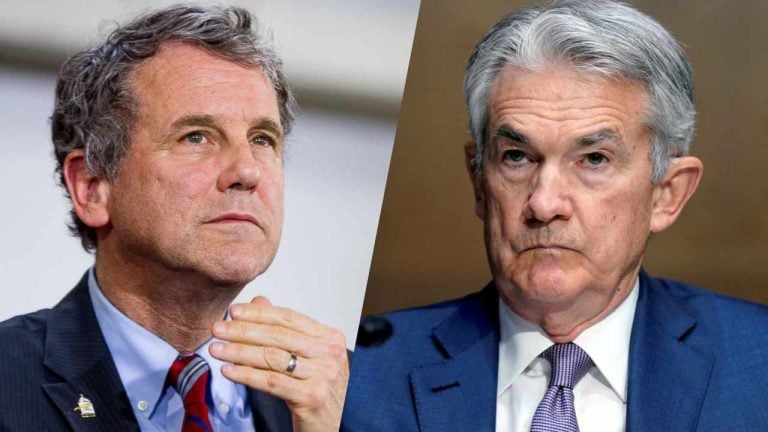

U.S. Senator Sherrod Brown has asked Fed Chair Jerome Powell not to forget the Federal Reserve’s “dual mandate” when making decisions about hiking interest rates at the next Federal Open Market Committee (FOMC) meeting. “It is your job to combat inflation, but at the same time, you must not lose sight of your responsibility to ensure that we have full employment,” the senator told the Fed chairman. U.S. Senator Reminds Powell of Fed’s Dual Mandate Federal Reserve Chairman Jerome Powell is facing political pressure over interest rate hike decisions. U.S.....

Despite the dollar’s 2016 gains and year-end rate hike, Bitcoin still outpaced the global reserve currency in 2016 in price terms. Bitcoin’s “inverse relationship to the Dollar” seemingly no longer persists. The Only Fed Rate Bitcoin Has Ever Known. Record low interest rates between December 2008 and December 2016 created unprecedented economic....