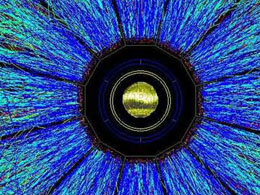

Fed Reserve and 6 Other Central Banks Set Out Core Digital Currency Principles

The seven central banks, along with BIS, have released a report setting out agreed core objectives that must be met by national digital currencies.

Related News

The report is a major step towards pushing central bank digital currencies forward. With Central Bank Digital Currencies a point of focus across the globe, a number of countries' banking authorities have jointly produced a document discussing the currency type at length. The Bank for International Settlements told Cointelgraph in a statement that a group of seven central banks and the BIS had collaborated on the report, "identifying the foundational principles necessary for any publicly available CBDCs to help central banks meet their public policy objectives." The BIS is a global....

Forbes magazine ran an article on August 24, "Why There Should be a Bitcoin Central Bank." If you want the short answer and want to skip the rest of the article, it boils down to this: because that would violate every core bitcoin principle. This article shows the ignorance of most of the world that is deep into yesterday's paradigm of money. This article is intended to establish four founding core principles of bitcoin technology that should act as the signal for "true north" from which banks, nations, and most importantly, the people of the world will eventually recognize. As people....

CBDC, also central bank digital currency, is a digital token issued by a country. Many governments and central banks around the world are exploring the use of CBDCs. Even though they mostly remain in the hypothetical stage. However, more than 80% of central banks are looking at digital currencies. The Reserve Bank of Australia announced […]

Bitcoin could be an interesting option to tackle full-reserve banking in the financial industry. The way this could work is by using Bitcoin as a hedge against banks, and assets could be accounted for on the blockchain. Transparency in full-reserve banking is of the essence, yet it is also one trait most banks are lacking right now. Bitcoin is often referred to as being many things, ranging from a commodity to currency, and even a solution to solving all of the financial trouble in unbanked and underbanked regions. But very few people believe Bitcoin has the potential to change reserve....

Bitcoin crossed the $11,000 threshold, central banks enumerate "core principles" for a CBDC, Coinbase sees 60 employees walk.