Institutions are buying Bitcoin like it’s late 2020

The amount of Bitcoin available on derivatives exchanges hits its lowest since May 11 — before the China miner rout took hold. Bitcoin (BTC) reserves on derivatives exchanges have dropped to levels last seen before the May price crash.Data from on-chain analytics service CryptoQuant confirmed that as of Tuesday, derivatives reserves totaled 1.256 million BTC — the least since May 11.Institutions repeat Q4 2020Against a backdrop of institutional interest returning to cryptocurrency instruments such as the Grayscale Bitcoin Trust (GBTC), figures show that major players have in fact been....

Related News

2020 was a massive year for blockchain adoption, with some of the largest financial institutions worldwide buying or integrating cryptocurrencies into their business model. It was also a historic year for decentralized finance (DeFi) which has grown from less than $1 billion in total value locked at the beginning of January 2020 to almost $15 […]

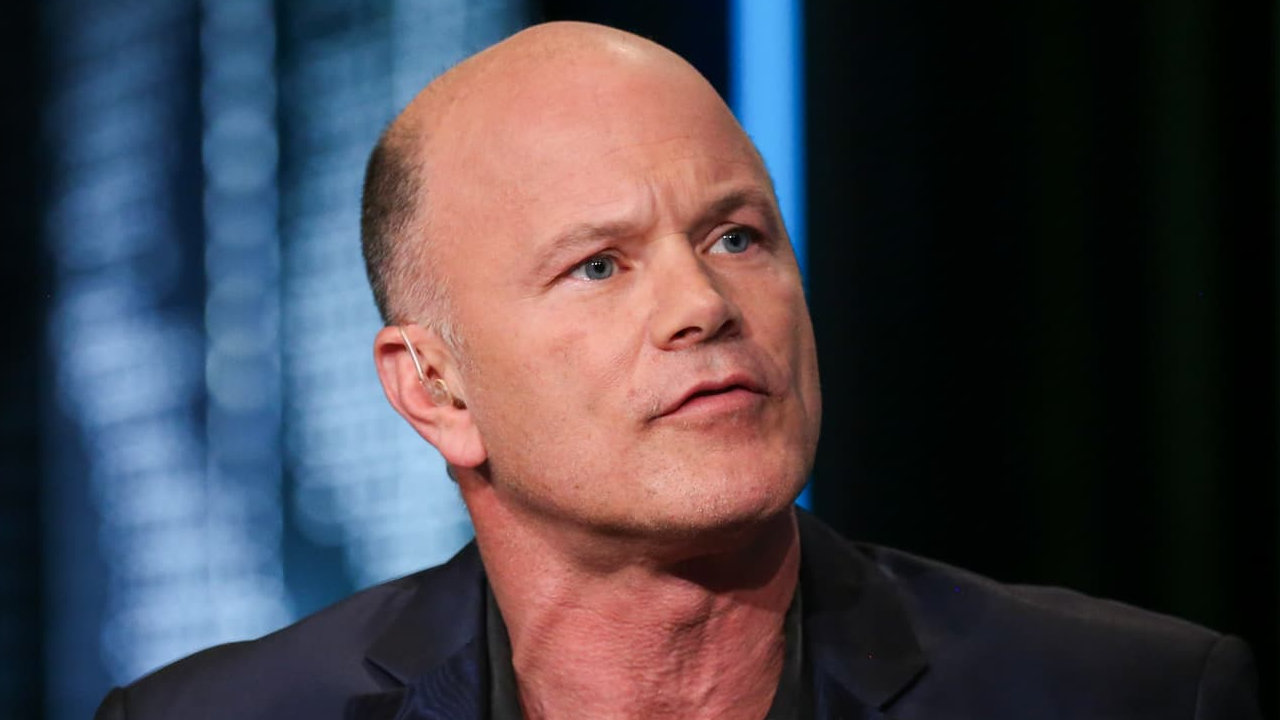

Galaxy Digital CEO Michael Novogratz says that cryptocurrencies, such as bitcoin, have bounced back because institutional investors are buying. Responding to U.S. Senator Elizabeth Warren’s anti-crypto stance, he stated, “We need to do a much better job going to D.C.” to educate lawmakers. Novogratz Says Institutions Are Buying Galaxy Digital CEO Mike Novogratz talked about the outlook for bitcoin in an interview with CNBC Wednesday. He was asked how he sees bitcoin’s price action and what he thinks has been driving the price of the cryptocurrency back to the....

Stock-to-flow creator PlanB suggests that now is the time to continue accumulating, with selling pressure fading fast. Institutions should start buying Bitcoin (BTC) again, leading analyst PlanB has said as one exchange sees a fresh $250-million withdrawal.In a tweet on Tuesday, PlanB argued that conditions were now right for buyers to continue accumulating BTC with confidence.PlanB: “Probably time” for Q2 buyingBTC/USD had seen a lack of momentum over the weekend, culminating in a dive to near $56,000. With resistance near all-time highs of $61,700 now at its lowest since the time that....

Some institutions have paused their buying, at least for the moment.

CME Group’s recent announcement that it will launch ether (ETH) futures on Feb. 8, 2021, is the “writing on the wall” that institutions will being buying the cryptocurrency next year, according to a pair of tweets by Ryan Watkins, an analyst at crypto data provider Messari.