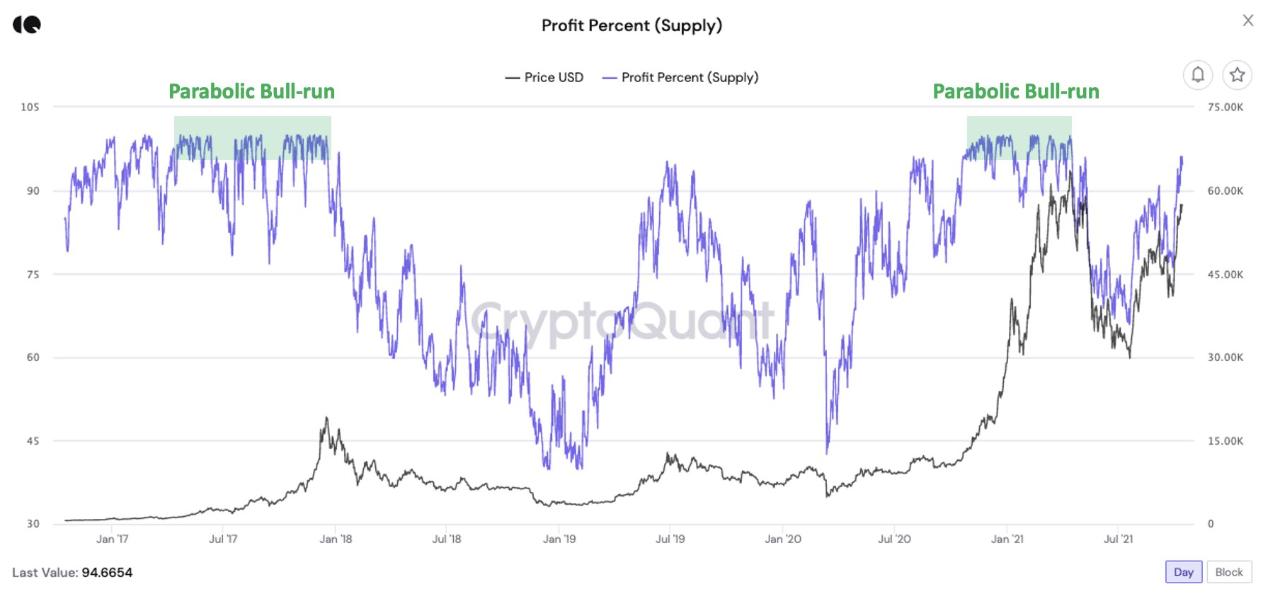

99% Bitcoin Supply In Profit Again, Here’s What Happened Next Historically

On-chain data shows 99% of the circulating Bitcoin supply has unrealized profits again. History may have the hint for where the market could head next. 99% Of The Circulating Bitcoin Supply Has Unrealized Gains As pointed out by a CryptoQuant post, the profit percent of the circulating BTC supply has reached 99% once again as […]

Related News

On-chain data shows about 70% of the total Bitcoin supply is currently in profit, a level that has historically been important for bulls. Around 30% Of Total Bitcoin Supply Is Now Underwater As per the latest weekly report from Glassnode, the percentage of BTC supply in profit has now fallen off to just 70%. The “percent of supply in profit” is an indicator that measures the percentage of the total Bitcoin supply that’s currently in the green. When the value of this metric increases, it means more coins have started to get into profit. This leads to holders becoming more....

Data shows around 15% of the total Bitcoin supply is now in loss, a value that has historically been sufficient to push the price down. Percentage Of Bitcoin Supply In Profit has Fallen Down To Just 85% As per the latest weekly report from Glassnode, the total BTC supply in profit has fallen down to just 85% this week, meaning that 15% of the supply is now in loss. The “percent supply in profit” is a Bitcoin indicator that highlights the share of the total supply that’s currently in profit. The metric works by looking at what price each coin in the chain was last moved....

On-chain data shows Bitcoin is currently not satisfying a condition that has historically occurred alongside major bottoms in the price. Bitcoin Supply In Profit Is Still Greater Than Supply In Loss In a new post on X, James V. Straten, a research and data analyst, has pointed out how BTC isn’t fulfilling the bottom condition for the supply in profit and loss metrics. The “supply in profit” here naturally refers to the total amount of Bitcoin supply currently carrying an unrealized profit. Similarly, the “supply in loss” keeps track of the number of underwater....

A historically significant 30% of the Bitcoin supply is now held at a loss — and that has ended in a bullish rebound twice since March 2020. Bitcoin (BTC) hodlers face a crucial week in more ways than one as $42,000 rekindles a familiar battle.As noted by on-chain analytics firm Glassnode on Monday, 30% of the BTC supply is now at a loss — historically, this has been a key number to defend for bulls.Mixed opinions on rebound chancesBitcoin's descent from $69,000 to current levels — at one point over 40% — is nothing unusual, but for long-term investors, there is a specific reason to hope....

On-chain data shows the Bitcoin Supply in Profit has witnessed a sharp increase recently. Here’s whether the current level is considered high or not. Bitcoin Supply In Profit Has Crossed The 87% Mark According to the latest weekly report from Glassnode, the Bitcoin Supply in Profit has marked an improvement alongside the latest rally in […]