JPMorgan Taps Former Celsius Exec As Crypto Regulatory Policy Director

Nothing supersedes personal experience. At least that seems to be the case with a new JPMorgan Chase hire this week, as the financial firm has brought in former Celsius executive Adam Iovine to serve as a director of digital assets regulatory policy, according to a variety of reports on Wednesday, which cite Iovine’s LinkedIn page. The reports come after headlines around JPMorgan’s CEO Jamie Dimon slamming crypto as ponzi schemes. Nonetheless, the institution has flip-flopped it’s public perspective around crypto while still building digital asset infrastructure.....

Related News

JPMorgan Chase & Co. has hired bankrupt crypto lender Celsius Network’s former head of policy and regulatory affairs as its new head of digital assets regulatory policy. The move followed JPMorgan CEO Jamie Dimon telling U.S. Congress that crypto tokens, like bitcoin, are “decentralized Ponzi schemes.” JPMorgan Chase Hires Head of Digital Assets Regulatory Policy JPMorgan Chase & Co. has hired a new head of digital assets regulatory policy who previously worked at the bankrupt crypto firm Celsius Network, Bloomberg reported Wednesday, noting that a JPMorgan spokeswoman....

“The volatility you see in it today just has to play itself out,” JPMorgan’s director of asset and wealth management said. Despite Bitcoin (BTC) not yet emerging as an “asset class per se,” JPMorgan considers it important to meet the demand for cryptocurrency investment, according to a senior wealth management executive.A large number of JPMorgan clients see digital currencies like Bitcoin as an asset class, the company’s director of asset and wealth management, Mary Callahan Erdoes, said.In a Bloomberg interview released Tuesday, Erdoes stressed that the bank will continue providing....

“If any regulatory or technical changes are required in a specific jurisdiction, Celsius will provide clear and timely communication as needed,” said the firm. Crypto lending firm Celsius Network has confirmed it is one of three platforms requested to provide information to the New York Attorney General’s office.In a Tuesday blog post, Celsius said it was not one of the two unnamed crypto lending platforms that New York Attorney General Letitia James ordered to “cease any and all such activity” around selling or offering cryptocurrencies. Rather, Celsius said it was “working on providing....

After the crypto lending platform Celsius halted operations on June 12, at 10:10 p.m. (ET), two days later the Wall Street Journal (WSJ) quoted “people familiar with the matter” who said Celsius was hiring restructuring lawyers. At the time, the WSJ said Celsius was looking to hire the bankruptcy and restructuring law firm Akin Gump Strauss Hauer & Feld LLP. However, a new report from the WSJ claims sources say that Celsius is now working with the restructuring advisory firm Alvarez & Marsal. Sources Say Celsius May Be Collaborating With a Restructuring Advisory Firm The....

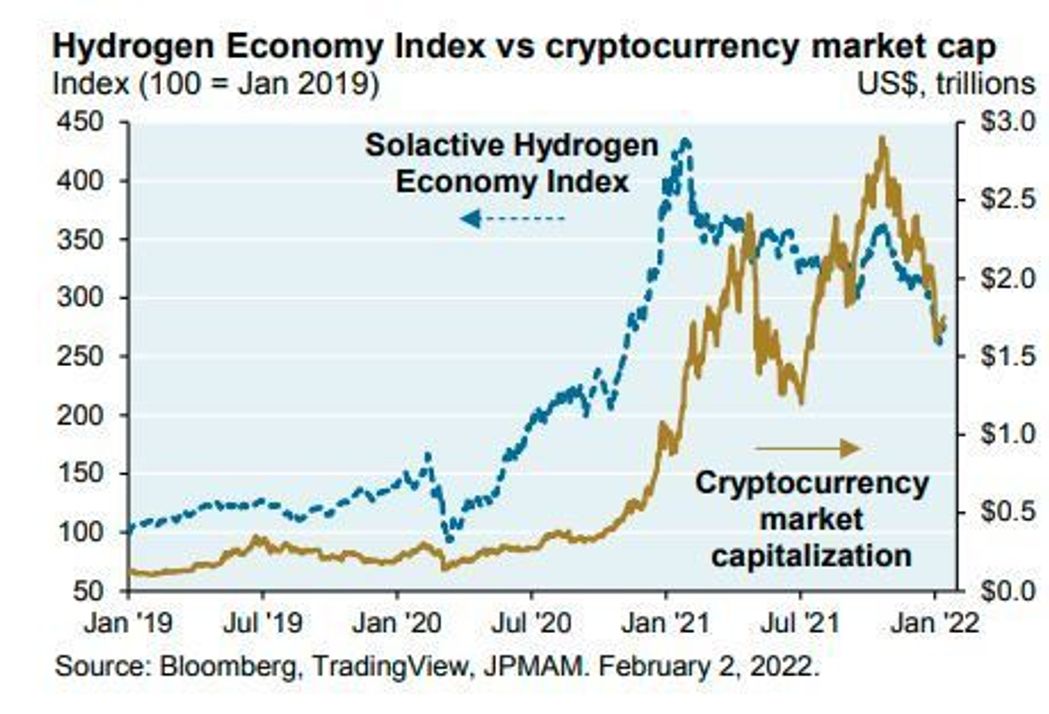

JPMorgan’s chairman of investment strategy, Michael Cembalest, is wary of bitcoin and other cryptocurrencies. The JPMorgan strategist stated in a column published Feb. 3 that his comments were his own and not those of JPMorgan Chase. JPMorgan Strategist Raises Issues With Crypto Market While much of the United States recovers from last week’s terrible winter […]